(Photo-illustration by Paul Dilakian/The Real Deal)

Building is back. Amidst war, disease and economic uncertainty, New York’s skyline is growing, and the contractors who hoist those bricks and beams have no shortage of jobs.

JP Morgan is moving ahead with a brand-new, 2.5 million-square-foot headquarters in Midtown. A $30 billion to $40 billion megaproject surrounding Penn Station has support from the governor and the mayor. And just as $8 billion of renovations wrap up at LaGuardia Airport, the state now plans a new $9.5 billion terminal for John F. Kennedy Airport. Demand for new development condos, and multifamily housing in general, is robust.

Even though construction has recovered from an initial slowdown during the pandemic, it’s occurring in a fundamentally changed world. Material costs are high, thanks in part to constricted supply chains that show no sign of easing any time soon. Billions of dollars in government infrastructure spending set to arrive in the coming years will only ratchet up competition for scarce materials.

Developers filed plans for 1,900 new buildings in New York City last year, bringing construction activity back to pre-Covid levels, according to a report from the Real Estate Board of New York, which analyzed public data.

The city received 665 new building filings in the fourth quarter, a 37 percent increase from the previous quarter and the most in any three-month stretch since 2016.

Not only are developers building more, but they’re building bigger. Those 665 new buildings represent nearly 32 million square feet of construction — about 10 Burj Khalifas’ worth — and the largest quarterly total since 2014.

As a whole, construction activity in 2021 was only marginally above pre-pandemic norms. But the city finished on a hot streak and is carrying that momentum into 2022.

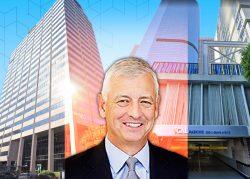

“It’s healthy out there,” said Jay Badame, president and COO of construction at AECOM Tishman.

For its annual ranking of the city’s top general contractors, The Real Deal analyzed every building permit issued across the five boroughs between March 1, 2021 and February 15, 2022. To crown the kings of new building construction, TRD added up the total square footage across the projects filed by each firm. Alteration work was measured by estimated job cost.

Monadnock Construction topped the new buildings list. The Brooklyn-based firm outworked the competition in both square footage and number of jobs, filing 17 permits combining for over 4.2 million square feet. The next-busiest firms reported 10 projects, and no others broke 4 million square feet. Despite its dominance this year, Monadnock’s activity is still dwarfed by last year’s champs: In 2020, AECOM Tishman was contracted for 11.2 million square feet of new building construction.

Monadnock Construction topped the new buildings list. The Brooklyn-based firm outworked the competition in both square footage and number of jobs, filing 17 permits combining for over 4.2 million square feet. The next-busiest firms reported 10 projects, and no others broke 4 million square feet. Despite its dominance this year, Monadnock’s activity is still dwarfed by last year’s champs: In 2020, AECOM Tishman was contracted for 11.2 million square feet of new building construction.

New Line Structures took second place with nearly 3.7 million square feet of new building work. Perennial heavyweights Turner and AECOM Tishman took third and fourth, respectively, an improvement for Turner and a slip for AECOM compared to last year. Hunter Roberts rounded out the top five with 2.1 million square feet.

This year’s leader in alterations was STO Building Group, besting their runner-up finish last year, with nearly $1.2 billion worth of work. Turner snagged second place, with J.T. Magen, JRM Construction Management and AECOM Tishman closing out the top five.

Finder’s fee

Frustration is evident in John McCarthy-O’Hea’s voice when the CEO of L&K Partners talks about metal door frames. The humble frames were never long-lead supplies for construction firms — they’re uncomplicated, non-electronic things — but in recent months, even they have been hard to find.

“We used to be able to get them in four weeks. Now the lead time is ten weeks,” he said.

If there’s one difficulty plaguing general contractors big and small right now, it’s supply chain delays. A single project often depends on supplies from countries in a range of different political and economic situations — and with varying Covid policies. Those differences complicate trade, and even local disruptions can ripple into a global shortage.

“Supply chain durations have — virtually without exception — doubled,” said Steve Sommer, a New York construction executive for Lendlease. “If the supplier said it’s four weeks, it’s now eight weeks. If the person said it’s 10 weeks, it’s now 20 weeks.”

If sourcing a door frame requires a logistics A-Team, imagine the challenges of finding something with a button or a screen. Processing chips are causing nightmares. A shortage of power supply parts has made the humble air conditioner public enemy No. 1 for general contractors.

SOURCE: TRD ANALYSIS OF ALTERATION AND NEW BUILDING PERMITS ISSUED IN BETWEEN MARCH 1, 2021 AND FEBRUARY 15, 2022 BY THE NEW YORK CITY DEPARTMENT OF BUILDINGS. IT INCLUDES ALL FIVE BOROUGHS. THE PERMITS ARE THE LATEST ISSUED WITH THE GENERAL CONTRACTOR AS THE APPLICANT.

Larger firms are using their size to their advantage, but even then there are limits. It took Turner Construction a year to get the roof insulation it needed for 181 Mercer Street, NYU’s massive new mixed-use development in Noho. But that wait would have been far longer for a smaller contractor; Turner employs about 300 people focused solely on procurement who identify and supply-chain bottlenecks and help the firm bypass them.

“When you have that kind of size, these manufacturers pay attention to us,” said Charles Murphy, Turner’s New York lead.

With project timelines stretched and fiercer competition for materials on the horizon, contractors are urging their clients to buy early and load up while they can.

“Control the market, otherwise the market will control you,” Murphy said.

Uncertainty around pricing and supply has tested contractor-client partnerships and led to new negotiations over who bears the costs. Escalation clauses establishing which side will cover a range of potential budget inflations are becoming more popular. A contractor might offer to cover 2 or 3 percent price bumps, but split anything from 3 to 5 percent spikes with the owner. It requires a new level of flexibility and uncertainty that developers typically seek to avoid.

“These are negotiation strategies that are not easy,” Lendlease’s Sommer said.

Contractors are also finding new business in environmentally friendly construction. With Local Law 97 set to impose potentially steep penalties on building owners who fail to meet greenhouse gas emissions caps starting in 2024, some are starting to retrofit their properties.

“Landlords and lenders don’t like paying fines where they don’t see returns,” L&K’s McCarthy-O’Hea said, so they’re starting to get in line now. “We’re going to have to pull the trigger, so let’s pull it early,” he added.

Clients don’t just care about an environmentally friendly product; increasingly, they’re factoring the sustainability of contractors’ work into their hiring decisions. They want less carbon in their concrete and steel. They want construction waste recycled.

“Our clients are absolutely emphatic with a capital E on sustainability components,” Sommer said.

Read more