About six years ago, “Million Dollar Listing New York” star and Douglas Elliman broker Fredrik Eklund had a vision.

While sitting at the rooftop pool at the SLS Hotel in Los Angeles with his business partner, John Gomes, real estate legend Barbara Corcoran and his older brother, Sigge, Eklund said that “we will be living” in L.A. at some point.

This July, that prediction came true.

Eklund sold his Tribeca condo and moved to Beverly Hills with his husband, Derek Kaplan, and their twin toddlers to oversee the expansion of the Eklund-Gomes team on the West Coast.

The move capped off nearly 24 months of explosive expansion for the team, which opened four offices in three U.S. cities and went from nine agents to more than 64 during that stretch. (It’s expecting its headcount to jump to 70 by early this month.)

While some may have initially scoffed when the celebrity brokers came on the scene in the mid-aughts, the duo has indisputably converted TV fame into brokerage dominance — at least in New York.

Last year, it was the No. 1 team in New York City, closing more than $720 million in sell-side deals in Manhattan, Brooklyn and Queens, according to The Real Deal’s latest ranking of top agents. Nationwide, it claims to have closed about $1.5 billion in sales in 2018.

But the two have their fair share of critics, including some who take more fundamental issue with the rise of giant superteams.

Several sources told TRD that they think it’s impossible for the leaders of large teams to give clients truly personal attention.

“I feel like when somebody hires me they want me, not No. 10 in my team,” said Brown Harris Stevens’ Lisa Lippman, who leads a four-person team. “When you hire Eklund-Gomes, who do you get?”

She added that Eklund and Gomes have undoubtedly created a successful team, and “I’m not going to say it’s negative or positive,” but it’s a “choice.”

Another broker — who asked not to be named but has competed against both the Eklund-Gomes team and Ryan Serhant’s 62-agent team at Nest Seekers International — took it a step further.

Another broker — who asked not to be named but has competed against both the Eklund-Gomes team and Ryan Serhant’s 62-agent team at Nest Seekers International — took it a step further.

“Pitching against Ryan and Fred and John is the easiest thing,” the source said. “It’s like taking candy from a baby. How do they actually compete with a full-service luxury broker who’s personally involved in every level of the transaction?”

Gomes and Eklund adamantly disagree.

And they have defenders. Developer Doug Steiner said he was “pleasantly surprised” by how involved they were when he hired them to market his 82-unit condo Steiner East Village in 2016. He said he was “pretty skeptical” at first — though he noted he’s skeptical of everybody.

“They gave valuable input. They know the market. They know how to sell,” said Steiner, noting that they sold all but one unit, attended every design meeting and “didn’t waste my money.”

Their model is also clearly working at a time when the residential brokerage business is in the midst of an existential crisis.

And now, as brokerages are desperately trying to salvage shrinking profits — which have been hit by everything from venture-backed startups to iBuying firms — Eklund and Gomes are exporting their brand and actively going after resales, too.

Late last year, they launched in L.A. In March, they followed that with an office in Miami Beach. And this July, Eklund announced his L.A. move on Instagram.

But they’re the first to admit that expanding nationally will not be easy.

In L.A., the team will have to scale up in an entirely different type of market, one where there are far fewer luxury condo towers to go after.

Meanwhile, in New York, the duo added a Brooklyn outpost this spring and is coming up on a year in its Flatiron District office.

And there are more transitions underway as Gomes — who’s often publicly cast as a sidekick to Eklund’s larger-than-life TV persona — takes the reins.

“I’m in charge in New York now,” Gomes said. “It’s my base to cover. His base is Los Angeles.”

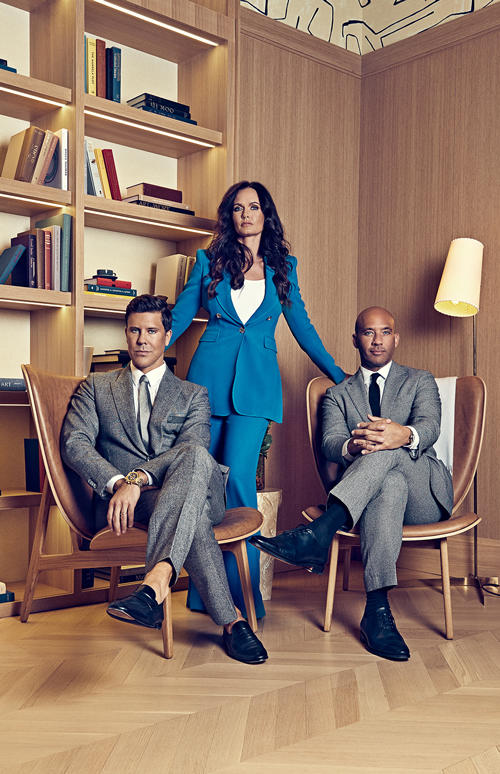

From left: Fredrik Eklund, Julia Spillman and John Gomes

“Everyone always says, ‘What about Fredrik?’ They think Eklund and Gomes should do every single solitary listing [together, but] what makes us great is the team,” he said. “We’re very transparent. None of our developers are worried.”

