Just before 8 a.m. on Dec. 13, 2016, two teams of sheriffs descended upon narrow streets lined with cinder block buildings in Laoag, a city in northern Philippines. They stormed a pair of office buildings, leading some onlookers to think brawls had broken out. In fact, the target was Avion BPO, a call center and research facility with U.S. clients.

A group of panicked Avion researchers locked themselves in a room. Other employees, including two pregnant women, were held for hours until they divulged their computer passwords. Flanked by armed security guards, Curtis Ricketts, then a top executive at CoStar Group, the publicly traded U.S. commercial real estate data giant, watched as hundreds of computers were seized and shuttled away in waiting vans.

The trove included 35 terabytes of data CoStar would use as evidence in a federal copyright-infringement case it had filed just hours earlier, 8,000 miles away in Missouri. The defendant in that suit: Xceligent, an Avion client and CoStar’s biggest rival.

A year after the raid, Xceligent, which had been hemorrhaging money, filed for bankruptcy and shut down. The move left CoStar with a near monopoly serving the commercial real estate leasing industry. CoStar’s market cap, now north of $15 billion, has more than doubled since the raid, as has its share price.

At the core of CoStar’s business is a detailed database of commercial properties — size, tenants, photographs and rents. It has long seen itself as the Bloomberg of commercial real estate, and in recent years expanded into the residential space with the acquisitions of Apartments.com and ForRent.com.

Yet to defend its turf, CoStar has gone to extremes, well beyond other information giants similarly vulnerable to data theft. Since the 1990s, CoStar has filed at least 33 federal copyright-related lawsuits against individuals, customers and competitors, from small data shops to multimillion-dollar companies. Bloomberg, for example, has filed no federal copyright-infringement lawsuits, though Reis, a real estate data company founded in 1980, has filed at least 11 lawsuits against people and companies it accused of using its service without paying.

For this story, The Real Deal interviewed dozens of CoStar’s customers, competitors, former employees, lawyers and industry experts, some of whom spoke on condition of anonymity. An examination of CoStar’s litigation history indicates that the company uses a playbook of aggressive lawsuits and public-relations warfare against its rivals. As will be seen, its tactics can push them to the brink of collapse or weaken them enough to make them soft targets for an acquisition.

“They’ve used litigation to suppress innovation in the space,” said Elie Finegold, the former head of global innovation and business intelligence at CBRE, the world’s largest commercial brokerage and one of CoStar’s biggest customers. “And over time, they have cultivated an adversarial approach to customers.”

Andrew Florance, CoStar’s founder and CEO, has defended his firm’s methods. “You learn at school,” he recently told Bisnow, “that you don’t just take someone else’s paper and write your name on it and submit it as your work.” In a statement, CoStar said it “does not sue competitors who compete lawfully” and that it “does not instruct its customers to access CoStar without a legitimate subscription.”

“CoStar enforces its intellectual property and database rights against industrial scale copying and resorts to litigation only when necessary to stop this harmful and unlawful conduct,” it added. “Court after court has ruled in CoStar’s favor, issuing judgments and ordering permanent injunctions.” CoStar pointed to Craigslist and Getty Images as examples of other companies that file many lawsuits.

Indeed, some observers consider CoStar’s approach to competitors unavoidable. “You would expect a company in that situation to aggressively protect its intellectual-property assets,” said Barry Werbin, an intellectual-property lawyer at Herrick Feinstein.

But the Washington, D.C.-based company has drawn scrutiny from the Federal Trade Commission, which filed an antitrust complaint against it in 2012 when it sought to acquire a major competitor, LoopNet. The FTC allowed the merger to proceed with the stipulation that, in order to ensure a competitive market, the combined company sell off one key LoopNet asset — Xceligent.

As the likes of Amazon, Facebook and Google build immense clout through the control of information and intense lobbying, federal regulators are struggling to curb their power. Some experts see CoStar as becoming a member of that club. The research firm Morningstar recently characterized the company as a “borderline monopoly” with “no true threats in terms of competition.”

Seven months after Xceligent filed for bankruptcy, CoStar said the average monthly price it charges new customers had jumped to $466 per broker, up from $255 the previous January — an increase of over 80 percent.

David Johnson, a former chief innovation officer for JLL, said CoStar plays an important role in the real estate space.

“If you are in the business of helping an industry, you should,” Johnson said. “But,” he added, “these guys are pretty cutthroat.”

