July 01, 2015

By Rich Bockmann

The adage “all real estate is local” takes on new meaning when it’s uttered half a world away.

As Chinese developers and investment firms ramp up their activity in New York City, they’re also building local real estate teams from the ground up.

To do that, these firms, which are mostly based in Beijing and Shanghai, have been poaching talent from some of the city’s top real estate firms, including Extell Development, Vornado Realty Trust and Silverstein Properties.

“They need people who are very familiar with the U.S. real estate market,” said Scott Hileman, director of the real estate group at the global consulting firm Deloitte.

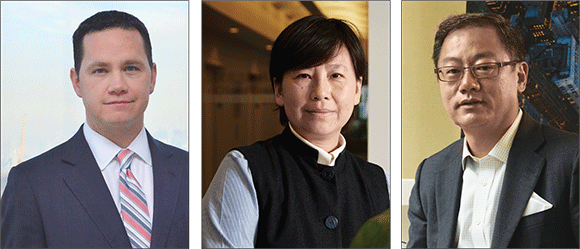

From left: Erik Horvat, Fosun’s Managing Director; I. Fei Chang, who oversees U.S. operations for the state-owned Greenland Holdings; and John Liang, managing director of Xinyuan Real Estate’s U.S. operations.

The competition for top talent is especially intense, Hileman said, because it comes in what’s already a tight market, even for premier New York real estate companies.

“The market is so strong; if you’re trying to hire people, it’s difficult in general,” he said.

For the most part, these New York hires do not speak Chinese. Some companies deal with the language barrier by hiring junior bilingual staffers or moving mid-level teams over from China to help facilitate communication between New York and company headquarters.

In some cases these companies “parachute in” executives from China who assemble local teams to pull the levers on their projects.

In some cases these companies “parachute in” executives from China who assemble local teams to pull the levers on their projects.

This month, The Real Deal looked at some of the fastest-growing Chinese real estate firms in New York and the players they are tapping to help plant permanent flags here. Read on for a closer look.

Fosun

Fosun International struck a deal to buy the 2.2 million-square-foot One Chase Manhattan Plaza for $725 million in October 2013. But the investment arm of China’s largest privately held company had no local team to manage the project.

So the following May, the firm sent 10-year company veteran Bo Wei to New York from Shanghai to build one.

Wei, who speaks little English and communicates mostly through a translator, is Fosun’s chief U.S. representative and vice president of its real estate division, Fosun Property.

“I want to emphasize that Fosun is a multi-national company with headquarters in Shanghai and lots of investment overseas and all over the world,” he told TRD through his interpreter. And “one principle we always hold is to respect the local market and local culture.”

Wei said that repositioning One Chase Manhattan Plaza, which Fosun rebranded as 28 Liberty, required finding New York industry players to bring on board. So he hired architecture firm Skidmore, Owings & Merrill; a leasing team led by Peter Riguardi, the president of New York operations for JLL; and CBRE as the property manager — all firms Fosun has relationships with in China as well.

In order to build an in-house team, the company turned to a recruiter to find someone who knew the market inside out.

Two months after Wei’s arrival, Fosun brought on industry veteran Erik Horvat, who was then heading the World Trade Center development at the Port Authority of New York and New Jersey, as managing director.

“They found me through a recruiter process,” Horvat said. “It makes sense for a new firm to do that.”

He noted that one of the things that convinced him to make the move was the chance to build a U.S. real estate team that has the support of a huge, global player.

“Fosun, as large as it is, in America, it’s really in an entrepreneurial place,” he said.

Horvat spent the last five months hand picking real estate pros to join a team that now numbers about a dozen professionals. And while most of the high-level staffers Fosun has poached from NYC competitors don’t speak Chinese, the majority of the office is bi-lingual, thanks to a number of Chinese-American hires and a team sent over from Shanghai.

The company landed several key hires from other major New York real estate firms and organizations.

For example, Jason Berkeley, who was brought on as Fosun’s head of development and construction, spent about six years at Larry Gluck’s Stellar Management, overseeing some 1.5 million square feet of Manhattan office space. James Connors, tapped as head of asset management, was general manager of the Empire State Building Company before heading the development of the National September 11 Memorial & Museum. And Tom Costanzo, who last month came on to head leasing at 28 Liberty, came from Vornado Realty Trust.

Those new hires have now allowed Fosun to begin expanding its presence in New York beyond 28 Liberty.

The company announced in May that it is partnering with JD Carlisle to co-develop a 47-story residential tower at 126 Madison Avenue.

Horvat said that as the company’s scope grows here, Fosun will continue hiring.

“We continue to grow and make good progress on the hiring side, but we want to be prudent in hiring,” he said. “We have two deals and I think we’re finally getting there. There will be more though.”

Xinyuan Real Estate

Rendering of the Oosten at 429 Kent Avenue in Williamsburg.

Of the Chinese firms with a presence in New York City, Xinyuan Real Estate is the most established. The company got its start here in 2008 when early investors, including billionaire Equity International Chairman Sam Zell, took it public on the New York Stock Exchange.

Today, the company has a staff of about 20 in the city and is in the sales phase of its 216-unit, ground-up residential development in South Williamsburg. The Piet Boon-designed condo building, dubbed the Oosten, is nearly 50-percent sold.

John Liang, the managing director of the company’s U.S. operations, said the fact that more than half of Xinyuan’s board is made up of American citizens gave the company a running start.

“They are well-connected in New York,” he said.