The seeds of expansion

In September 2017, Eklund and Gomes set up a meeting with Elliman Chair Howard Lorber. Their goal: getting permission to exceed the firm’s 10-agent team limit.

Lorber gave his blessing with a few conditions, namely that the team — which has an annual gross commission income hovering around $20 million and has been the company’s top-producing group for four straight years — drop out of Elliman’s internal company rankings. He also wanted the team to set up its own office so as not to overtake the firm’s Flatiron office and agreed to bankroll the office’s expenses.

Lorber, along with Eklund and Gomes, — who have a 70-30 commission split with Elliman — declined to comment on the total cost of expansion.

But the brokerage chairman told TRD that he’d back other Elliman agents looking to expand their teams so long as it made business sense.

“It’s not just Fredrik and John and no one else,” Lorber said. “If someone else wants to do it and has the wherewithal and the talent to do it, then I’ll back them the same way that I’ve backed Fredrik and John.”

Around the time they were talking to Lorber, both Eklund and Gomes were on the verge of becoming first-time parents — both to twins.

“Everyone thought that was the end of Eklund-Gomes!” added Gomes. “Oh god, those two? Twins? Two sets of twins?”

But weeks after welcoming their newborns, they were back in Lorber’s office with a new proposal: national expansion.

Lorber gave them the green light, which kicked off a dizzying round of hiring and preparation.

From Lorber’s vantage point, agreeing to Eklund’s relocation and a national expansion makes sense.

“I thought OK, it’s either going to be zero or positive. If it didn’t work, that’s zero. If it worked, it was positive,” he said. “He could always come back to New York. So what is there to lose?”

Elliman itself launched in California in 2014 and has been trying to get a foothold in L.A.’s luxury market, but it’s yet to become a major player.

“They’ve already brought in a bunch of business for California,” Lorber said. “They’ve done probably better than we had thought for last year.”

Elliman agents can reel in developments on their own, but exclusives on new condo buildings often filter through Elliman’s Development Marketing division, which is led by Susan de França. De França and Lorber then invite select Elliman agents to interview with developers.

But some sources say that Lorber personally doles out new development assignments to Eklund and Gomes (as well as to other top Elliman brokers). The team denies that they’re getting fed the business.

“[Howard] always makes a joke with us about it,” said Eklund. “All these people call him like, ‘Ah, you’re giving everything to [Eklund and Gomes]!’ And he’s like, ‘I’m not giving them anything.’”

Gomes added: “More than 90 percent of our new development business comes from our own clients. They’re not Elliman or Howard Lorber clients.”

That said, Eklund noted that the team did get its first L.A. assignment, Townscape Partners’ 48-unit condo and townhouse development 8899 Beverly, from Elliman.

And Lorber said he had a hand in building up their new development portfolio. “Don’t forget, before they came here they weren’t really doing any new development business to speak of.”

Vertical or horizontal?

Getting more business in L.A. is not as easy as just buying a Beverly Hills house.

Prices are leveling off and the luxury market is cooling, according to Michael Nourmand, who heads up his family’s 175-agent brokerage, Nourmand & Associates, in L.A. “The number of deals are down. Period,” he said.

Eklund’s Instagram announcement noted that “LA has some of the world’s most exciting new development projects coming — vertical living is finally happening here.”

Eklund’s Instagram announcement noted that “LA has some of the world’s most exciting new development projects coming — vertical living is finally happening here.”

But compared to New York, the condo market is still a drop in the bucket.

In the past year, L.A. County saw only $6.8 billion in condo sales, according to TRD’s analysis of Redfin data. By comparison, last year, Manhattan alone saw $20.25 billion worth of co-ops and condos sell, according to data from appraisal firm Miller Samuel.

And Nourmand noted that single-family homes are most in demand.

“L.A. is a very horizontal city,” he said. “I think the idea that we’re going to follow NYC … I don’t agree with that.”

Eklund said later he’s also going after luxury homes, and recently landed an $18 million listing in Beverly Hills.

