Real estate data firm Xceligent, which has been embroiled in a multimillion-dollar lawsuit with CoStar Group, shut down operations Thursday and filed for Chapter 7 liquidation, according to a source familiar with the matter.

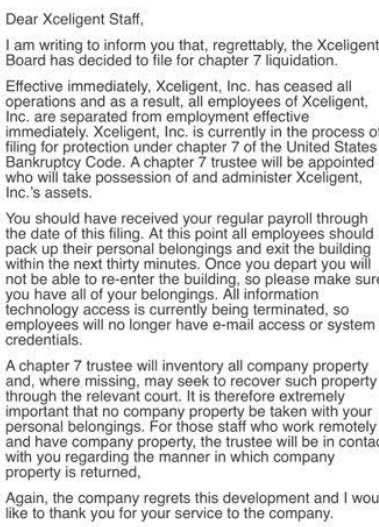

A note was sent out to staff Thursday informing them about the decision, according to a source who read it. Employees were asked to vacate the building immediately, and Xceligent’s website was down as of Thursday evening.

“At this point all employees should pack up their personal belongings and exit the building within the next thirty minutes,” the note from Xceligent acting CEO Jody Vanarsdale, which was reviewed by The Real Deal, reads. All 250 of Xceligent’s employees, mostly based at the firm’s headquarters in Kansas City, Mo., were let go.

Note sent to Xceligent employees Thursday

“What shocked me is that they have a real business,” said one executive in the real-estate data space. “The problem is, they were just bleeding money. With that lawsuit…CoStar just crushed them! Jesus.”

CoStar sued Xceligent last December, alleging copyright infringement and claiming the rival commercial property database stole its images. Xceligent hit back in June, filing an antitrust lawsuit against CoStar. Doug Curry, Xceligent’s founder and CEO, led the legal crusade. But in October, Xceligent’s parent company, Daily Mail and General Trust (DMGT), fired him, citing disappointing revenue growth.

Earlier this week, the Wall Street Journal reported that settlement talks between CoStar and Xceligent had broken down. CoStar’s demand that Xceligent remove some material on its database, the report said, was one Xceligent wasn’t willing to meet.

A spokesperson for DMGT told TRD that the decision to file for Chapter 7 is “not at all connected to the CoStar litigation.”

The two main factors behind the decision, the spokesperson said, were a “smaller than expected revenue from the expansion into New York, and a decline in renewal rates.”

“I think they thought there was a greater opportunity than there was,” the spokesperson said. Reached by phone Thursday evening, Curry declined to comment. Bisnow first reported the news of the closure earlier Thursday.

“Everyone at DMGT is grateful to the Xceligent team for their hard work and wishes them well for the future,” the company said in an official statement. “DMGT will continue to focus on investing behind market-leading positions and remains committed to commercial real estate information. We own strong businesses within this major and under-served asset class, including Trepp, Landmark, BuildFax and EDR.”

DMGT’s new CEO, Paul Zwillenberg, is a former executive at Boston Consulting Group who’s been evaluating the company’s stable of businesses. It is in the midst of selling EDR, a real estate environmental data firm. On Nov. 30, DMGT said it had written down the carrying value of Xceligent to zero, citing the disappointing results in New York.

Xceligent’s website

A founder of a real estate data startup described Xceligent’s battle with CoStar as “the straw that broke the camel’s back,” but said it could not have been the main reason for the shutdown.

“A real business is not one that is bleeding money,” the founder said. DMGT would have backed Xceligent all the way, he speculated, were it a profitable venture.

“I could stomach the fight of a lawsuit if I believe the underlying asset is valuable,” he said.

Whether or not the litigation was the catalyst, it’s clear that Xceligent’s shutdown is a triumph for the publicly-traded CoStar. As of the market’s close Thursday – before the news of the shutdown broke – the company’s share price was at $287.80, up more than 50 percent this year. The Washington, D.C-based firm, which has a market cap of $10.4 billion, has publicly bared its teeth and said earlier this year it could spend up to $20 million on Xceligent-related litigation. When Curry was fired from Xceligent in October, CoStar was quick to use the decision as a marketing opportunity.

Even its statement on Xceligent’s shutdown – as corporate communications go – pulled no punches.

“CoStar sympathizes with those negatively impacted by this liquidation,” the company said. “We understand that Xceligent failed as a result of business missteps over two decades, as acknowledged by DMGT in its most recent earnings call, and we commend DMGT for making this difficult business decision. We remain committed to offering the best available data and insight to commercial real estate professionals, and stand by ready to help Xceligent’s former customers.”