What are buyers in Fairfield County looking for? Proximity to New York City, new construction and homes on the tony waterfront top the list. With an area that spans more than 800 square miles and a wide price range, Realtors have to be adaptable as houses move quickly.

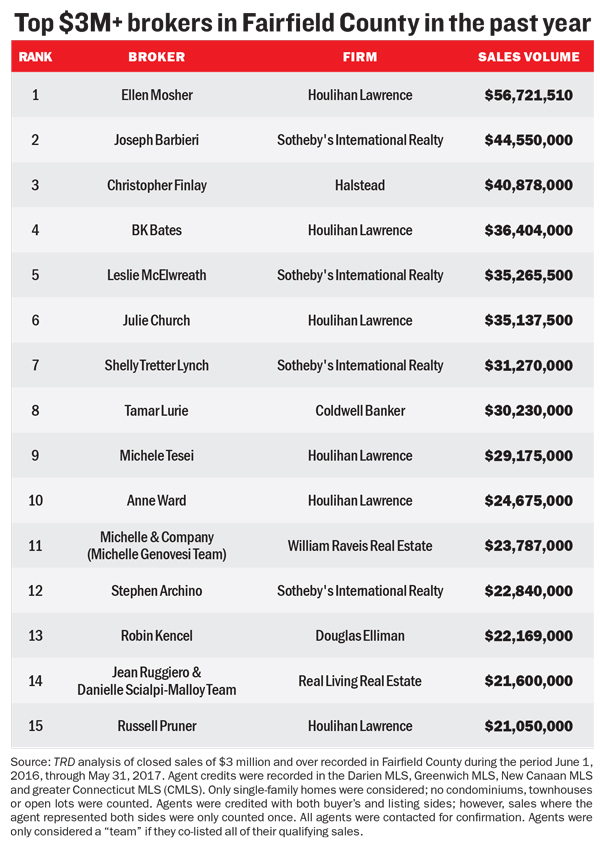

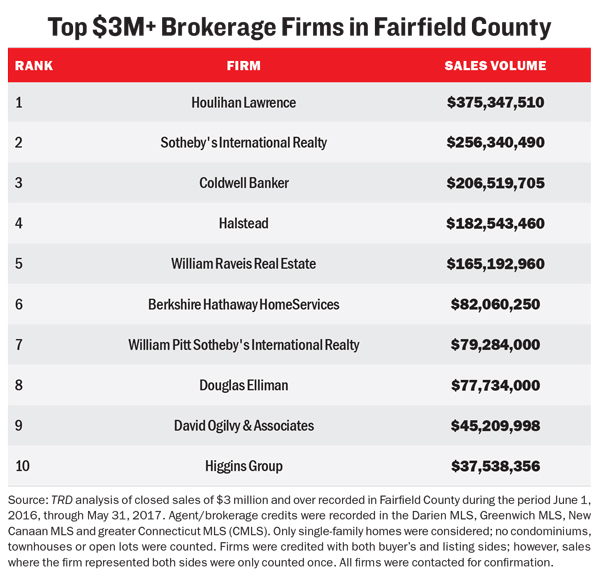

To see who’s winning in the competitive market, The Real Deal looked at the sales volume of single-family homes of $3 million and over in Darien, Greenwich, New Canaan and the rest of Fairfield County between June 2016 and May 2017, ranking the top brokerages and brokers.

Leading the list was Houlihan Lawrence, which was recently acquired by Berkshire Hathaway HomeServices. Its total closed sales volume came in at $375 million. Chris Meyers, who runs the firm, said it has been a year of curveballs. Whereas 2016 was a slow year for areas like New Canaan, the town has rebounded strongly, with Meyers seeing sales up 20 percent. Other towns are also doing well. “If we had been talking about Darien three months ago, I’d be concerned about where we were headed. Now, here we are in early July and Darien’s year-to-date sales are up 5 percent. But more impressively, book pending business there is up almost 100 percent,” Meyers said.

Meyers reported that nearly everything that hits the market with an appropriate price is sold within two weeks, frequently with multiple offers.

Where that slows, however, is at the very top. “It really continues to be a tale of two markets,” he explains. “There’s the entry-level segments that continue to be inventory-constrained and very hot and the high end of the market, where we’re seeing the opposite.”

