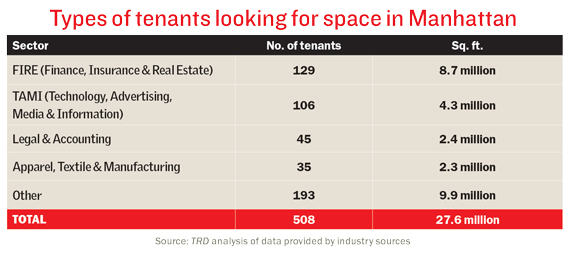

Even as the tech sector continues to blaze a trail through Manhattan, it’s the financial services, insurance and real estate (FIRE) industries that are set to lease the most space in Manhattan in the coming years.

Tenants in the FIRE sector are in the market for at least 8.7 million square feet, according to an analysis of industry data by The Real Deal. Five of the ten companies on the hunt for the largest amounts of office space are in those fields, including HSBC, which is seeking at least 700,000 square feet, AllianceBernstein, which is looking for at least 600,000 square feet, and BlackRock [TRData], which is seeking at least 500,000 square feet, according to industry data.

The technology, advertising, media and information (TAMI) tenants, in contrast, are searching for an estimated 4.3 million square feet. The leading TAMI firms on the hunt in Manhattan include Facebook, which is looking for more than 550,000 square feet, and Grey Advertising, which is seeking about 800,000 square feet, according to the industry tally.

All in all, financial firms in New York are typically in need of the most office space, since many of the nation’s largest banks are headquartered in Manhattan and occupy millions of square feet in the borough. Some of the financial giants that have a large footprint in the city and are not in the market for new space include JPMorgan Chase, Citigroup and Morgan Stanley. As of the first quarter of 2016, each of those companies occupied more than 4 million square feet in Manhattan alone, figures from CoStar Group showed.

All in all, financial firms in New York are typically in need of the most office space, since many of the nation’s largest banks are headquartered in Manhattan and occupy millions of square feet in the borough. Some of the financial giants that have a large footprint in the city and are not in the market for new space include JPMorgan Chase, Citigroup and Morgan Stanley. As of the first quarter of 2016, each of those companies occupied more than 4 million square feet in Manhattan alone, figures from CoStar Group showed.

Financial firms “still represent so much of the marketplace, and their leases will expire,” said Peter Riguardi, president of JLL’s New York office, who represents HSBC and BlackRock, among other firms.

Behind FIRE and TAMI comes legal and accounting firms, with 2.4 million feet of required space. The apparel, textile and manufacturing industries follow, with 2.3 million feet.

The largest office tenant among those firms seeking new space is the luxury apparel company Ralph Lauren, which is seeking 700,000 square feet, according to the data. However, a representative for Ralph Lauren told TRD that the company is “not actively looking for space.”

There are some 500 companies seeking at least 27 million square feet as of June, TRD’s analysis showed. Marc Miller of MHP Real Estate Services, who represents legal and real estate firms, as well as companies in other industries, said he is seeing diversity among the kinds of businesses seeking new space.

Yet Riguardi said the majority of tenants in the market now are searching for new office space because their current arrangements are coming to an end. “The transactions in the market now are driven by lease expirations,” he noted.

That comes on the heels of a steep rise in asking rents in recent years and a growing amount of uncertainty in the global economy, which has instilled more caution among tenants. And that may be to the disadvantage of landlords. The total volume of office leasing in Manhattan has fallen 21 percent in the first half of 2016, to 15.6 million from 19.7 million in the same period last year. As a result, tenants are gaining the upper hand, according to several insiders, even as asking rents overall have plateaued.

“Pricing is staying relatively firm; however, the concessions have shot up,” said Cushman & Wakefield’s Mark Weiss. Weiss and Moshe Sukenik of Newmark Grubb Knight Frank are representing the global law firm Hogan Lovells in its search for about 250,000 square feet. “The effective rent is absolutely down, notwithstanding the per-square-foot rent being reported for most deals,” Weiss said.

In total, there are fewer tenants on the hunt for new office space now compared to the past few years. “There are more choices and less competition for those choices,” Weiss explained. “But that is temporary and will adjust. It’s hard to say when, but it certainly will.”