It’s not every year that a landmark piece of Manhattan’s skyline trades hands. But that’s what happened last spring when trophy collector Aby Rosen and his partners gained control of the famed Chrysler Building in April.

It’s not every year that a landmark piece of Manhattan’s skyline trades hands. But that’s what happened last spring when trophy collector Aby Rosen and his partners gained control of the famed Chrysler Building in April.

Even more eye popping was the price tag: Rosen and his overseas backers paid just over $150 million to buy the ground lease controlling the Art Deco trophy tower and a smaller property nearby.

CBRE’s Darcy Stacom, who brokered the deal on behalf of seller Tishman Speyer and the Abu Dhabi Investment Council with her partner Bill Shanahan, said that once the new owners open their checkbooks to invest in renovating the Chrysler Building, the money spent will be more in line with what one might associate with a Midtown icon.

She also noted that deal came in a year when big-ticket sales were few and far between.

“There was a lot on the market last year and a lot that did not trade,” Stacom told The Real Deal last month. “I think a lot of it was pricing related.”

Indeed, 2019 was another tough year for New York City’s investment sales market and the brokers who put these deals together, as the total dollar volume of commercial properties sold continued to fall from the market’s 2015 peak.

The tally of completed sales throughout the five boroughs fell nearly 30 percent to $37.8 billion in 2019, down from $53.5 billion the year before, according to data from Real Capital Analytics.

The number of properties sold was at its lowest point since 2011, according to Cushman & Wakefield, which attributed the decline to new regulations that impact the city’s most actively traded asset class: multifamily rental housing, which saw total dollar volume in sales plummet 42 percent last year.

And it wasn’t just multifamily that was down. Dollar volumes fell across virtually every other commercial property type: office (-32 percent), retail (-29 percent), development sites (-27 percent) and hotels (-12 percent). Of all the major property types, only industrial saw an increase.

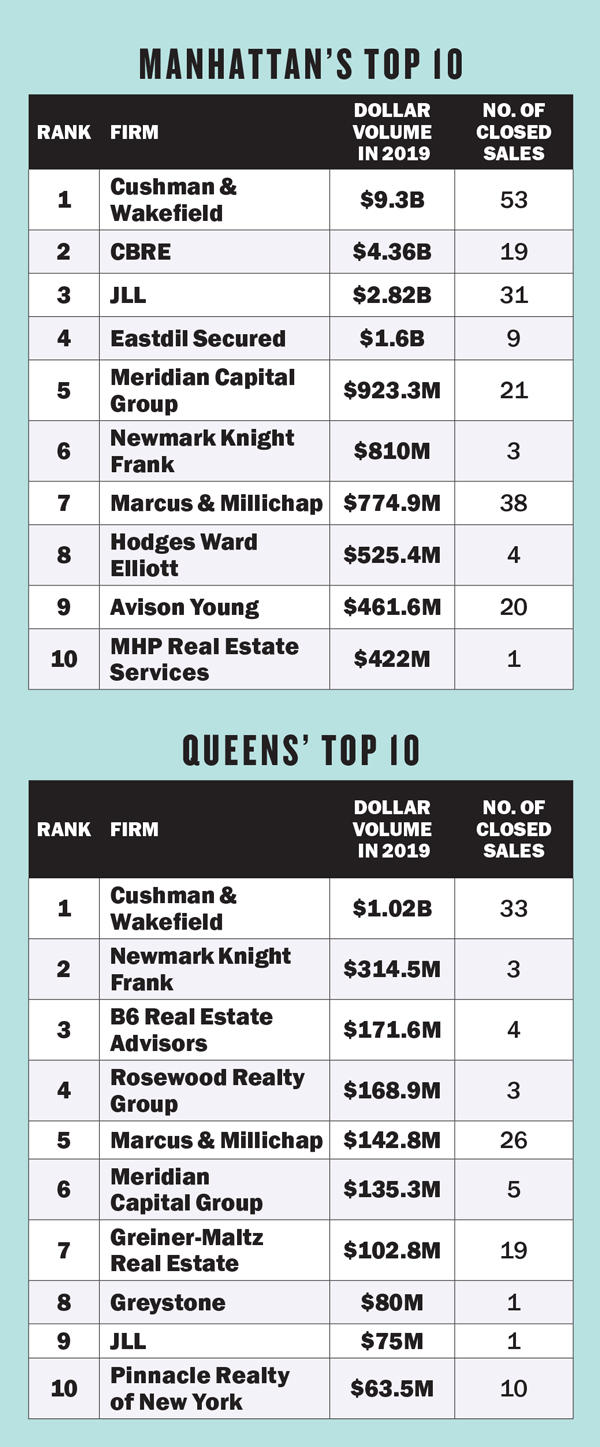

Against that backdrop, the city’s top brokerages hustled to maintain market share simply by not losing out on more deals than their competitors. In TRD’s annual ranking of the city’s leading investment sales firms, Cushman & Wakefield, led by its top team of Doug Harmon and Adam Spies, held onto the No. 1 spot with $10.9 billion worth of deals — far above the firm’s next competitor.

Against that backdrop, the city’s top brokerages hustled to maintain market share simply by not losing out on more deals than their competitors. In TRD’s annual ranking of the city’s leading investment sales firms, Cushman & Wakefield, led by its top team of Doug Harmon and Adam Spies, held onto the No. 1 spot with $10.9 billion worth of deals — far above the firm’s next competitor.

But Cushman’s total was still down nearly 35 percent from the previous year.

CBRE came in second place with $4.6 billion in sales, down 28 percent from the previous year. And JLL rounded out the top three brokerages with $3.2 billion in sales, a big bump from last year that was mostly attributed to the firm’s acquisition of HFF. TRD ranked firms based on the total dollar volume of sales above $1 million or more recorded in 2019, including leasehold interests.

