Pop-up shops are getting access to some of the best storefronts in New York City under so-called licensing deals, with a lot less hassle than a regular retailer faces.

James Famularo, a commercial broker at Eastern Consolidated, was introduced to licensing deals a few years ago when a lawyer suggested his client use one instead of a traditional lease to rent out a basement retail space at 352 Bowery in Noho. The lawyer pointed out that a lease could allow the tenant to block access to vital building utilities in the basement — possibly preventing the landlord from providing heat or electricity to tenants upstairs — while a license wouldn’t.

Not long after, Famularo heard that such licenses, which permit tenants to use a space rather than possess it for a fixed period, were being used to rent to pop-up shops in the city. Besides insulating the retail owner from legal headaches, they are generally a fraction of the length of an 80- to 100-page lease, making it easier for both the landlord and pop-up tenant to do business. Famularo said his team has inked about two dozen licensing deals for pop-ups since then.

“It’s pretty brilliant,” he said, noting that such licenses can be revoked without a judge’s order. “Normally landlords don’t like the liability of pop-ups. Once they have the space, they can be hard to get out and you have to go through court. So they came up with the idea to license the space. It just made perfect sense.”

Stable long-term retail tenants are hard to come by in Manhattan as the market continues to soften, and the real estate industry is adapting to short-term tenancies as much as long-term ones. Additionally, many pop-ups come with celebrity backing, from Gwyneth Paltrow to Kanye West, which can help landlords promote their properties.

A pop-up tenancy, which by most industry definitions lasts from one day to one year, can be extremely attractive to both parties — a landlord monetizes the space and remains open for a long-term lease, and the tenant gets visibility in the high-profile New York market with relatively little long-term risk.

As The Real Deal reported in December, pop-ups are typically seen as a stopgap measure that landlords and brokers can use while they wait to secure more permanent tenants. But some industry players say they will become increasingly commonplace as building owners look for new ways to minimize losses and retain tenancies in the ongoing shift from brick-and-mortar retail to e-commerce.

Online sales currently make up less than 15 percent of all retail sales in the U.S., but by 2025 roughly one in every four purchases will be made online, according to a November 2016 report from the global advisory firm FTI Consulting. Retailers themselves have become increasingly wary about signing long-term deals in such a rapidly accelerating environment, Winick Realty Group broker Kelly Gedinsky said.

“Things change so drastically these days, it’s harder for retailers to consider a long-term deal,” she noted. “Unlike five years ago, landlords are more open to pop-ups because so many [potential tenants] are coming to them and their brokers saying, ‘Look, we want to test this market for a year. If it works, we’d be happy to look into a longer-term deal.’”

The pressure on New York retail landlords to fill vacancies has become particularly severe after extremely pricey lease deals and building trades following the Great Recession formed what many now call a bubble.

Between 2010 and 2014, average asking rents in 16 Manhattan corridors tracked by CBRE skyrocketed by a whopping 89.1 percent while total retail sales for the borough grew by only 31.9 percent, creating what the commercial brokerage called “an unsustainable situation for some tenants as rents surpassed what their sales growth could support.”

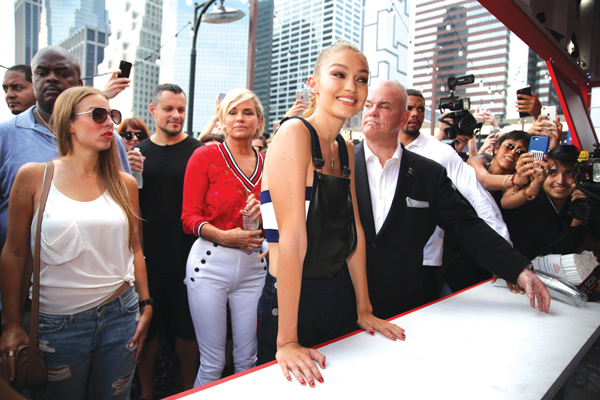

Fashion model Gigi Hadid helped promote a Tommy Hilfi ger popup in February 2017.

