Waterton is beefing up in the South Loop.

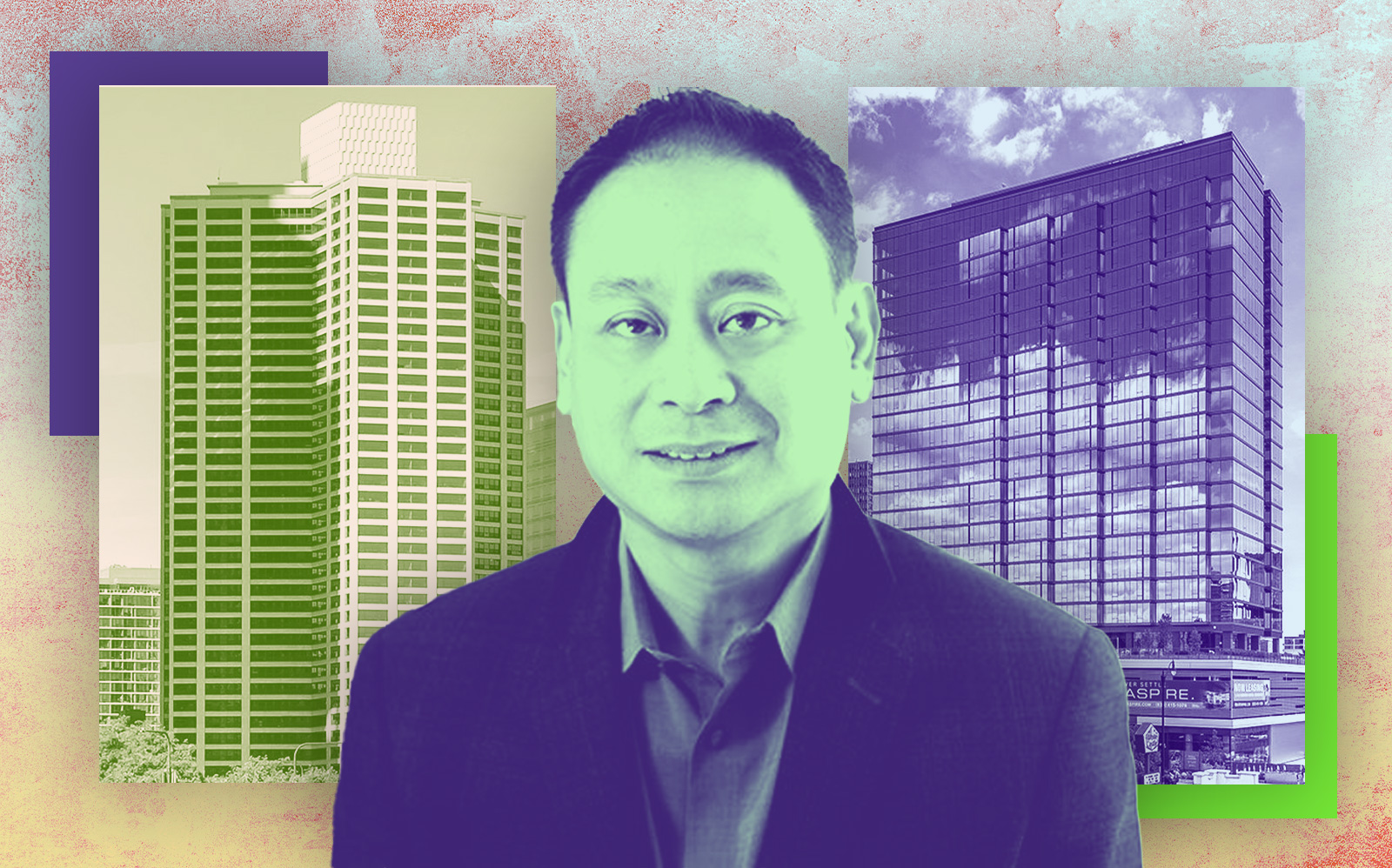

The Chicago-based firm led by CEO David Schwartz paid a little more than $81 million for the 346-unit Alta Grand Central at 221 West Harrison Street, Crain’s reported. That’s about $235,000 per unit.

snagged a South Loop apartment complex near one it acquired last year for $170 million in what was one of the largest residential transactions of 2022.

Newmark brokers Liz Gagliardi and Chuck Johanns marketed the property on behalf of the sellers, Chicago-based D2 Realty and Atlanta-based Wood Partners, which put the Alta Grand Central on the market in May. The sale appears to be a gain for the D2-Wood venture, as it took out a $65.7 million construction loan to help fund the development that opened in 2020, and it refinanced the asset with a $64 million mortgage in the following year.

The 14-story Alta Grand Central is just one block away from the 496-unit Alta Roosevelt at 801 South Financial Place, which Waterton also bought last year for $170 million, or $343,000 per unit. The firm has since rebranded that complex as the Elle.

The two South Loop complexes “are attracting renters seeking an upscale rental experience with the relative affordability of the South Loop neighborhood,” Waterton’s Julie Heigel said in a statement.

Read more

Despite the strong apartment demand in Chicago, it’s been a sluggish year for multifamily deals amid rising interest rates and a tight lending environment. Nationwide, apartment sales declined 64 percent year-over-year last quarter to $89.6 billion, the outlet reported, citing data from MSCI Real Assets.

Several multifamily landlords that have successfully offloaded their assets have taken big losses. In Streeterville, for instance, Vanbarton Group sold the 268-unit Seneca building for $55 million in July, down considerably from the $75 million it paid for the site in 2014.

Alta Grand Central, meanwhile, has an occupancy rate of 93 percent and an effective gross income that’s increased by 22 percent over the past 12 months, Newmark’s marketing materials said.

— Quinn Donoghue