Discreet, bespoke and focused on luxury, Manhattan’s boutique residential firms have seen their fortunes soar in recent years thanks to a luxury market that was firing on all cylinders. While those days are not over, there are signs of trouble ahead — including a projected influx of ultra-luxe new developments coupled with a slower pace of high-end sales.

For now, however, the boutique firms at the top of The Real Deal’s list amassed an astounding roster of high-end listings.

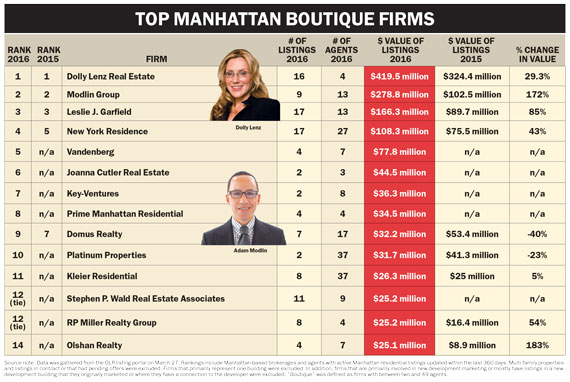

Dolly Lenz’s eponymous firm again dominated this year’s ranking of boutique brokerages, according to TRD’s data, which was pulled from listings portal On-Line Residential on March 27. Firms with between two and 49 agents qualified.

Dolly Lenz Real Estate, with just four agents, including the power broker’s husband and daughter, racked up more than $419.5 million worth of listings, up 29.3 percent from $324.4 million last year. The firm’s priciest listing is the penthouse at the Ritz-Carlton at Battery Park City, which is asking $75 million and which first hit the market in March 2015.

Lenz, who in the past has disputed TRD’s data because the firm doesn’t use OLR, did not respond to multiple requests for comment.

But the breakout star of this year’s ranking was the Modlin Group, clocking in at No. 2 with $278.8 million worth of listings, up a stunning 172 percent from $102.5 million last year. Its biggest-ticket exclusive? Demi Moore’s penthouse at the San Remo, at 145-146 Central Park West, asking $75 million. The pad hit the market last April, just weeks after last year’s ranking was done.

Coming in at No. 3 was townhouse specialist Leslie J. Garfield with $166.3 million worth of listings, up more than 85 percent from $89.7 million in 2015. And the No. 4 spot went to New York Residence with $108.3 million in listings, up 43 percent from $75.5 million in 2015.

Rounding out the top five was Vandenberg, which had four listings valued at $77.8 million.

As a group, Manhattan’s boutique firms had 111 exclusive listings as of March 27, worth $1.3 billion — up from 103 listings valued at $878.2 million in 2015.

Those numbers reflect price jumps in the luxury market, where the median sale price jumped 21 percent to $6.6 million during 2016’s first quarter, according to real estate appraisal firm Miller Samuel.

“It used to be a lot of money to buy or sell an apartment for $10 million. Today that number is $100 million,” said Adam Modlin, who launched his 13-agent firm in 1999. “The deals have grown, and the size of the deals has grown.”

Of course, all that could change if the slowdown among high-end sales persists, along with price chops in the most upper echelon of the market, which would impact the bread-and-butter deals of many boutique firms.

Hello, goodbye

This year’s ranking saw several veteran real estate players pop on and off the list.

While Engel & Völkers, an international firm based in Germany, graduated to the mid-sized list, Peter McCuen & Associates slipped off this year’s ranking — as did several other small firms that are highly sensitive to fluctuations in the market, since a listing or two can change their status.

The three-agent firm Joanna Cutler Real Estate took No. 6 with $44.5 million in listings. It was followed by Key-Ventures with $36.3 million, Prime Manhattan Residential with $34.5 million and Domus Realty with $32.2 million.

Platinum Properties snagged the No. 10 spot with $31.7 million worth of listings. Kleier Residential came in at No. 11 with $26.3 million worth of listings. And Stephen P. Wald Real Estate Associates and Reba Miller’s boutique firm tied at No. 12 with $25.2 million in exclusives each. Miller, who launched RP Miller and Associates in 1998, did a stint at CORE between 2011 and 2014. She then left to reopen her own company, rebranded as RP Miller Realty Group.