At the same time, Manhattan vacancies rose from a post-recession low of 2.5 percent in 2012 to 3.7 percent in 2016 and 4.2 percent in the first quarter of 2017, according to the tenant rep firm Okada & Company. Borough President Gale Brewer’s office counted 200 vacant stores along Broadway in June, which she blamed on high rents and online retail along with Manhattan’s pricey commercial rent tax.

The glut of empty storefronts and growing flexibility among landlords has made physical space more accessible than ever for young businesses, such as startup fashion and tech brands, that don’t want or can’t afford a long-term lease.

The New York-based online platform Storefront — which functions a lot like StreetEasy and Airbnb — lets prospective pop-up tenants browse through spaces on a map by price and square footage. For a 20 percent service charge, a representative for the company walks a renter through the process, and the landlord gets additional general liability insurance when a space is booked. Storefront also uses license agreements to rent properties listed on the site.

Storefront’s national director, Joy Fan, claims that 30 percent of all vacant retail space in Manhattan is listed on the site either publicly or privately, the latter for landlords to “test” the service. More than 3,000 spaces were publicly listed in June, and Storefront has spent $2.8 million expanding in New York since it entered the market in 2013.

“We don’t see ourselves as a competitor to the traditional retail market … We just see that space is space,” Fan told TRD. “Vacancies are unfortunate, but the shift needs to happen, so we’re really architecting the next layer of retail for the future.”

The average number of days a retail landlord can expect to rent out to pop-ups through Storefront varies significantly with the type of retailer that shows interest. On average, “experiential activation” clients — those looking to penetrate a conference or event crowd — occupy a space for four days out of a month. A brand launch lasts an average of six weeks, and a “target market launch” — when a brand pops up in a specific neighborhood to appeal to a local demographic — averages three months.

But while the “disruptors” at Storefront are ready to usher in a new age of retail, the pop-up sector isn’t quite ready to shoulder the full weight of Manhattan’s retail market. Brokers and landlords don’t profit much from these short-term deals yet, and most are interested in bringing in pop-ups for their more intangible benefits: letting a retailer test-drive a space, after which it may want to lease long-term, and at the very least driving more traffic to the space, Famularo said.

“To be honest, there’s no money in it for a broker,” he acknowledged. “It’s good if we can make a few bucks, but it’s really not worth any good broker’s time. It monetizes the asset, it keeps stress away from the account, and it brings life into the space.”

Some landlords are diving in head-first and reconfiguring their spaces to accommodate changing consumer behaviors and attract a new tenant demographic.

Omari Properties, for instance, is looking for nontraditional retailers for a seven-story building in Soho. The firm, run by brothers Eddie Omari, Uri Omari and Manny Omari, opened the property at 433 Broadway in 2016.

The new building was designed for long-term traditional retail with the expectation that the high rents of the years prior would hold, the property’s manager and Uri’s son-in-law, Edan Abehsera, told TRD. The retail space is 9,100 square feet, with 6,100 on the ground floor and the rest on the lower level, and the landlord wanted up to three tenants at $600 per foot, according to the brokers marketing the space at the time.

Omari held out for a long-term tenant for a year, but Abehsera said they couldn’t find tenants even when they were asking for half the going rate around the corner on Broadway. The firm decided to switch gears this year and is now planning a 2,000-square-foot trial space for a “co-working for retail” concept. Retailers without physical locations can rent small spaces there and ship their products to Abehsera; he will provide the infrastructure — including employees — to sell them.

Omari already houses shared office space on the upper floors of 433 Broadway, so Abehsera said he wants to market them together as a package, particularly for small fashion and tech firms in need of office and sales space.

If it works out, the landlord could look to expand the model to other properties in the area. Abehsera said he believes Omari can make the $600 per square foot it originally wanted for its retail space and that the company will be better positioned for the future.

“We were waiting for a tenant, and we saw where the market was and took it upon ourselves to divide it up,” he explained. “We’re going full on — we don’t see the market changing anytime soon, so this is a longer-term play.”

Correction: A previous version of this story misidentified Storefront as a San Francisco-based company. The online platform was founded in San Francisco and still has an office there, but moved its headquarters to New York City. The company provides landlords (not renters) with additional general liability insurance.