According to the MLS, sales of homes over $3 million in Fairfield County, excluding Greenwich, are down 25 percent for the year to date. When it comes to homes over $10 million, four were sold at this point last year while only two have sold this year.

The high-end market — which Bill Raveis, chairman and CEO of William Raveis Real Estate (No. 5 on TRD’s ranking of top brokerages), defines as anything over $5 million in Greenwich, $3 million in New Canaan or $2.5 million in Westport and Fairfield — represents a huge challenge for brokers and requires a much heavier lift to get things sold. This generally means that getting someone to a purchase takes much longer than it once did.

“This isn’t 2004, 2005, where people were just arriving in Greenwich, looking at five houses and putting offers in. I find in the higher-end market, in the $5 million-plus market, people are looking at anywhere from 20 to 40 homes,” says Ellen Mosher of Houlihan Lawrence, who ranked No. 1 on TRD’s list of top Fairfield brokers. She’s typically now working with up to 20 clients at a time while also coordinating with brokers representing many more.

For Mosher, this means putting in a bit more elbow grease. “I’m going back to a more organic approach to it, where I am looking at surrounding areas. With high-end homes, people are looking in multiple areas. They’re not just looking in Greenwich. They’re looking in Bedford,” she says.

Mosher takes advantage of this by reaching out to brokers in other high-wealth locales to see if they are representing any buyers who might find what they need in Fairfield County. A current listing in back-country Greenwich has a Mediterranean style that gives it more of a Beverly Hills look than a Connecticut one, so Mosher got in touch with agents in Dallas and Los Angeles to see if they might have clients looking to relocate to a property with an aesthetic they’re used to living in.

The strategy has served her well. “In an industry where everything’s about social media now and internet presence, what gets lost is that old-fashioned approach of relationships and speaking with other agents and pounding the pavement a bit,” she said.

Raveis said there’s an easy answer to getting a top property to sell — slash the price. “It’s the best way to compete now at the high end — pricing. All the advertisements in newspapers, traditional marketing, that’s not it. It’s about pricing,” he says. As examples, he mentions a Westport home where the price dropped from $6 million to $2.9 million after three and a half years on the market, and an instance where a friend who purchased a Fairfield home for $3 million and put another $1 million into it ended up selling for just $1.5 million.

“The pricing levels have come down to such an extent that they’re actually bargains. I’ve never seen them like this before,” he says. While he acknowledged that this is a very unpleasant reality for sellers, he sees it as a rare opportunity for buyers to land properties that they might never have been able to even envision living in a decade ago. “It’s just really a very special time at the high end. The owners themselves are certainly not going to be happy with it. But I’m certain the people buying it are,” he said.

Interest in the area can be attributed to several factors, according to Alexander Chingas, a partner at Riverside Realty Group. Among them is the diversity of offerings across towns, which appeals to a variety of different buyers. “The coastal areas of Fairfield County are always the strongest performers, so everything from Greenwich to Fairfield along the water always does very well,” he says. His company is based in tony Westport, which offers public beaches and a town-owned country club. Adjacent is the town of Fairfield, where prices start at under a half million and reach into the tens of millions. “That’s a big strength to this area, that there are a lot of points of access for people to get whatever it is that they need or are looking for while still maintaining an approximately one-hour commute to the city,” Chingas says.

Proximity to New York City is one of the biggest draws, making towns like Greenwich, Darien and New Canaan particularly desirable. “Generally, the closer you are to New York City, the more attractive to a lot of potential buyers. Many of our clients, maybe most, commute in and out of New York City, so the farther east you go in Connecticut the farther you are away from that central hub,” said Joe Valvano, president of Coldwell Banker Residential Brokerage in Connecticut and Westchester County, which was No. 3 on TRD’s ranking of top brokerages.

Consumers seem to be moving toward more urbanized experiences within Connecticut. “The millennials and the baby boomers tend to be looking at similar properties in many cases. They tend to be looking at properties that are close to transportation, many that are in town. You see in Stamford and some other communities they’re building high-rise condos, townhouses that are in walking distance to shopping, to transportation,” Valvano said.

The coast offers a huge appeal and an exception to the phenomenon of high-priced properties being slow sellers. “Unique waterfront, it almost doesn’t matter the price point,” says Diane Ramirez, Chairman and CEO of Halstead, which clocked in at No. 4 on the ranking.

