Randal Wyatt was renting a mouse-infested apartment in a Portland, Oregon, neighborhood known for its high crime rate. When he wasn’t working as a student advocate or raising his twin sons, he attended a homebuyer seminar and saved money to buy a place.

Randal Wyatt was renting a mouse-infested apartment in a Portland, Oregon, neighborhood known for its high crime rate. When he wasn’t working as a student advocate or raising his twin sons, he attended a homebuyer seminar and saved money to buy a place.

It wasn’t enough: After two years, he still had not found anything in his price range.

It took a stroke of luck to get his name on a deed. Last August, an owner offered him a three-bedroom house in Albina, a formerly Black neighborhood, for just $230,000 — about a third of its market value.

Decades ago, before it gentrified and home prices ran up, Albina was a bustling Black community. Today, Wyatt is one of its few Black homeowners.

“There has to be some sort of program or something like that to help Black families get back into these neighborhoods and afford these homes,” Wyatt said.

Speaking from his 2,200-square-foot home, complete with a backyard and garden, Wyatt had hit on among the most confounding issues in housing policy: how to raise property values in Black areas without pricing out new Black families.

A growing push to help Black households build generational wealth starts with home equity, which is infamously lower in communities of color. But the undervaluation of these homes also makes them more affordable for Black families, most of whom are renters.

The average home in majority Black neighborhoods is worth $46,000 less than a comparable one in majority white neighborhoods, controlling for such factors as local amenities and schools, according to a Redfin analysis of more than 7 million homes listed and sold from 2013 to this February. A 2018 Brookings Institution study found the discrepancy added up to $156 billion in lost value for Black homeowners.

While some suggest that cities invest heavily in Black neighborhoods to drive home values up, there are two sides to that coin, said Francesca Ortegren, data scientist for Clever Real Estate.

“Home prices increasing means it’s harder to get a home in that area, which does make it harder for Black Americans to qualify for mortgages in those areas,” Ortegren said. Gentrification often follows, leading to a shift in demographics over time.

Sordid history

Many Black Americans were blocked from obtaining mortgages by redlining, which eroded homeownership in historically Black neighborhoods. At the same time, whites-only covenants and unwritten racism barred Black families from buying outside redlined areas. These and other factors created a yawning racial gap in homeownership rates that widened even after Congress passed landmark fair housing legislation in 1968.

Still, some historically Black neighborhoods endured. In the 1960s and early 1970s, stately row houses in northwest Brooklyn, such as in Fort Greene, Clinton Hill and Prospect Heights, could be scooped up for five-figure sums. In the new century, when a jobs boom, falling crime and rising home prices in New York City led whites to push out in those neighborhoods, their property values shot up, and longtime homeowners were able to cash out for sums in the millions.

But that put the homes out of reach for what might have been the next generation of Black owners. Similar scenarios unfolded in other urban areas across the country. Gentrification became a dominant theme in many of them, souring some on the idea of pouring money into Black neighborhoods in order to raise property values.

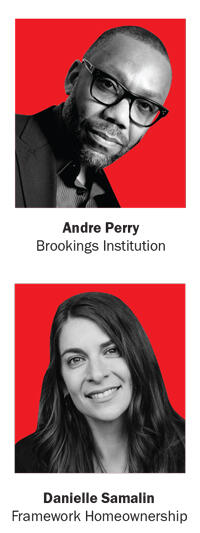

“Let’s be clear that if you invest in places and not people, that’s encouraging gentrification,” Brookings Institution senior fellow Andre Perry told NPR in a “Planet Money” podcast episode.

Perry looked for ways to address the wealth disparity without triggering displacement and demographic shifts. He ultimately recommended putting more money in the hands of Black families and especially mothers, such as by giving them better access to loans, and electing more Black women to positions where they can enact policies that value Black lives and dismantle racist practices.

Although such fixes address the tension between wealth and affordability, disinvesting in infrastructure — parks, transit, schools — and keeping home values depressed in Black communities don’t strike many people as good housing policy.

Read more

“In the short term, devaluation might seem to make homeownership more accessible and affordable,” said Danielle Samalin, CEO of Framework Homeownership, a social enterprise that educates new homebuyers. “But the long-term benefits of home price appreciation and increase in equity don’t come with it.”