And working in his favor is a landscape that’s becoming more bicoastal, with developers working on projects in New York and L.A. For example, the Lightstone Group is currently building the megaproject Fig + Pico in Downtown L.A. and selling 130 William Street in Lower Manhattan.

And behind New York and Tokyo, L.A. is the third-fastest-growing city among those with net worths of $30 million-plus.

David Kramer, a top producer at the Beverly Hills-based luxury brokerage Hilton & Hyland, said Eklund’s move to L.A. is symbolic of how the residential market has changed over the last decade.

“It’s New York money coming in. Now the big players are national and international,” said Kramer, who met with Eklund and brought a client to 8899 Beverly.

Still, both Gomes and Eklund have spent much of the year working at a breakneck speed to learn the L.A. market and say they’ve spent hundreds of thousands of dollars on flights between the coasts.

Gomes has spent many L.A. days sitting shotgun in a Mercedes-Benz G-Class cruising through neighborhoods while following along on Google Maps. Eklund, meanwhile, invited a slew of top brokers out for dinners and cocktails.

And the two are heavily relying on their team CEO, Julia Spillman, the mastermind behind their national expansion (see sidebar).

Spillman — who now runs daily operations and makes decisions on everything from hiring to budgets — said the preparation has, at times, been 24-7.

And the work is not going to let up anytime soon.

To break into their two new markets, the team is offering to take over listings for both Elliman and non-Elliman agents in exchange for a 25 to 30 percent referral fee — or to co-list properties.

“We’ll go in 50-50 [on co-listings],” said Pietro Belmonte, who runs the team’s seven-agent office in Miami. “But we’ll take the lead on the marketing.”

“We’ll go in 50-50 [on co-listings],” said Pietro Belmonte, who runs the team’s seven-agent office in Miami. “But we’ll take the lead on the marketing.”

So far, they say, it’s working. In L.A., the team says it’s closed 40 deals since launching last fall.

Though team leaders declined to say how much they’ve closed in Miami, Belmonte claims it’s snagged $100 million in listings over the past two months. “We call it the Fredrik effect,” he said, noting the lion’s share of those listings will hit the market in November.

The making of the machine

Eklund and Gomes met in 2006 while working at CORE, the new development marketing firm headed by Shaun Osher.

As Gomes — who got his start in real estate while working as a maître d’ at Balthazar, where he met broker-turned-developer Michael Shvo — describes it, there were stacks of papers “literally falling off” Eklund’s desk.

He made Eklund a proposal: “I [will] pay you a referral if I close any of those deals,” he recalled.

Eklund — who did a brief stint in adult films and has launched several businesses, including a tech startup in his home country of Sweden — agreed, and their partnership took off from there.

But the team has had growing pains.

Hunie Kwon, who joined the team in 2010 and is still a member, said it was a revolving door of agents in the early days.

“It was not operating anything like a team,” said Kwon, who hired Eklund at the boutique firm JC De Niro in 2004 after he responded to a Craigslist ad.

Eklund acknowledged he struggles with the logistics of executing a team strategy — “like, really, I have no patience.”

He used to joke that he was “the best new development pitcher and John [was] the best show-er and salesman, but we didn’t have the organizational skills.”

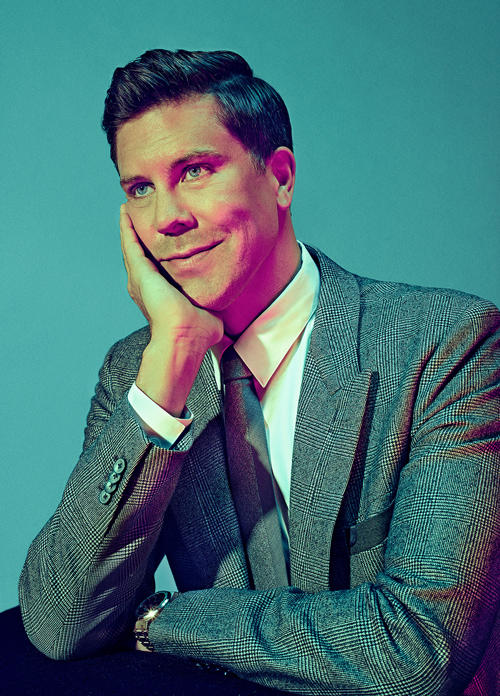

Fredrik Eklund

“We just weren’t born to be managers,” said Gomes.

That’s where Spillman now comes in.

A new sweet spot

The team’s expansion comes amid a soft luxury market, an oversupply of condo inventory and a looming recession.

