In late February, Jonathan Lickstein, managing broker at LoKation Real Estate, headed towards Pembroke Pines for another stop on the brokerage’s agent appreciation tour. It was one of 10 networking events the Pompano Beach–based firm has planned throughout the state between January and April, and a useful way for Lickstein to build in-person relationships with LoKation’s rapidly expanding roster of agents.

Another swiftly growing firm in South Florida, eXp Realty, has created an entire online world where its agents use Sims-like avatars to interact with each other and eXp executives — playing virtual soccer, hanging out on a virtual beach and driving virtual motorboats.

These are just two of the disparate approaches brokerages are taking to compete for agent talent in South Florida, where home prices are soaring in lockstep with sales.

Propelled in part by an influx of out-of-state buyers, demand for housing is so ravenous that RealtyHop in February named Miami the least affordable housing market in the country, surpassing New York and Los Angeles, as spiking home prices outpace wage growth.

“More and more people are coming into the market,” Lickstein said.

“More and more people are coming into the market,” Lickstein said.

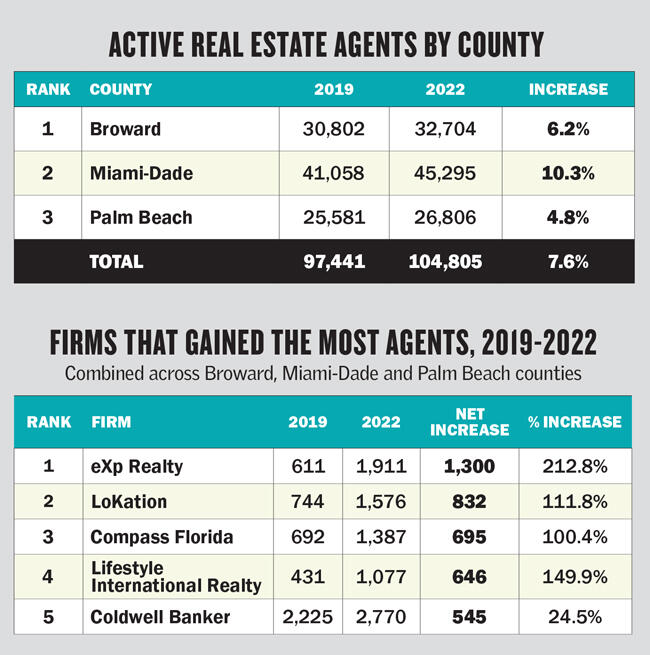

As home buyers flock to South Florida, so do agents seeking to get in on the action. Data analyzed by The Real Deal show that thousands of aspiring dealmakers have converged on the region in recent years, with the total headcount across Broward, Miami-Dade and Palm Beach counties swelling 11 percent since 2018 to nearly 105,000 agents as of this year.

”It’s the growth of our industry,” said Chris Umpierre, a spokesperson for the Miami Association of Realtors. ”People are looking at our industry and want to get involved.”

Fred DeFalco has contributed to that change. At 68, he’s worked in the real estate industry for more than four decades, both as an agent and executive, with stops at One Sotheby’s International Realty, Coldwell Banker and The Keyes Company. Now, he’s with eXp, leading a team of agents based in Boca Raton. He’s quick to talk about real estate when given the chance, and he believes the industry is in the midst of a revolution.

Or, in DeFalco’s words: “The industry is where it belongs: in the hands of the agent.”

In January 2019, the number of agents with a current and active license in Broward, Miami-Dade and Palm Beach counties totaled 97,441. By 2022, that number increased to 104,805.

TRD submitted an open-records request to Florida’s Department of Business and Professional Regulation for all active and current agents in the three counties, along with their brokerages, as of January 2019, 2020, 2021 and 2022.

Headcounts were determined by the brokerage to which each agent is affiliated and the county in which they reside. Agent referral companies were not included in the tallies.