“Sued the pants off them”

Florance, 55, has long viewed his creation as under attack. Impeccably dressed, with neatly parted silver hair, he cultivates an image of the quintessential CEO. People describe him as charming and courteous, but also as someone with a vindictive streak who will personally wade into public fights.

“Andy is very, very smart and very, very ruthless,” said Finegold, the former CBRE executive who has dealt with Florance on multiple occasions.

After initially agreeing to an in-person interview for this story and a tour of the company’s research facility in Richmond, Virginia, a CoStar spokesperson said Florance would not be made available and asked for questions to be emailed. The company then described TRD’s inquiries as containing a “toxic stew of half-truths, baseless insinuations and outright falsehoods.”

“TRD is seeking to improperly harm a competitor,” CoStar added. (TRD sells custom research products mostly focused on new development in New York and also has plans to display residential and commercial property listings.)

The son of Colden “Coke” Florance, a prominent Washington, D.C., architect, Florance graduated in 1986 from Princeton, where one of his lab partners was Amazon’s Jeff Bezos. He learned to digitize records, including property and deed data, and landed an internship at Stout and Teague, a commercial development firm.

After graduating, Florance worked out of his parents’ basement and launched his first company, Real Estate Infonet, which provided brokers with a database of commercial buildings.

He turned to digitizing other records, including data from the U.S. Securities and Exchange Commission. Today known as EDGAR, the program became the industry standard for searching public filings for U.S. companies.

Florance, then 23, proposed a business based on Infonet that could help identify bad loans. Michael Klein, a brash D.C.-area attorney who represented discount-store tycoon Herbert Haft, saw the potential. In 1987, he and TPG Capital founder David Bonderman invested in Florance’s idea to start a company called Realty Information Group. It grew to employ a dozen researchers, with 300 subscribers who reportedly paid between $2,000 and $3,000 per month for access. Klein became chairman and continues to chair CoStar today.

The startup had an immediate impact. Leasing brokers need to know what office spaces are available and how much they cost. That information used to only be available through word of mouth, and big firms, with armies of brokers to collect data, had a sizable advantage over smaller competitors. Florance changed that: Anyone with a computer and a subscription now had instant access to rents, existing tenants, square footage and building photos. An office market hiding in plain sight had been illuminated.

But the threats to this business model soon became apparent. In 1993, the company received calls from customers asking to cancel their subscriptions because another site was offering the same service for just $100 a month. Florance learned that his former bosses at Stout and Teague were reselling his data, and it was appearing on the site. With Klein as his attorney, Florance took them to court and was awarded $10,000 in damages.

“We sued the pants off them and we won,” Florance told The Washington Post at the time. “A visible brokerage firm was caught with its drawers down.”

Barbarians at the gate

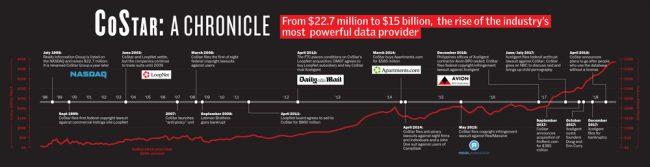

In July 1998, Florance took his company public, raising $22.7 million in an initial public offering. A year later, the firm was renamed CoStar Group. It had revolutionized the industry, but its methods of collecting data were old-school: Researchers drove around the country snapping photos of buildings and collected data by calling brokers and landlords.

Andrew Florance (Illustration by Chris Koehler)

By contrast, LoopNet, a commercial real estate data platform founded in San Francisco in 1997, was a product of the digital age. Instead of relying on swarms of researchers, it offered brokers and landlords an online hub to share information about their listings. Crowdsourcing allowed it to build a database far faster and cheaper than CoStar did. But the model also meant that users might, in theory, take CoStar’s data and share it on LoopNet for anyone to use.

In 1999, as LoopNet was raising its third venture funding round, CoStar fired its first legal salvo in a 10-year copyright-infringement campaign. The case became one of the first to fall under the Digital Millennium Copyright Act, a landmark 1998 law that specifies what responsibilities online platforms, such as file-sharing site Napster, have when it comes to hosting third-party content. CoStar argued that LoopNet was liable for third parties uploading stolen images onto its platform; LoopNet disputed that.