But Gomes said they are pivoting in response to those realities, noting that they used to focus largely on the $8-to -$10 million range.

“It’s all about lower price points now,” he noted. “In the future, to make the kind of money we’re making today, we’re simply gonna have to do more. So the team needed more people handling both new development and resales.”

The team’s hiring strategy is also reflecting that — though it took some internal bickering to get there.

Spillman and Gomes dubbed themselves the “resale committee,” believing that expanding the team’s resale operation was crucial, while Eklund was trying to “put the kibosh” on that, explained Gomes.

“Julia and I saw this so clearly, and we really believed in it, but … Fredrik is very …” He paused to snap his fingers.

“Advanced,” said Eklund, cutting in with a smile.

Two years on, Eklund admits that their strategy has worked. Currently, their business is nearly 40 percent resales and 60-plus percent new development — versus 85 percent new development in spring 2016.

But hiring is not as easy as it sounds; many experienced agents are being wooed by other firms in New York, Miami and L.A.

In New York, the team’s sleek, 10,000-square-foot Flatiron office — which is stocked with food and has a putting green, massage table and meditation room — seems to be one of the perks it’s offering hires. But it’s also luring agents with the same kind of financial incentives that a startup might, and promising that they’ll get handed business when they walk in the door.

For example, former Compass agent Keith Copley, who joined this spring, took over $26 million in listings when he started, according to Spillman.

The team has about 10 different commission splits. “It’s like a Swedish smorgasbord,” said Eklund.

He declined to elaborate, but said the team offers splits at the high end in each market.

(Sources say industry-wide, standard splits on teams vary from 10 percent to 50 percent with the team leader, depending on the agent’s role in the deal.)

While megateams in the industry are generally stacked with junior agents, Gomes said their goal is to grow an experienced bench of 100 agents.

He said that during interviews with new recruits, many agents say they want to join the team because they pitched against Eklund-Gomes and lost.

Industry veteran Horacio LeDon — the former head of new development for Elliman in Florida and California, who now runs his own firm — said their “sweet spot is finding really, really good agents who haven’t been able to create a lot of business for themselves.”

Clayton Orrigo — who worked for Eklund and Gomes before heading to Compass in 2017 — said joining teams often doesn’t work for people who “have that desire to go build something on their own.”

“I was starting to do significant deals, and I wanted to make sure people knew it was me,” Orrigo said. “I think a lot of people were like, ‘That’s weird [that you’re still with Eklund and Gomes]. You’re doing all this business, why haven’t you started your own team yet?’”

Still, he has a strong affection for the duo and said their partnership, which he called “something to look up to,” inspired him.

He said, however, that because of his experience he opted not to name his team after himself.

“Honestly, that’s why I named it the Hudson Advisory Team,” he said. “I want people that work for me to stay for a long time.”

Gomes acknowledged that the team name “bothers” him, too, because it overshadows so many of the hardworking agents churning out deals.

Compass’ Leonard Steinberg, meanwhile, said he is fundamentally opposed to teams going bigger than 20 agents because he believes large teams confuse clients (see sidebar).

In terms of Eklund and Gomes, Steinberg said: “That sounds more like a brokerage to me. Is it a brokerage or a team?”

Should they stay or should they go?

Given the size and name recognition of the Eklund-Gomes operation, many wonder whether the two plan to start their own firm.

It’s not an unfounded idea. Both are entrepreneurial, and they regularly invest in projects they’re hired to sell. Eklund has also started a new side gig in L.A. — writing screenplays with Sigge, a best-selling author in Sweden who also recently moved to Beverly Hills. Eklund declined to comment on the plot, but said at least one major studio is reviewing the script.

But both brokers insist they have no plans to leave Elliman.

“We do not have any interest whatsoever in starting our own real estate firm,” said Gomes. “We have the support of Douglas Elliman, they figure out all the infrastructure, [and] we follow them … I can tell you, we’re retiring at this firm.”

Gomes said he’s been approached by executives ranging from Corcoran Group CEO Pam Liebman to Compass founder Ori Allon. Eklund said he’s never received comparable offers.

That may largely be because many think Gomes is the workhorse running the business off-camera while Eklund gets the glory. The two, who thrive on needling each other, describe their relationship as a work marriage and a close friendship that they have no plans of ending.

They said they’ve also rejected offers for “millions” to take their team to another firm.

“We wouldn’t do that to Howard at this point,” Eklund said.

“Not everything is about money,” he said. “Especially now with kids. It’s like, you know, you wanna sell a lot and have no headache.”

These days, “we’re like, old dads,” he added.