Ares Management is living up to its name with its handling of a suburban Chicago office debt.

The New York-based alternative investment firm named after the Greek god of war filed a foreclosure lawsuit Thursday against John Grassi’s Spear Street Capital and its Swiss partner. Together, the pair own a 483,000-square-foot building in Rolling Meadows, and Ares alleges they defaulted on a $30 million loan on the property, which they borrowed weeks before the start of the pandemic.

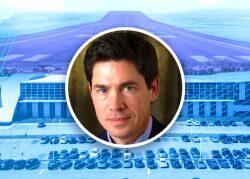

Despite striking one of the biggest suburban Chicago office leases of 2022 with a federal agency, a joint venture of Grassi’s San Francisco-based firm and the Zug, Switzerland-based company Partners Group that owns the Atrium at 3800 Golf Road are at risk of losing the property to its lender.

Ares, in a complaint filed in Illinois federal court, contends Spear Street and Partners Group failed to pay off practically any portion of a loan that was due last week. The alleged default is one of many to emerge between commercial real estate landlords and their lenders as the office leasing market was pummeled by pandemic-fueled space shedding. Downtown and suburban Chicago owners have been hit particularly hard as of late.

Landlords such as Vancouver-based Adventus have not only walked away from their investments on offices in Chicago’s suburbs as lenders swarmed in on unpaid loans, but the highest-profile downtown building buried by untenable debt was also seized by its lender last month.

Last year, Adventus said it was handing the 312,000-square-foot Oak Brook Office Center back to its lender, and the owners of the historic, 44-story Chicago Board of Trade building handed the 1.4 million-square-foot tower to Apollo Global Management rather than fight a foreclosure suit. The landmark tower’s former owners were a joint venture of Chicago’s Glenstar and Los Angeles-based Oaktree Capital Management that defaulted on a senior loan from Apollo that was part of a $256 million debt stack on the property.

In Rolling Meadows, Spear Street and Partners Group last year inked a 20-year, $36 million lease for 116,000 square feet with the Federal Aviation Administration, in what amounted to a downsize for the agency and a move from its longtime Des Plaines offices. The deal gave the building a boost after its formerly largest tenant, Capital One, put up 165,000 square feet for sublease in 2020.

Still, suburban Chicago’s office leasing market has yet to regain much steam. Tenants shed 70,000 square feet more than they absorbed in the third quarter last year, and another 600,000 square feet was put up for sublease to push the total available to a record-high 4.8 million square feet in the suburbs, according to CBRE.

An Ares spokesperson declined to comment, and Spear Street and Partners Group did not return requests for comment. An LLC registered to Grassi, who’s CEO of Spear Street, is named as a defendant in the foreclosure case and it has not yet had attorneys appear in the case, online court records show, and DLA Piper attorneys representing Ares didn’t return requests for comment.

Spear Street bought the Atrium for $29.5 million in 2010, and kept a minority stake in the property when Partners Group bought a portion of it in 2016 for an undisclosed price as part of a multi-state portfolio deal. Spear Street also owns the 46-story, 967,000-square-foot office tower at 500 West Monroe Street in Chicago’s West Loop, which it bought for $412 million in 2019, and the 31-story, 651,000-square-foot office asset at 225 West Wacker Drive on the northwest edge of the Loop.

Read more