Because facts such as square footages and tenant names are not subject to copyright, CoStar couldn’t sue over duplicated lease data it believed was stolen from its database. So it zeroed in on photos taken by its researchers that had landed on LoopNet.

“That was the linchpin,” said Wayne Pierce, an attorney who represented LoopNet. “Without that, they [CoStar] had nothing to stop the invasion of the Huns.”

Pierce recalled spending hours poring over photos, trying to figure out if two images were identical. “I just thought it was ludicrous,” he said. The suit ended in a settlement in 2003, but CoStar and LoopNet continued to tussle in court for years over other disputes.

CoStar was also entangled in other legal fights. In 2002, Andrew Blount, founder of the real estate software firm Realhound.com, sued CoStar and Florance for libel. At the time, the two firms shared a major customer: CBRE. The suit alleged that Florance told CBRE representatives Blount was a “felon” who built software “time bombs” and wasn’t legally allowed to create property software. Shortly after Florance’s remarks, Blount alleged, CBRE canceled its contract with Realhound.com. A jury found CoStar and Florance not liable. Blount appealed, and the two sides settled, court records indicate.

One method CoStar used to catch bad actors was to insert false numbers, or “seeded data,” for data points such as square footage on its platform. If a fake number turned up on a rival platform, CoStar cried data theft. In 2007, the company built on this effort by launching an “anti-piracy team” and developed its own software to catch misuse by tracking who logged onto its platform and from where.

“They had a whole black ops,” said one former longtime CoStar salesperson.

The fugitive

On the eve of the 2008 global financial crisis, CoStar’s shares were worth more than $1 billion. But five months after Lehman Brothers went under, they had plummeted to around $500 million. Across the country, tumbling real estate prices drove developers and lenders into bankruptcy and appraisers and brokers out of work. Fewer people needed CoStar’s product, and far fewer still could continue to pay high sums for it.

As with many subscription-based services, some CoStar users shared passwords. As the company’s revenues stagnated, it began cracking down on this practice: Between March 2008 and March 2009, CoStar filed nine anti-piracy lawsuits against its users, court records show.

The first target was Mark Field. In March 2008, CoStar sued Field, his California-based appraisal firm Alliance Valuation Group and a handful of people and companies he allegedly shared his CoStar password with for fraud, breach of contract and copyright infringement.

“With their customer base, the real estate market, going to hell, their ability to survive was in jeopardy,” Pierce, the attorney who had represented LoopNet and then Field and some of his co-defendants, said of CoStar. “I had the definite impression that they were happy to squeeze the little guys to send a message, so that they could hold on to their business.”

The defendants fought the charges, but they were reeling from the financial crisis. Field eventually stopped paying his legal bills and went to Mexico. “He’s out of a job. His company’s ruined,” said one of the defendants. “It was easy for him to kind of pick up and go.”

Yet the suit went on. “I had no documents, no witnesses and no client,” Pierce recalled. “I couldn’t even call [Field] on the phone. I filed a motion to withdraw, and it became a — I would say a show trial.”

CoStar opposed Pierce’s motion to withdraw from the case, and the judge ordered him to continue to fight it. In court, he watched as CoStar’s legal team paraded in witnesses and experts.

“They knew that all these guys had folded their tent,” Pierce said. “They had resolved that they were going to send a message.”

In March 2012, the court ordered Field to pay CoStar $2 million in damages. CoStar later put out a release lauding its legal victory over “multi-national data theft” by an “individual that reportedly crossed the Mexican border from the U.S. to avoid a multi-million dollar damages bill.”

Field could not be reached for comment for this story. CoStar said it “amicably resolves” most cases of access without a subscription and only sues “where the wrongdoer refuses to cooperate with us or the improper access is highly egregious.”

The contender

CoStar’s largest customers, including CBRE, JLL and Cushman & Wakefield, had long bristled at their arrangement with the data firm. To some executives, their subscriptions, which cost millions of dollars annually, boiled down to buying back the very data their brokers and analysts had supplied to CoStar’s researchers.

These tensions boiled over in December 2011, when CBRE sent out a memo to its brokers to not share any data with CoStar. The memo prompted a sharp rebuke from Florance, who accused CBRE of “trying to corner all the data” and called for the company to be investigated for anti-competitive practices.

CBRE executives quietly met with their JLL and Cushman counterparts to discuss a not-for-profit data-sharing arrangement that would consolidate property data from the three companies and become an alternative to CoStar.