At Platinum, which scaled back operations two years ago to renew its focus on the Financial District, President Danny Hedaya said business is strong despite a slip in listings from 2015, which he chalked up to TRD‘s one-day snapshot of the firm’s exclusives. Since restructuring, he said, the firm is investing internally “to allocate more resources to each agent.”

Commercial deals and residential leases — which TRD does not incorporate in its ranking — are also trending up. And Platinum has noticed an uptick in sales of starter homes and lower-priced apartments. “We’ve listed a few [properties] under $1 million in the last two months and within a week we’ve had bidding wars,” said Hedaya.

Generally speaking, the smaller firms on this year’s list are tightly packed: There’s only a $1.2 million spread between companies in the No. 11 and No. 14 spots.

Edging onto this year’s list at No. 14, Olshan Realty — which last appeared on TRD’s ranking in 2013 — had $25.1 million in listings, up from $8.9 million last year.

Still, Donna Olshan, firm president and founder, pointed out that TRD’s analysis only measures a snapshot in time. “Inventory fluctuates, depending on which submarket you’re working on,” she said. “The lower the price, the fewer the listings. The higher the price, the more listings.”

Olshan said her firm, which has seven agents, rarely keeps lower-priced listings on hand for very long. “When we get them on the low end — meaning below $2 million — they move quickly. There’s turnover,” she said.

Echoing others in the industry, she pointed out that overpriced properties are simply sitting on the market.

In the luxury market, which is defined as the top 10 percent of all sales, properties are indeed taking longer to sell. The average number of days on market was 122 during this year’s first quarter, up 35.6 percent year over year, according to Miller Samuel.

While price sensitivity has impacted brokerages of all sizes, Modlin pointed out that boutique firms have an opening to compete against their larger peers if they can accurately price listings.

As opposed to the heady times of 2013 and 2014, when inventory was so tight that properties flew off the shelves, it’s not as easy to make deals these days. “During this market,” he said, “buyers and sellers have different expectations for pricing.”

Olshan, meanwhile, has carved out a niche by providing granular data on residential contracts signed above $4 million.

“If you value data, context and service, then you use someone like us,” she said. “If you just want a tour guide and want to do a lot of window shopping — and there are people like that — that’s a different type of buyer.”

The international effect

Despite headwinds in the luxury market (and the global marketplace for that matter), a number of boutique firms that cater to foreign buyers and sellers said their clients are more interested than ever in owning a piece of New York real estate.

“A lot of the increase in [our] business is from clients who are with us for a while, and now they’re increasing their portfolios because New York is a good place to do business, and there’s not much confidence in other parts of the world,” said Thomas Guss, president of New York Residence, who originally hails from Austria.

Rick Pretsfelder, a partner at Leslie J. Garfield, said his firm is “getting more traction” from international buyers following the firm’s alliance with London-based Beauchamp Estates, which was announced in 2015. He also said Garfield has expanded beyond its Upper East Side stronghold and now has a critical mass of listings Downtown. And the firm is marketing more than $150 million worth of multifamily properties that can be converted into single-family homes. (Multifamily buildings are not included in TRD’s analysis.)

Giampiero Rispo’s Domus is also catering to an international clientele. While the firm’s listings figure dropped to $32.2 million from $53.4 million in 2015, Rispo said that his company brokered roughly $200 million worth of buy-side deals last year. “Real estate is a safe haven,” the Italy native said, explaining why his European buyers are still buying in New York.

Rispo said that his clients historically hold onto their properties, yet some are now open to selling, given the massive price appreciation in the residential market.

“Europeans don’t sell. They like to keep it for a long time. Unless I approach them, they may not be aware of the potential value of their asset,” he said.

Of course, there’s no telling how much longer those assets will continue to appreciate.

At the start of 2016, pricing was flat and transactions were down, according to Pretsfelder, who cited more stock market volatility, lower Wall Street bonuses and higher inventory. “People are asking a lot of money for their properties,” he said, “and buyers have more options these days.”

Correction: An earlier version of this story and ranking mistakenly excluded several firms by not capturing all of their qualified listings. Those firms are: Vandenberg, Joanna Cutler Real Estate, Key-Ventures, Prime Manhattan Residential and Platinum Properties. The story and chart have been updated.