And home equity is no small matter. It is wealth that can be used to put children through school, start a business or endure financial setbacks — and be passed down through generations. Excluding the richest 1 percent of Americans, it accounts for 29 percent of household wealth, second only to retirement accounts’ 33 percent, according to the U.S. Census.

Within those numbers, however, are vast racial discrepancies. The average wealth of white households is roughly eight times that of Black ones. A stark differential in home ownership rates — 74 percent for whites, 45 percent for Blacks — accounts for much of that gap.

Renters can build wealth in other ways. But with many living paycheck to paycheck and lacking the built-in savings mechanism of a mortgage payment, they tend not to. The poorer half of U.S. households collectively owns just 1 percent of equities. For the bottom 90 percent of American households by net worth, which holds only 16 percent of U.S. stock wealth, home value is a crucial repository of wealth.

“Most other investments are a bit riskier than homeownership, [which] almost guarantees that you’re going to gain equity over time,” said Ortegren.

Appraising the problem

Appraising the problem

While longtime Black homeowners may benefit from holding onto homes in gentrifying neighborhoods, racial bias in appraising remains an issue for homeowners who live in majority Black areas.

A study by Clever Real Estate found that white neighborhoods were valued about 60 percent higher than Black ones. Specifically, each 1 percent increase in a neighborhood’s Black population corresponded with a $2,581 decrease in home values.

Among metro areas, Flint, Michigan, had the largest racial disparity in property values — 645 percent. Miami was fourth at 485 percent.

Appraisals are largely determined by recent sale prices of comparable homes, creating a feedback loop that advocates have been trying to break, including by engaging with the appraisal industry and forming a federal task force.

President Joe Biden has made it a priority, enlisting the Department of Housing and Urban Development to change lending regulations, fair housing laws and appraisal industry standards.

In June, the agency, along with more than 100 trade organizations and advocacy groups, unveiled a seven-point plan to address those barriers and turn 3 million Black renters into homeowners within a decade.

Its initiatives include homeownership counseling, a down-payment assistance program and increased housing production through land use reforms and economic intervention in communities that need it most.

Other points address credit and lending, civil and consumer rights, homeownership sustainability, and marketing and outreach. This includes mortgage counseling, special credit programs and specified pools for mortgage securitization as well as foreclosure prevention so Black owners are not forced back into the rental market.

Such strategies, particularly those involving counseling, savings and credit access, are an effort to support those who may find themselves locked out as a community grows and expands economically, said Cy Richardson, senior vice president for economics and housing programs at the National Urban League, which signed on to the proposal.

“The notion of creating more folks who have access to the mainstream homeownership marketplace, we believe, has exponential value for these communities that have been on the outside of the equation for generations,” Richardson said.

Back to Black

Randal Wyatt’s housing benefactor did not pick him at random. Rather, she reached out after learning about the organization he founded last summer, Taking Ownership PDX.

It provides free repairs for Black-owned homes and businesses in historically Black neighborhoods. While running the organization, Wyatt noticed how the standards of upkeep, maintenance and aesthetics of those areas changed as white people moved in, he said.

“If these Black homeowners who are trying to hold onto their homes aren’t keeping up with their houses, instead of neighbors coming over asking why aren’t you able to keep up with the paint job on your home … they’re calling the city,” Wyatt said. That leads to fines for not meeting code, adding to owners’ costs and potentially driving them out.

The original goal of the organization was to revitalize Black-owned homes to increase their value — a form of reparations, Wyatt said. But, flooded with requests, Taking Ownership had to limit its efforts to emergencies and minor interventions.

Other cities have dabbled with housing reparations funds. This year, the Local Reparations Restorative Housing Program in Evanston, Illinois, allocated $400,000 to give eligible families up to $25,000 for down payments or home repairs. The funding will come from a tax on cannabis sales.

Others have made efforts as well. Impact Shares, an investment manager, just launched an affordable housing exchange-traded fund that invests in securities backed by pools of mortgage loans made to minority and low-income families.

“We’re buying agency mortgage-backed securities where the population is over 50 percent nonwhite and at least 40 percent of the population is below the poverty line,” said Ethan Powell, the founder and CEO.

The idea is to create a funnel so public investors can better allocate capital into these areas, lowering the cost of home financing there.

“This isn’t going to be a solution to everything,” Powell said. “But it’s a great start.”