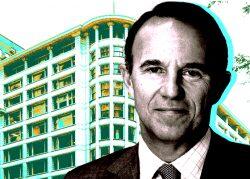

Isaac Shalom is testing the market for retail space on Chicago’s State Street, traditionally one of the most esteemed retail strips in the city that’s facing steep challenges amid the pandemic.

A 171,000-square-foot retail space is up for sale at the corner of State and Madison streets at One North State, that a venture led by the New York investor has owned since 2004, Crain’s reported. The venture hired CBRE to sell the property.

Shalom’s business paid $54.5 million for the four-level retail property 18 years ago. It’s not clear what the property would bring in today, though it presents a potential opportunity for real estate investors who want to bet big on State Street’s comeback.

Since the onset of the pandemic, a string of big retail names have closed their State Street stores. DSW walked away from the retail corridor in June, exiting about 26,000 square feet at the Sullivan Center at 35 State Street, followed by Old Navy’s departure from the corner of State and Randolph Streets in July.

Still, the property has held up and is more than 93 percent leased with tenants including TJ Maxx occupying 70,000 square feet on the second floor and Burlington with 60,100 square feet in the basement. Other tenants include Chipotle, Dunkin’ and The Body Shop.

Yet Burlington’s future is in question. Its lease expires in February, and a CBRE leasing agent representing Shalom’s venture has told The Real Deal the tenant is in negotiations regarding a potential renewal.

The property was appraised at over $100 million in 2013, when Shalom refinanced it with a new $60 million mortgage.

Its performance has slipped a bit, having generated $100,000 less revenue last year than in 2015, when it brought in $7.68 million, according to data tied to a commercial mortgage-backed securities loan. Its net operating income added up to $4.46 million last year, down from $5.31 million in 2015.

Overall, the pandemic pushed the Central Loop vacancy rate up to 23.4 percent at the close of 2021, up from below 15 percent in 2019, according to brokerage Stone Real Estate. State Street has lost more retailers than it has gained.

Read more

— Rachel Herzog