Property taxes are up in Cook County, just not for everyone, with relief coming especially to owners in predominantly Black neighborhoods.

Taxes levied on real estate rose by 3.8 percent, to $16.7 billion, in 2021, according to an analysis from Cook County Treasurer Maria Pappas’ office released today as the second installment of property tax bills is set to hit mailboxes.

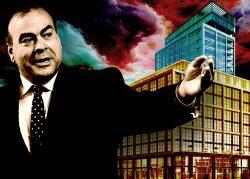

While Cook County Assessor Fritz Kaegi has sought to redistribute more tax burden to commercial owners only to be foiled by their appeals, he fulfilled a goal to lower residential taxes in some South Side neighborhoods.

That occurred even though residential properties didn’t receive lower valuations from the assessor’s office. Instead, they carried less of the tax burden because their assessed values went up at a lower rate than the rest of the city, Kaegi told The Real Deal. Assessed value across the city went up by about 20 percent, while it up by just 8 percent in the 8th Ward, which includes South Shore, Chatham, Calumet Heights, Pullman, Avalon Park, Burnside and South Chicago.

Communities at the lower end of the city’s price spectrum, such as these, had historically been overassessed, and Kaegi’s most recent reassessment was more accurate, he contends.

“They haven’t had the same kind of gentrification that we’ve seen elsewhere. Broad swaths of the South and West side haven’t benefited from the broad rise in housing values,” Kaegi said.

Overall, homeowners are paying almost 54 percent of the increased tax burden, while businesses are taking on about 46 percent, the treasurer’s office said. Median tax bills for Chicago homeowners increased by almost 8 percent, although that wasn’t evenly distributed by neighborhood. The treasurer’s office found that gentrifying Latino neighborhoods experienced tax hikes, while homeowners in some predominantly Black neighborhoods got a break compared to 2020.

“It’s not a question of relief, it’s a question of accurate estimate evaluation,” Kaegi said.

On the mostly Latino Lower West Side, the homeowner’s median tax bill rose to $7,239, up 46 percent from 2020. The median tax bill in Avondale, another Latino neighborhood, increased by 27 percent, according to the analysis.

In West Garfield Park, a predominantly Black community, homeowner taxes dropped by almost 45 percent. Decreases of $1,000 or more in commercial median taxes occurred in several

predominantly Black communities on the South Side, including the Pullman, Burnside, Chatham, Calumet and South Chicago areas.

Hiking commercial valuations aren’t fueling rises of apartment rents, Kaegi argued, adding that apartment owners are already pricing rents at the highest rates they can for the market. He pointed to out-of-state investment in Chicago multifamily properties and construction of new apartment buildings still taking place despite rising assessments.

“We have strong fundamental drivers here in the multifamily market and assessments are much more transparent than they ever have been,” he said. “I don’t think you can argue that higher taxes are driving the rents.”

Multifamily brokers and the investors they work with, however, have said that increasing assessments and thus the tax bills on apartment buildings as rapidly as Kaegi has can dent the values buyers are willing to pay as the expense rises. That forces owners to seek lower values through appeals of his valuations to the Board of Review in order to sell at their target prices.

The treasurer’s office said that board, a three-member county body that hears owners’ appeals of the assessments set by Kaegi’s office, was responsible for shifting more of the tax burden to commercial properties from homeowners. The three-member county board lowered commercial property values by 24 percent, or by almost $6.2 billion, undoing Kaegi’s initial valuation of the properties.

“That’s a big driver of why residential bills went up when they really should have been going down overall,” Kaegi said.

That echoes an earlier report from Kaegi’s office, which also pointed a finger at the Board of Review. A spokesman for the board said at the time that the report ignored errors Kaegi made in assessing the properties.

More gradual commercial increases aren’t possible since valuations are reassessed every three years, Kaegi said, and he’s optimistic future hikes on commercial properties will stand after two Board of Review members were replaced in November’s election. George Cardenas, a former Alderman for the 12th Ward, is replacing Tammy Wendt, and Samantha Steele replaces Michael Cabonargi. Both Wendt and Carbonargi were ousted in the summer’s Democratic primary.

“We know that the new board is committed to being more transparent in their valuations, having their values in line with the market, reducing these ethical conflicts, all good things that we think will lead to more fair valuation and not such a burden on small businesses and homeowners,” he said.

Outside the city, some southern and southwest suburbs broke the pattern of mostly white and Latino areas feeling the biggest increases in tax bills as Black communities experienced decreases. Differences across this region were stark, with overall taxes dropping in 23 out of 87 suburbs while rising in the rest, the treasurer’s office found.

The largest overall percentage jump in total taxes in the southern and southwest suburbs occurred in Country Club Hills, which the U.S. Census Bureau pegs at 88 percent Black. The village’s taxes rose by 24 percent to $58.9 million total. Still, median taxes on a commercial property in the south and southwest suburbs overall — which is home to much of the region’s Black population — grew by 3 percent to $15,362, while the median residential bill decreased by $2, to $4,917.

Meanwhile, in the ritzy northern suburb Winnetka, where 93 percent of the population is white and the home of some of Cook County’s priciest residences such as lakefront mansions, the median homeowner’s tax bill dropped $82 to $20,658, accounting for a nearly 1 percent decrease in the village’s overall assessed value. In the suburbs as a whole, far more property owners were hit with increases than received decreases.

Read more