If there’s one thing that brokers unanimously agree on, it’s that their clients are overwhelmingly opting for new homes over resale properties. Meyers said he’s never seen the preference be higher, observing that the premium on new construction is 15 percent above a comparable home built only a few years ago; that spread used to be between 7 and 10 percent. He believes people see the price jump as being well worth the convenience of avoiding renovations. “The old adage in real estate was to buy the worst home on the best block, if you will, and look to create value by renovating and making improvements. Today most buyers seem to have the opposite approach. They want something that is absolutely ready to move into without having to do any work,” he said.

Ramirez echoed his point. “Everyone right now, for some reason, loves new. You could have a renovation that’s five or 10 years old, which you look at as still new — it’s not the new of today,” she said. “The developers today, they really get what the consumer wants. They’re doing their homework. What they’re bringing into the kitchen and the bathrooms, especially, is beautiful. It’s the soaking tubs and the materials they’re using.”

Brokers across the board also agreed on the necessity of homes being priced realistically.

How to land on that elusive perfect price can be easier said than done, though. “Pricing is more of an art than it is a science. You can get all of the empirical data that’s available, but it doesn’t necessarily give you what the market value is for another property because each property is somewhat unique and distinct,” Valvano said.

At Houlihan Lawrence, Meyers is leaning heavily on market comps, using real-time data that reflects activity from within the last month.

“We’re able to really pinpoint within relatively small price brands where buyers have been most active, [through] both searches on our website and visits to homes. Obviously you’re looking at the proven market, which is what’s gone into contract in the last four to eight weeks,” he said. “There are really micro-level shifts happening in this marketplace in real time, and the more that you’re able to draw on that information and that insight when you make a pricing decision, the better you’re going to be.”

Approaches on how to get a leg up on the competition differ from firm to firm and range from the visual to the technical.

At William Pitt Sotheby’s International Realty, ranked No. 7, the focus has been on how best to nurture and maintain relationships with clients, according to Lance Pendleton, vice president of sales development and education. The firm recently began working with the customer relationship management software Contactually, which will give it critical data to better connect with its customers.

“They’re a platform that primarily is about making sure that no one slips through the cracks,” he said

“They’re a platform that primarily is about making sure that no one slips through the cracks,” he said

Meanwhile, Houlihan Lawrence has built a Facebook advertising tool that targets ads toward potential buyers in the communities they operate in.

“We’re seeing response rates from the ads that we’re able to generate through there that are running at anywhere from 3-5x the industry norms for other types of advertising. It’s really about trying to marry market data and market information with marketing platforms,” Meyers explained.

Not all the strategies are tech-based. Sometimes it simply comes down to showcasing the property in a picture-perfect light. However, a regular old photo doesn’t cut it anymore. When a property is listed in the eight figures, buyers are going to want to see it shine from every conceivable angle.

“It’s no longer that the beautiful, high-definition photos are going to do it. You’ve got to have the video, you have to have the drone shots, the 3D walkthroughs. You need to differentiate your property for the customer so that they absolutely want to see it,” Ramirez said.

And more people are investing in professional stagers to make the homes even more enticing. “Not only just taking out and decluttering the existing furniture that’s there, but also bringing in new furniture, doing stuff with paints to go with more neutral tones,” Meyers explained. “Buyers today tend to be really drawn to clean simple styling, and the whiter things are with the least amount of furniture, the better.”

When it comes to challenges, inventory is one that’s frequently cited — for different reasons. Where six months of inventory is the standard, Fairfield County is seeing that go much lower with more modestly priced homes and much, much higher with the top prices.

“We’ve got some markets and price points where we’ve got three months or two and a half months of inventory. What happens there is you get multiple bids, multiple offers, but only one person can buy the house,” he said. “Then, what’s happened in other markets where you’ve got very high-priced properties, you might have five, six years’ worth of inventory.”

These days, Realtors have to adapt to market conditions at much greater speeds.

As Pendleton observes, trends are moving much more quickly than in prior years. “It really is strange because, again, these things are starting to shift much faster than they used to. Where you’d have a certain trend for 10 years, it might only last two now.”

Even the color schemes change rapidly. “Right now, we joke that everything needs to be painted fifty shades of gray,’’ said Pendleton.

—Harunobu Coryne provided research for this article