R2 buying Michigan Avenue office tower for $70M as CBRE takes loss

R2 buying Michigan Avenue office tower for $70M as CBRE takes loss

Trending

Alter Group selling River North offices in likely loss for lender

Asset formerly leased by Google expected to sell for less than $60M loan issued in 2019

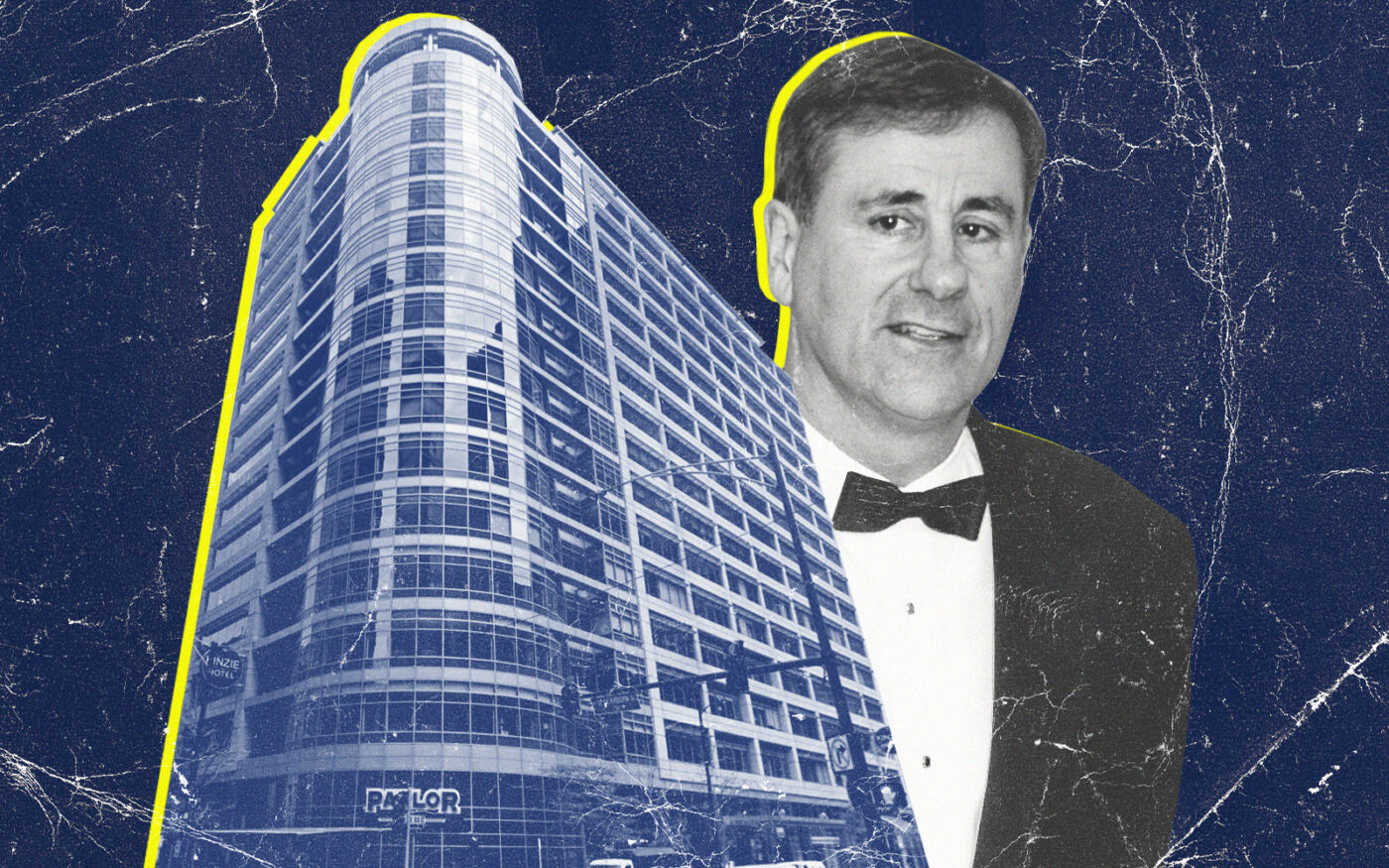

Alter Group is throwing in the towel on a River North office building that’s likely worth less than the property owner’s debt.

The Wilmette-based firm has hired Cushman & Wakefield brokers Cody Hundertmark, Tom Sitz, Dan Deuter and Paul Lundstedt to sell the office portion of the 17-story tower at 20 West Kinzie Street, CoStar reported.

Roughly 80 percent of the 258,000 square feet is vacant, Alter Group vice president Rich Gatto told the outlet. The firm, which completed the building in 2000, was left with a huge void to fill when its biggest tenant, coworking space provider WeWork, ditched its space earlier in the pandemic.

WeWork, which has been forced to pull back on spending as the company faces financial trouble, was already a fallback option for Alter. The coworking giant refilled space that Google had previously leased, as the tech firm grew to occupy much of the building before it left for the burgeoning Fulton Market District eight years ago.

People familiar with the property believe it will sell for less than the $60 million loan Alter Group took out from Bank of America to refinance the asset in June 2019. After the pandemic hit and pummeled Chicago’s office sector, Alter Group has explored a potential short sale that would have allowed Bank of America to recoup part of the loan’s value, the outlet said.

The 20 West Kinzie listing is the latest example of distress rippling through the Windy City. The pandemic-fueled remote work movement contributed to record high office vacancies last quarter, and high interest rates, banking failures and employer layoffs worsened the issue in recent months.

As loan maturity dates approach, office landlords across the city are being forced to either hand the keys back to their lender, sell their properties at a loss or face foreclosure suits. Chicago developer R2, for example, plans to pay $70 million for the 41-story tower at 150 North Michigan Avenue. That’s about $16 million less than the property’s mortgage and even less than the nearly $121 million it last traded for in 2017.

— Quinn Donoghue

Read more

R2 buying Michigan Avenue office tower for $70M as CBRE takes loss

R2 buying Michigan Avenue office tower for $70M as CBRE takes loss

Green Cities scoops Lake & Wells building for $98M

Green Cities scoops Lake & Wells building for $98M

Commerz files $360K eviction suit against WeWork

Commerz files $360K eviction suit against WeWork