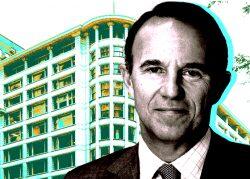

The future looks bleak for a Loop retail property owned by Isaac Shalom amid a struggling retail sector and tight lending climate.

After the 171,000-square-foot space at One North State Street was listed for sale and never drew buyer, a venture led by Shalom, a New York-based investor, appears poised to hand back the asset. Shalom missed April and May mortgage payments on $49.7 million loan against the asset, and he faces an uphill battle to salvage the debt and hang onto the property, Crain’s reported.

The retail space currently has a strong occupancy rate of 93 percent, which is far better than the Central Loop average. But leases for the property’s two largest tenants, TJ Maxx and Burlington, expire next year. If they don’t renew, 76 percent of the space would be vacated.

The $49.7 million loan matures in February of next year, and refinancing the property would be tricky for a number of reasons. Spiking Interest rates have pushed commercial property values down significantly since last year. Plus, banking fallouts earlier this year have led to an overall tighter lending climate, and banks are more reluctant to dish out loans for retail holdings in downtown settings.

That’s because Chicago’s retail sector has been pummeled by the pandemic, as it has in other cities. Last year, the vacancy rate among Central Loop retail properties was 24.8 percent. While that fared better than 26.1 percent in mid-2021, it’s still much worse for landlords than the 2019 average of 14.7 percent.

Read more

It’s possible that Shalom is trying to work out a deal that would allow him to retain ownership of the property. Alternatively, he’s decided it makes no sense to make more payments on a loan he won’t be able to pay off.

Shalom, however, already captured a return on his initial investment. His venture bought the space for $54.4 million in 2004 and refinanced it in 2013, pulling $21.3 million out of the property with a new $60 million loan.

— Quinn Donoghue