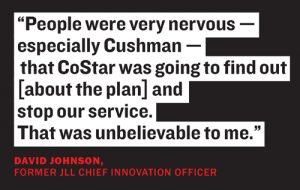

“There needed to be a better, more reliable solution,” said Johnson, the former JLL CIO, who was involved in the meetings. “But people were very nervous — especially Cushman — that CoStar was going to find out [about the plan] and stop our service. That was unbelievable to me.”

Citing concerns of retaliation from CoStar, Cushman pulled out of the talks, according to former executives at the companies, putting an end to the proposal.

In emailed statements, CBRE said it had a “long and mutually beneficial relationship with CoStar,” and JLL said, “We value our relationship with CoStar.” Cushman declined to comment. CoStar said that “these companies and other national brokerages have formed dozens of data-sharing partnerships over the last 30 years” and “CoStar has not once ‘retaliated.’”

It was a move by CoStar to further consolidate its power that finally handed its customers a viable alternative.

After a 10-year dogfight between CoStar and LoopNet, the company’s biggest competitor and the target of its copyright-infringement campaign, LoopNet’s board agreed to sell the company to CoStar for $860 million. The FTC investigated the deal for antitrust violations, and CoStar spent $10,000 lobbying Congress on “Antitrust issues relating to commercial real estate information industry,” public records show.

In April 2012, the FTC approved the acquisition, but with the condition that LoopNet sell Xceligent, a Missouri-based real estate information firm that it had bought a stake in in 2007. LoopNet’s president Tom Byrne and CEO Richard Boyle left the company after the deal closed.

“It was a little startling for us, to have our only competitor buying out our parent company,” Xceligent co-founder Doug Curry told Talk Business of the CoStar-LoopNet deal. “That was the darkest day in [Xceligent’s] history.”

Britain’s Daily Mail and General Trust bought Xceligent for less than $10 million and pledged to invest millions more in the company. The FTC barred CoStar from bundling its products in a way that might harm competitors and ordered it to scrap noncompete clauses. The so-called consent decree, put in place to protect Xceligent’s growth in the market for five years, also allowed customers to cancel contracts and sign up for a competitor’s products. A third-party monitor was appointed to ensure compliance.

“By maintaining Xceligent as an independent competitor and ensuring Xceligent’s ability to grow and expand, the FTC’s settlement order will foster continued competition in these markets,” Richard Feinstein, then head of the FTC’s Bureau of Competition, said at the time.

The pulpit

On April 1, 2014, Michael Mandel, CEO of commercial real estate data firm CompStak, saw an announcement from CoStar that it had filed a federal anti-piracy lawsuit against his customers.

After two years of relative harmony in the CRE data space, Mandel said, he and others at the startup were blindsided by the suit, which alleged that several CompStak users had stolen data from CoStar and repurposed it on CompStak. As evidence, CoStar cited seeded data on CompStak, which uses crowdsourcing to build up its database and has raised millions in venture capital since it launched in 2011.

“The presence of this seeded data in the CompStak service constitutes the proverbial ‘smoking gun’,” read CoStar’s complaint, which was covered in several publications, including TRD. It also alleged that CoStar images had been reproduced without authorization.

But CompStak did not publish images, and its legal team said that the users had taken the incorrect data from public sources, not CoStar. CoStar dropped the case two months later, but not before a judge ordered CompStak to disclose the identities of customers alleged to have committed the offense.

“They had no case to begin with,” Mandel said in a recent interview. “The point was not about copyright. The point was about trying to smear CompStak in the press.” CoStar maintains that it “sought cooperation” from Mandel before asking a court to intervene; Mandel said “that is patently untrue.”

CoStar was just warming up. In 2015, it filed a copyright-infringement case against RealMassive, alleging that the Texas-based commercial real estate data firm had repurposed more than 100 CoStar images on its site.

Several RealMassive users stopped uploading data onto the platform while the lawsuit was ongoing, citing fears of being targeted by CoStar.

“It absolutely worked,” a former executive at RealMassive said of CoStar’s lawsuit.

Rather than fight the case, RealMassive agreed to settle for $1 million. Florance declared that “RealMassive’s systematic theft of CoStar intellectual property had been conducted on, for lack of a better phrase, a real massive scale.”