The upstarts

The upstarts

Each year since 2019, eXp Realty has recruited more agents than any other brokerage in the region, followed closely by LoKation (formerly known as The K Company) and Compass.

From 2019 to 2020, eXp went from 611 agents to 949 — a 55 percent increase. A year later, its agent count nearly doubled to 1,856, a 96 percent jump. All told, eXp saw a net increase of 1,300 agents over the three-year period, more than tripling its headcount in South Florida.

DeFalco joined eXp in November 2018 after watching a promotional video sent to him by his nephew, whom he helped get into the real estate business. He lauded eXp’s approach to collaboration and pay structure, two factors to which he attributes its growth.

eXp’s infrastructure exists almost entirely in the cloud. Agents use avatars to interact with each other and the company offers a revenue-sharing program to reward them for recruiting others. The firm charges agents a $149 start-up fee, an $85-per-month cloud brokerage fee, a $25 transaction broker review fee and a $40 transaction risk management fee which has a $500 cap. Agents split commissions with eXp until they clear $80,000 in gross sales.

Critics have likened the firm’s revenue-sharing model to multi-level marketing at best, or a pyramid scheme at worst. Founder Glenn Sanford has dismissed these claims, telling TRD in an interview last year that “there are a lot of people who don’t like alternative ways to handle compensation, because it competes with the more traditional business approach.”

LoKation has added the second-most agents since the start of 2019 — 832 — more than doubling its headcount in the region to 1,576 as of January of this year.

Most agents at LoKation keep 100 percent of their commissions. Those with less than a year of experience or who have brokered fewer than four transactions must either undergo a training program or complete three initial transactions with an 80/20 split.

The brokerage, which operates throughout Florida as well as in Georgia and Colorado, gained 1,258 agents altogether last year, 68 percent of whom came in through referrals, according to Jeremy Beard, director of business development. LoKation’s acquisition of Fort Lauderdale–based Venture Realty Group last year brought in 170 new agents, the company said at the time.

The brokerage, which operates throughout Florida as well as in Georgia and Colorado, gained 1,258 agents altogether last year, 68 percent of whom came in through referrals, according to Jeremy Beard, director of business development. LoKation’s acquisition of Fort Lauderdale–based Venture Realty Group last year brought in 170 new agents, the company said at the time.

Established agents at LoKation pay the firm $99 per transaction and $99 per month, plus a $35 quarterly compliance fee. For new agents, there’s a $499 fee per transaction, a $99 annual fee and the same $35 quarterly compliance fee, but no monthly fee. Both plans require agents to pay $99 per rental transaction.

Compass recruited the third-most agents over the three-year period, jumping from 692 in January 2019 to 1,387 this year. A Compass spokesperson wrote in an email that the company offers support and education services to agents, but declined to answer questions about the commission structure. The firm’s April 2021 IPO filing showed that it has spent hundreds of millions of dollars in cash and equity on acquisitions to scale its business nationally, including scooping up some South Florida brokerages wholesale.

