An architecture firm is closing in on a leasing deal that would again nudge Chicago’s record-high office vacancy rate even higher, while adding to financial woes for Magnificent Mile landlords.

Solomon Cordwell Buenz, or SCB, wants to occupy roughly 35,000 square feet in Boston-based landlord Beacon Capital Partners’ 52-story landmark tower at 330 North Wabash Avenue, Crain’s reported. If the deal is finalized, SCB would vacate its 39,300,square-foot space at 625 North Michigan Avenue when its lease expires next year.

SCB’s potential move prolongs the trend of companies downsizing their operations amid the remote-work era, which has triggered huge rounds of layoffs and brought office demand down to an all-time low. The amount of available sublease space in the city reached 8 million square feet by the end of June.

Class A buildings, such as 330 North Wabash, are essentially the only office properties to have withstood the pain of the public health crisis, as companies flock to properties with top-tier amenities and other desirable features to bring employees back to the office. While the city’s vacancy rate has risen from 19.4 percent to nearly 23 percent over the past two years, the vacancy rate for Class A properties has flatlined during that stretch.

SCB’s move is also another good sign for well-capitalized landlords with funds from lenders they can put toward building out custom spaces for tenants who have particular visions about how to optimize their office space for the age of increasingly hybrid work week schedules.

Beacon’s office portion of the North Wabash tower — which also includes the Langham, a 380-room luxury hotel owned by Oxford Capital — is 93 percent leased and performing far better than most Chicago office buildings. Beacon’s portion netted $19.5 million in revenue last year, well above its debt service payment of $9.4 million.

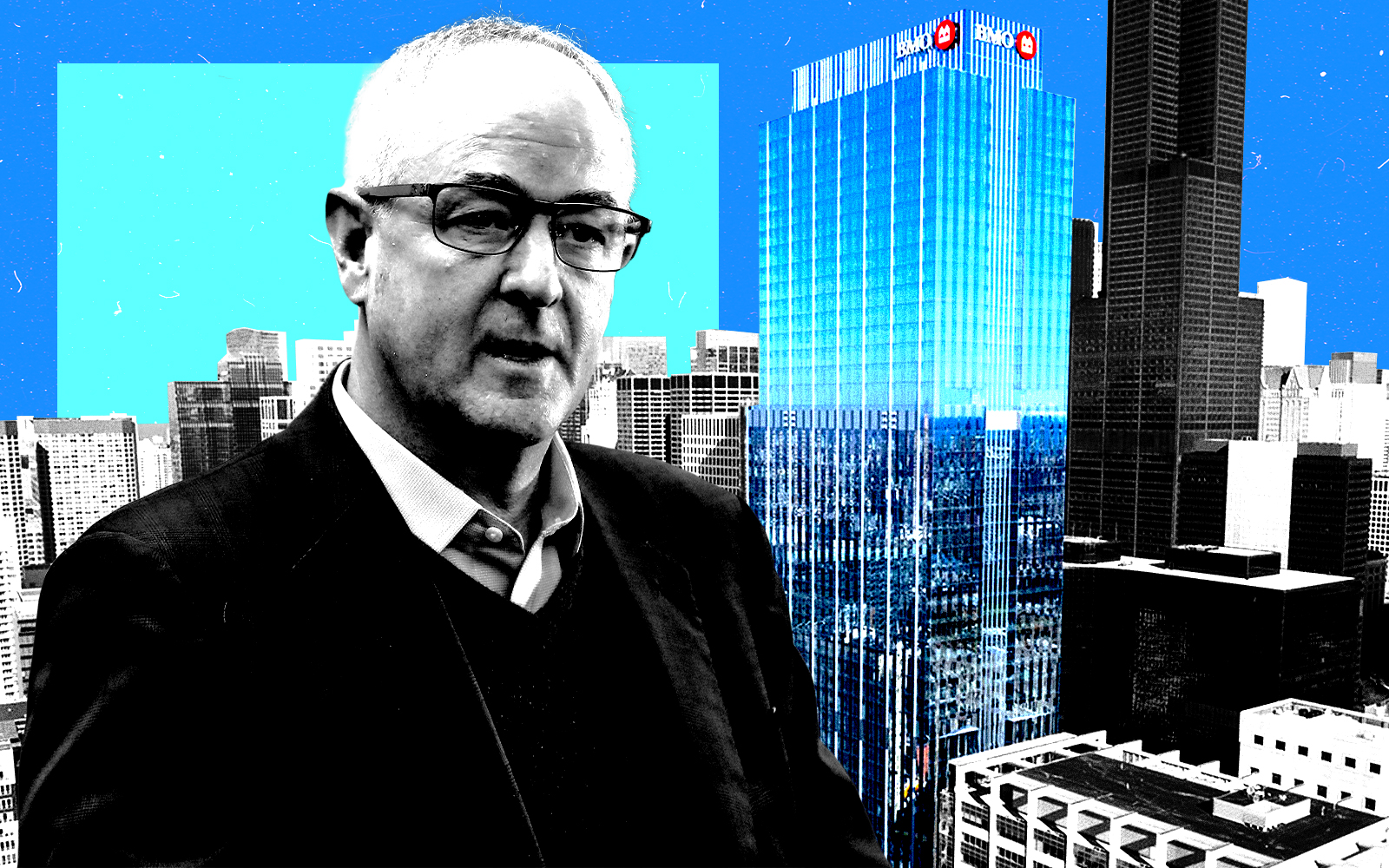

Beacon bought its share of the property, which was formerly called the IBM Building and is now known as AMA Plaza, for nearly $468 million in 2016. The landlord plans to perform several renovations at the site, including repurposing two office floors into new amenity space and improvements to its outdoor plaza. The planned upgrades helped lure SCB as a tenant, the outlet reported.

Some challenges lay ahead for Beacon, though. Engineering consultant Thornton Tomasetti is ditching its nearly 31,000-square-foot space, and the building’s largest tenant, the American Medical Association, has an option to terminate its 298,000-square-foot lease in 2025. Plus, two floors are occupied by near-bankrupt co-working space provider WeWork.

SCB’s current landlord, Chicago-based Golub & Co., owner of the 27-story 625 North Michigan building, may have some bigger problems on its hands. Its office floors are 84 percent leased, but if SCB departs, the building’s occupancy rate would drop well below the city average of roughly 77 percent. Golub is getting by for now, though, as the property’s $3.8 million in net cash flow last year was enough to cover its $2.4 million in debt service, and the owner’s $51 million loan against the building doesn’t mature until March 2026.

— Quinn Donoghue

Read more