By 2016, after honing its machine over more than a decade of lawsuits, CoStar was ready for its most ambitious crusade yet.

Not in Kansas anymore

Doug and Erin Curry (Credit: LinkedIn)

Over the past seven years, CoStar has spent around $2 billion on acquisitions, including big-ticket buys of LoopNet, Apartments.com and LandsofAmerica that gave it a larger global presence as well as a foothold in the residential space.

As it grew, so did its main rival, Xceligent. Bolstered by thousands of customers in 50 markets, including Los Angeles, the company prepared to enter one of CoStar’s most lucrative territories: New York City.

Xceligent tapped a 300-strong team of researchers, some of whom walked the streets of Manhattan to take building photos. Curry, who co-founded Xceligent with his wife, Erin, in 1999, held back-to-back meetings with brokers by day and schmoozed at industry events by night.

“I think they’ve got all the elements for success,” Mike Slattery, head of research at the Real Estate Board of New York, said of Xceligent in August 2016. “They’ve got experience, they’ve got capital and they’ve got staff.”

CoStar didn’t take the threat lying down. Two weeks after Xceligent debuted in Miami, and just months ahead of its New York launch, CoStar filed a federal copyright-infringement lawsuit against Xceligent in its home state of Missouri. Xceligent had committed copyright infringement on an “industrial scale” and used “offshore researchers” in India and the Philippines to steal 9,000 images from CoStar’s servers and repurpose them, the suit alleged.

CoStar said the company “files lawsuits when supported by the law and the evidence we have.” Asked why it didn’t send Xceligent, or RealMassive or CompStak, a cease-and-desist letter first, the company said that “where we uncover massive infringement and evidence of deliberate wrongdoing, there is no need for a letter.”

CoStar employees at the firm’s Washington, D.C. office in 2016

Like other CoStar competitors, Xceligent countered that the images were taken from public sources and that it would have removed them had CoStar notified it. In a statement on Dec. 13, 2016, it lambasted CoStar for what it said was a pattern of “filing lawsuits against its competitors to protect its dominant market position.” CoStar did not respond.

Hours later, Philippine authorities barged through the doors of Avion BPO.

Capture the flag

The operation in the Philippines was described by NBC News as a “daring raid carried out with military precision.” In a newsletter sent to customers, CoStar described Avion as “Xceligent’s biggest research sweatshop … in a remote Philippines jungle.” But in Laoag — a city of 110,000 people with three McDonald’s and several luxury hotels — witnesses who spoke to TRD more recently described a relatively more sober affair.

Digital-forensics experts, private security and sheriffs went into the buildings and emerged with hundreds of seized computers. Witnesses said 14 vans and an airplane were used to transport the items from the site. Ricketts, the former CoStar executive, was accompanied by more than a dozen attorneys from ACCRA — one of the most powerful law firms in the Philippines.

Under Philippine law, copyright-infringement lawsuits can warrant a search-and-seizure order to gather evidence for future court action. Microsoft, for example, has petitioned for similar raids on Philippine businesses it accused of using pirated versions of its software.

But such raids are usually conducted by the National Bureau of Investigation — the country’s equivalent of the FBI — or the Philippine National Police. Officials within the NBI’s cybercrime division told TRD they had no knowledge of the Avion raid, and the national police said the same. In this case, a court-appointed commissioner oversaw the raid.

A written request by TRD to view CoStar’s petition for the search-and-seizure warrant was denied by the issuing judge, Elma M. Rafallo-Lingan, of Pasig City Regional Trial Court Branch 159 in Manila. “The case,” a court clerk said, “is not imbued with public interest.”

The reveal

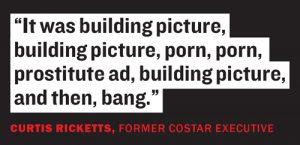

On June 28, 2017, Xceligent fired back with an antitrust lawsuit that called for an “end to CoStar’s decades-long monopoly in the CRE information industry.” Three days later, Florance and Ricketts appeared on NBC to discuss the seven-month-old raid. On camera, they unveiled a new bombshell.

“It was building picture, building picture, porn, porn, prostitute ad, building picture, and then, bang,” Ricketts said of the seized material.

“Bang what?” the interviewer asked.

“Child pornography,” Ricketts replied. “That was it, I immediately shut the computer off, picked the phone up, called the attorneys, and they called the FBI.”