Challenging the incumbents

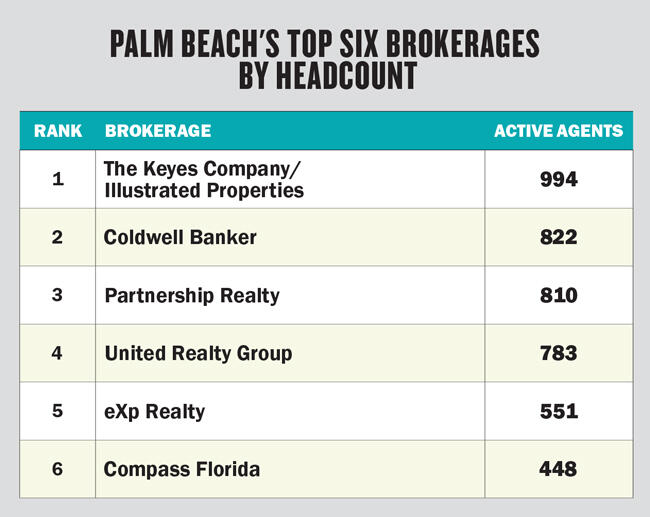

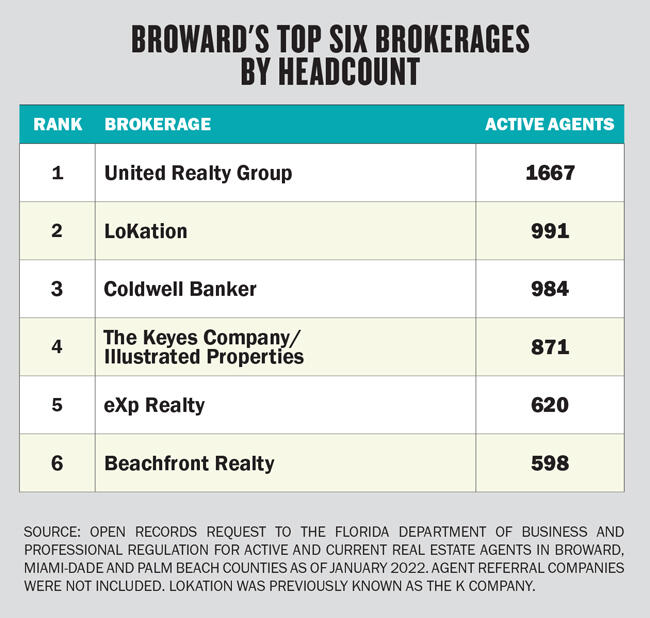

Despite the speedy growth of some of these firms, the brokerages with the highest headcounts in South Florida remain relatively unchanged.

Across all four years, The Keyes Company, which merged with Illustrated Properties in 2016, has held the top spot in terms of agent headcount across Miami-Dade, Palm Beach and Broward counties, though it remained relatively flat over that time period.

In January 2019, Keyes and Illustrated had a combined 2,894 agents in the region, ahead of second-ranked United Realty’s 2,677. Coldwell Banker, Beachfront Realty and Douglas Elliman rounded out the top five.

As of January this year, Keyes and Illustrated had 2,906 agents — a net increase of 12 — while Coldwell Banker had jumped to second on the list with 2,770, narrowly edging out United’s 2,767. eXp had risen to fourth place, with 1,911 agents, and Beachfront ranked fifth with 1,758.

Keyes and Illustrated hire both new and experienced agents, and offer both in-person and virtual training. CEO Mike Pappas declined to discuss the fee and commission structure at the combined firms.

Keyes and Illustrated hire both new and experienced agents, and offer both in-person and virtual training. CEO Mike Pappas declined to discuss the fee and commission structure at the combined firms.

“We’re very competitive at all levels,” he said.

United allows its brokers to keep 100 percent of their commissions, but charges a $299 transaction fee, with no monthly fees. Unlike Keyes and Illustrated, United only hires brokers who have already been producing within the last two years.

Elizabeth Rodriguez Hernandez, managing broker for United, estimated about 30 percent of its agents complete at least one transaction a month. United has no formal coaching or mentoring programs in place and doesn’t assign desks in its offices to realtors, but makes space available to them.

Beachfront takes 10 percent of commissions, and managing broker Mark Kurkin said the firm doesn’t charge any other fees and hires both new and experienced agents.

The total headcount across the top 10 brokerages in January 2019 was 13,030. By January of this year, that number had jumped to 17,794 — a 36.6 percent increase that far outpaced the 7.6 percent growth across all firms in the region over the same period.

LoKation’s Lickstein believes the migration boom fueled by the pandemic increased the pool of potential agents. That, combined with Florida’s relatively low threshold for obtaining a license, the freedom from being tethered to an office and the job’s flexible work schedule make it an attractive line of work, he said.

“It’s the power of real estate in South Florida,” Umpierre said. “When the pandemic started, a lot of industries struggled, and it was real estate that carried the economy, not just in South Florida, but the U.S.”