Liang came to the United States from Beijing in 1991 to study architecture at the University of Arkansas. After several years designing buildings, he jumped to the development side and enrolled at the Wharton School at the University of Pennsylvania. After graduating, he landed a gig as an asset manager at General Growth Properties overseeing a portfolio of some 30 malls on the East Coast. He then did stints at Lerner Heidenberg Properties, a New

Jersey-based retail owner, and in the real estate division of the A&P supermarket chain.

In 2012, he connected with Xinyuan chairman Yong Zhang through a mutual acquaintance.

Liang said trying to find top-level talent in America for a Chinese company presents a classic Catch-22 situation.

“There’s a dilemma: You can find good real estate people who speak Chinese, but have never been in a senior management role, who had never run big companies,” he said. “On the other side, you may have some people who are senior enough, but they don’t have U.S. real estate operational experience.”

Liang’s hires include vice president of acquisitions Can Tavsanoglu, who came over from the Lightstone Group, and residential broker Cindy Morin from Halstead Property, a Beijing native who speaks Mandarin.

He said having a bi-lingual residential sales director on staff is crucial, considering that Xinyuan is marketing a third of its units to buyers in China.

In fact, about half of the staff is bi-lingual, which is especially important in the accounting department. Liang pointed out that the company is overseen by the main regulatory agencies in both the U.S. and China — the Securities and Exchange Commission and the China Securities Regulatory Commission.

Kuafu Properties

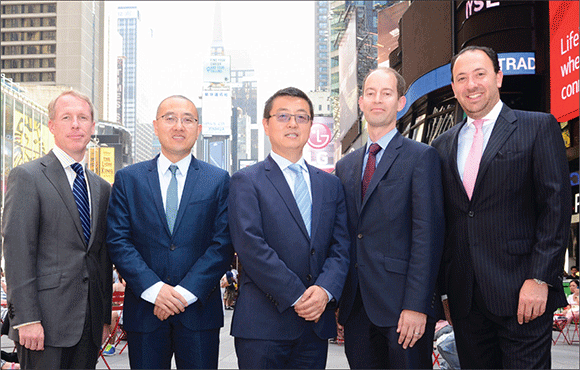

Kuafu Properties’ team now includes, from left: Christopher Sameth, Shang Dai, Zengliang “Denis” Shan, Jeffrey Dvorett and Stephen Muller. The company went into contract to buy a $300 million site last month.

Last year, Forbes referred to the “U.S.-based (but Chinese-named)” Kuafu Properties as the “mystery real estate company” planning a 47-story tower on a $62 million development site in Hudson Yards it bought with partner Siras Development.

Indeed, the company’s principals, Shang Dai and Zengliang “Denis” Shan, are new to development.

Dai came to the U.S. from Chicheng, a rural town about 50 miles north of Beijing, in 2002 and started his own law firm in Flushing, Dai and Associates, catered largely to Chinese-based companies looking to do business

in the U.S.

Shan, who founded China’s largest privaView Postte architecture and design firm, CCDI Group, arrived a decade later in 2012.

The two teamed up that year and began building Kuafu.

The pair took “two years to fully understand and get traction on deals and navigate the waters,” said Stephen Muller, who joined the company in February as its chief investment officer.

“They had really relied on their relationships in America to source everything, from deals to personnel.”

Muller, formerly a managing director at the Midtown-based real estate investment bank the Greenwich Group International, said he met Dai at a Washington, D.C. conference last year hosted by the Association of Foreign Investors in Real Estate.

Kuafu’s first key hire was Christopher Sameth, who was previously a principal at the investment firm Investcorp where he invested in debt funds active in the city’s commercial real estate market.

Late last year, the company added Jeff Dvorett, the Extell Development executive who oversaw development of One57, as head of development.

The company now has nine employees, and is looking to hire more as it expands its portfolio, which in addition to the Hudson Yards tower, includes the 223,000-square-foot, mixed-use tower it’s co-developing with Stillman Development at 151 East 86th, dubbed 86th and Lex.

Kuafu last month also went into contract to buy a $300 million development site on the Upper East Side across from Bloomingdale’s, where it could build up to 280,000 square feet.

Greenland Holdings

State-owned developer Greenland Holdings had a memorandum of understanding in place to invest $1 billion in a Downtown Los Angeles mixed-use project in 2013 when it sent I. Fei Chang to the U.S. to oversee the development and source more deals.

Chang, who studied architecture at Yale and speaks fluent English, quickly built a pair of teams to work on projects on each coast to handle the company’s growing portfolio. In New York City, Greenland inked a deal in December 2013 with the Forest City Ratner Companies to buy a 70-percent stake in the 6,430-unit residential portion of the Pacific Park project in Downtown Brooklyn.

To oversee the project, Chang hired development manager Scott Solish from the New York City Economic Development Corp., who as vice president of real estate was responsible for projects such as the new Whitney Museum of American Art in the Meatpacking District and the sale of a development site at the northwest corner of Central Park in Harlem, where a 75,000-square-foot residential development is planned.

Chang still serves as Greenland Holdings chief representative in the U.S., scouring deals and working with decision makers back in China.

“I’m still the head of acquisitions,” she said. “I make decisions and recommendations to headquarters.”

The New York City team now has 15 employees, including chief financial officer Jianhong Zhang, who came here from Shanghai, and deputy CFO Clifford Schwartz, who was at Silverstein Properties where he served as treasurer.

“On the States-side team, being bi-lingual is not the priority,” Chang said. “The most important thing is their expertise and desire to progress.”

Correction: An earlier version of this post incorrectly identified the architect of The Oosten in Williamsburg as Peter Poon. The architect is Piet Boon.