In addition to doing work for Xceligent, Avion, the target of the raid, was also contracted by Backpage, a U.S. classifieds site that hosted prostitution advertisements. Florance positioned CoStar as a champion of anti-sex trafficking laws, and the company spent $70,000 on lobbying Congress in 2017 on “issues pertaining to human trafficking.” Ricketts could not be reached for comment, and CoStar said that, at present, “Ricketts has no affiliation with CoStar Group.”

In a letter to senators in support of the Stop Enabling Sex Traffickers Act of 2017, CoStar condemned child sex trafficking and Xceligent in the same sentence. Despite being a real estate data company with no involvement in sex trafficking, Xceligent was thrust into news coverage on the subject in major media. When Xceligent’s board removed Curry in October, CoStar issued a statement bashing his “perverted philosophy” of accusing CoStar of anti-competitive practices for defending its data.

To bolster the public-relations offensive, CoStar sent brokers across the country brochures that detailed Xceligent’s alleged misdeeds and included news reports about Backpage. It also sued another Xceligent contractor, Pittsburgh-based RE BackOffice. A day after the suit was filed, the two companies issued a joint stipulation in which RE BackOffice confessed that Xceligent had directed it to copy content from CoStar-owned websites.

But a week later, RE BackOffice walked back its admission of guilt in a statement. It agreed to sign the stipulation, a source close to the company said, because it didn’t have the money to fight CoStar in court.

“That’s the bottom line,” the source said. “So the question is: Do you just take the beating and move on?”

The gravedancer

On Dec. 14, 2017 — a year and two days after the lawsuit was filed — Xceligent filed for Chapter 7 bankruptcy. Its parent company, DMGT, had spent $19 million in legal expenses in the prior year alone, which it attributed “primarily” to Xceligent. CoStar and other competitors took out Google Ads with keywords such as “We are ready to help” and “Attention Xceligent customers.” It also vowed to continue enforcing its claims against Xceligent.

This January, CoStar did the PR equivalent of a touchdown dance: It announced an exclusive partnership with the Kansas City Regional Association of Realtors, a leading trade group in Xceligent‘s hometown.

Most observers say that though the lawsuit helped speed up Xceligent’s demise, the company failed because it lost too much money in its bid to cut into CoStar’s market share. DMGT and Doug Curry declined to comment.

“Xceligent failed to expand large enough, deep enough and wide enough to offer an alternative to CoStar,” said Johnson, the former JLL CIO. “They fumbled the ball and never really gave it a run. It wouldn’t matter if CoStar was egregious or not. A crying shame, as my dad would say.”

A new target

Since CoStar’s brush with the FTC during the LoopNet merger and divestiture of Xceligent, the agency has not pursued any further action against the company. And with Xceligent no longer in business, the regulator’s attempt to maintain a competitive market appears to have all but failed.

“It [the CoStar-LoopNet merger] is a black eye for the FTC,” said Andre Barlow, a former Justice Department antitrust attorney. “When you have a result like this, customers are the ones that suffer.” He pointed to other recent failed remedy campaigns by the agency, including the mergers of car rental giants Hertz and Dollar Thrifty and supermarkets Safeway and Albertsons. The FTC declined to comment.

CoStar spent at least $19 million on litigation in 2016 and 2017, SEC filings show. But the company’s financial position has strengthened — net income in the second quarter of 2018 grew 98 percent year over year, to $44 million — and its acquisitions continue.

In September last year, CoStar announced that it would acquire ForRent, a rental-listing platform that it would use to expand Apartments.com. The antitrust regulator ordered a 60-day hold on the merger to assess potential anti-competitive practices, but ultimately approved the $385 million deal this past February.

Lacking serious competitors, CoStar has intensified attention on another perceived threat. On an April earnings call, Florance said, “we believe that there is as many as 10,000-plus people and perhaps two to three times that number illegally accessing CoStar.”

The individuals illegally print out CoStar photos, Florance said, and the company is prepared to sue them for hundreds of thousands of dollars.

“We think it’ll cost a little bit,” Florance told his investors. “But nothing like we spent last year on Xceligent.”

—The Real Deal’s Konrad Putzier, David Jeans and Christian Bautista reported from New York. Jeans also reported from the Philippines, along with Nancy C. Carvajal, a freelance reporter formerly with the Philippine Daily Inquirer and the Philippine Center for Investigative Journalism.