The streets of Flushing, New York City’s largest Chinatown, are swarming with visitors from all over the tri-state area going to doctor’s offices, law firms and other businesses in the neighborhood. And members of Flushing’s booming community of professionals have a long-standing tendency to buy — rather than rent — office space.

That preference has translated into an unusually active commercial condo market.

“Flushing’s a unique market — it’s got a heavy Asian concentration, and traditionally the Asian community is made up of owners as opposed to renters,” said Daniel Wechsler, head of the investment sales division at Ariel Property Advisors. “So there’s more product being built to cater to that demographic, which is why you see it in Flushing really more than other parts of the city.”

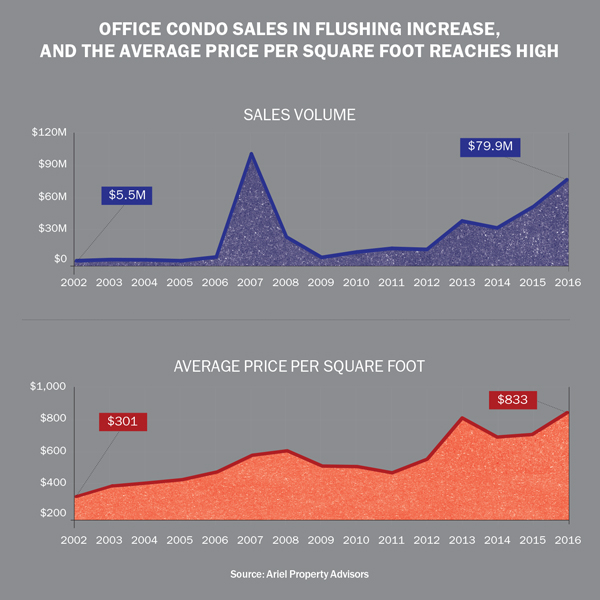

Last year, there were 56 office condo sales totaling $79.9 million in Flushing — the most the market has seen since 2007, when there were 107 sales worth a combined $100.6 million — according to data from Ariel Property.

And the activity has continued in 2017.

In March, home health care agency American Business Institute bought a pair of office condos for $2.7 million, or more than $1,140 per square foot, at Onex Real Estate Partners’ new SkyView Wellness Center. Two months earlier, law firm Hang and Associates paid $1.7 million, or just shy of $1,200 per square foot, for a condo at F&T Group’s Queens Crossing — roughly double what the office sold for a decade ago.

Those per-square-foot prices are essentially on par with pricing for new residential condos, which is $989 in the area year to date, according to Miller Samuel, a Midtown-based appraisal firm. (The average price for all office condos — both new and resale — was $833 per square foot in Flushing, according to Ariel.)

In a city where residential space typically commands a premium, the fact that new commercial and residential condos are selling for prices in the same ballpark makes Flushing unique.

Michael Falsetta, executive vice president at Miller Cicero, Miller Samuel’s commercial sister company, said that while prices for residential units in Flushing are roughly half of what they are in Manhattan, they are roughly equal to what office condos fetch.

The numbers back that up.

For example, new-development residential condos in Manhattan sold for an average price of $2,645 per square foot in the first quarter, according to numbers from Miller Samuel. By comparison, commercial condos in the borough commanded only $847 per square foot, according to Michael Rudder, founder of the office-condo brokerage Rudder Property Group.

“The same discount doesn’t hold. That tells you there’s a different demand factor at work,” Falsetta said.

And developers are doubling down. The Queens neighborhood is getting the single-largest injection of new office-condo product in its history with 75 coming on line at F&T’s 1.8-million-square-foot Flushing Commons, 47 units across 80,000 square feet under construction at its 1.2-million-square-foot Tangram, two blocks away, and 32 office condos at Onex Real Estate Partners’ SkyView.

And developers are doubling down. The Queens neighborhood is getting the single-largest injection of new office-condo product in its history with 75 coming on line at F&T’s 1.8-million-square-foot Flushing Commons, 47 units across 80,000 square feet under construction at its 1.2-million-square-foot Tangram, two blocks away, and 32 office condos at Onex Real Estate Partners’ SkyView.

The development craze for office condos in the area is not new.

Flushing’s first modern office-condo building — F&T Group’s 47-unit, 110,000-square-foot development Prince Center — was completed in 2002. The firm followed that up in 2007 with Queens Crossing, a 420,000-square-foot mixed-use building located at 136-17 39th Avenue.

In fact, the office-condo market accounts for roughly 27 percent of Flushing’s total office market, according to research by The Real Deal. Meanwhile, office condos make up approximately 2 percent of the more than 500 million square feet of office supply in the borough, according to Rudder Property Group.

“The office condo has always been much preferred in Flushing, primarily because of the types of businesses there,” said Wendy Cai-Lee, who served as the head of East West Bank’s consumer and business-banking practice before leaving earlier this year to start her own debt-and-equity fund.

“They’re mostly small-business owners: either professional offices, doctors, lawyers or accountants,” she added. “It’s a lot of professionals that service the bilingual market.”

Most of the purchasers are small businesses that have reached the point where it makes more sense to buy than rent, said Andrew Feldman, a broker at venture-backed residential brokerage Triplemint who does commercial sales and leasing in Flushing.

“They’re businesses that have been well-established already,” he said. “They’re well-funded and they’re making money.”

Flushing’s economic growth for roughly two decades is only intensifying the push into the office-condo business.

Between 2000 and 2015, Flushing added more than 13,000 jobs, growing at a rate of 34 percent, according to state Comptroller Thomas DiNapoli’s office. That was more than double Manhattan’s average job-rate growth of 15 percent. And during that same time, the state Attorney General’s office approved 347 new Flushing office condos, an analysis of AG filings found.

Nearly half of the job gains were in health care — the largest sector of Flushing’s economy.

Flushing Commons

“Downtown Flushing is like a hub. It’s like a commercial city center for Eastern Queens,” said Michael Wang, a principal at the commercial brokerage G8 Real Estate and treasurer of the Greater Flushing Chamber of Commerce.

Wang said that No. 7 train, the Long Island Rail Road and a web of 20 bus routes that converge in the neighborhood make it a natural commercial nerve center and a magnet for Asian residents throughout the New York metro area.

“There are a lot of buildings here that are full-blown medical buildings, where the doctors may be at Flushing [Hospital] or Queens Hospital or maybe tied to something in the city,” he said. “There are plenty that aren’t affiliated with hospitals, too.”

In addition, a quirk in the city’s zoning code incentivizes developers to construct more commercial condos. In commercially zoned areas west of Union Street, developers can achieve the highest floor-to-area ratio by setting aside a large portion as community facility space for businesses that benefit the local area — say a school or religious institution. That space, which Flushing’s developers usually sell off as commercial condos, is considered less valuable in many other parts of the city, according to developers and brokers.

In Manhattan, for example, developers often include community space simply because it lets them construct taller buildings, not because they find value in renting it out. But given that medical offices fall into the “community space” category, Flushing’s developers are eager to build it.

And office condos cost less to build than residential condos because developers deliver them as blank white boxes. Office condos also don’t lose sellable space the way residential condos do when a developer starts adding things like hallways, kitchens and bathrooms. So even if an office condo sells at less than a residential condo on a nominal basis, its effective pricing is often higher because there’s more space to sell in the unit.

“If you’re selling it for $900 per square foot, it’s almost equivalent to $1,200 [per square foot a residential condo would sell for],” said David Brickman, managing director at Onex.

But even as construction chugs along at new office-condo projects in Flushing, questions persist about just how deep the market is. Buying a condo represents a large financial investment that not every company can afford.

Michael Meyer, president at F&T Group, said the number of buyers in a position to buy a residential condo far outweighs those who can buy offices.

Brickman agreed and said that, tempting as these projects may seem, Onex would wade cautiously if it decided to do another office-condo building.

“There’s a smaller demand circle [compared to residential] that you’re trying to capture in terms of who your end users are,” he said. “I would be sort of cautious if I was underwriting a new project, looking at demand.”

“The economics on paper might be compelling,” Brickman added, “but if the supply outstrips the demand, you could be looking at a longer absorption period if you build too many.”

But for the time being, developers (at least those with projects in the ground) are banking on the fact that the buyers — and financial returns — will be there.

“The highest and best use for real estate in Flushing is office condos,” Meyer said.