When it came to the year’s slow sales activity, RCA’s Jim Costello said almost every asset class had a story as to why dollar volumes were down — whether it’s oversupply in the hotel sector or the retail market’s broader woes. He added that it’s also harder for buyers to pull the trigger now than in headier times when they could buy a property and bet that values would simply go up.

“When cap rates are falling from 6 percent to 5 percent, it’s easy to get people excited to buy an asset and pay a lot of money and run with it,” Costello said. “Without that momentum, they have to spend more time underwriting and have to become really careful.”

Keeping score

Cushman’s biggest deal of the year, the $2.2 billion sale of WarnerMedia’s Hudson Yards office condo to the Related Companies, grabbed headlines as one of the city’s most expensive commercial sales in a generally compressed market.

That trade was bigger than the the top deals of the firm’s next largest competitors combined: CBRE’s $798 million sale of the U.S. Post Office’s leasehold on the Morgan North postal facility to Tishman Speyer and JLL’s $600 million sale of the ground under 425 Park Avenue to iStar Financial.

Other big-ticket deals notched by the Harmon and Spies team, which declined to comment for this story, include the $1.2 billion sale of the Putnam Portfolio and the $909 million sale of the Coca-Cola building on Fifth Avenue. The latter became controversial last fall when scorned bidder Michael Shvo bought the building for a higher price tag after Coke turned down his offer. In the end, the beverage giant left money on the table by not selling to Shvo in the first place, sources told TRD at the time.

Eastdil Secured, meanwhile, slid to the No. 4 spot with $1.6 billion worth of sales, down a whopping 73 percent. Representatives for the firm, which brokered the $270 million sale of 175 Water Street in the Financial District to Metro Loft Management, declined to comment.

And rounding out the top five firms, Marcus & Millichap came in fifth place with $1.39 billion in sales, which remained relatively steady compared to its total last year even as the broader market suffered a steep decline. The firm’s largest deal was the $205 million sale of 520 Fifth Avenue.

Last July, JLL completed its $2 billion acquisition of HFF, its larger rival in New York City investment sales. HFF did $3.34 billion worth of deals in 2018, compared to JLL’s $1.54 billion that year. The merger of the two companies more than doubled JLL’s dollar volume to $3.24 billion, moving it up the ranking from No. 7 in 2018 to No. 3 last year.

JLL’s Andrew Scandalios said he thinks the combination of JLL and HFF gives the newly merged firm a chance to take on the perennial top firms.

“I’m going to be stunned if we aren’t consistently in the top three with the combined platforms,” he said. “I think we have a real shot at being No. 1 or 2 consistently every year.”

Multifamily mess

To the small army of sales brokers who trade apartment buildings back and forth each year, 2019 was the year of the rental apocalypse.

Sales of multifamily buildings actually started to slow down in 2018, after Democrats ousted real-estate-industry backed politicians in Albany and took control of the New York State Senate, setting up the stage for pro-tenant reforms.

The other shoe fell in June when state lawmakers passed a package of new laws that significantly limited the ways landlords could raise rents on rent-stabilized properties, chilling the market even further.

Eric Anton of Marcus & Millichap — which jumped up to the No. 5 spot and grabbed market share by keeping its volume relatively flat at $1.4 billion — called the new rent laws “a total slap in the face” to the market’s momentum.

He said that while sales were down in 2019, the real effects will be realized when new housing supply gets squeezed in the future. “In three or four years, it will be much tighter,” Anton said.

He said that while sales were down in 2019, the real effects will be realized when new housing supply gets squeezed in the future. “In three or four years, it will be much tighter,” Anton said.

The largest multifamily deal of the year was L+M Development Partners and Invesco’s purchase of a 2,800-unit portion of the Putnam portfolio from Brookfield Asset Management and Urban American, brokered by Harmon and Spies.

In any given year, a $1 billion-plus multifamily sale would get brokers buzzing. But the Putnam portfolio consisted of mostly market-rate units.

The deal that really got the industry talking was A&E Real Estate’s acquisition of the 18-building Kestenbaum family portfolio in Rego Park, Queens, for $150 million in November.

It was the first big deal to close since the rent laws were passed and represented a 28.5 percent discount to the $210 million the portfolio had been asking when it hit the market in February.

Paul Massey, whose firm B6 Real Estate Advisors brokered the Rego Park portfolio sale, declined to comment on specifics of the sale, citing a confidentiality agreement. But he acknowledged it was a deal that many in the multifamily space paid attention to.

“A sale like that gives a signal to where the market will stabilize,” Massey said. “There haven’t been enough data points to see where cap rates are going.”

It’s not surprising that the brokerages that rely heavily on multifamily took a hit.

Aaron Jungreis’ Rosewood Realty Group — considered the go-to brokerage for rent-stabilized apartment building and portfolio sales — saw its dollar volume drop roughly $1 billion from 2018. The firm slid from No. 5 that year to No. 9 in 2019.

“The headwinds were very clear. We had a tough year,” said Jungreis, who recently launched a national division to do deals outside the five boroughs in response to the new law.

GFI Realty Services took the No. 17 spot on TRD’s ranking in 2018 but fell out of the top 20 this past year. Company president Michael Weiser said, in a tough market like this, brokers look to branch out to markets outside New York City or in different asset classes, like industrial.

“Basically you adapt and refocus,” he said, noting that maintaining morale is essential in the current market. “Definitely when it’s down, you keep the bar fully stocked at all times.”

Broker moves

The broker landscape wasn’t as volatile in 2019 as it had been in years past, but there were still some significant moves that shook things up.

The merger of JLL and HFF, for example, produced some friction: A number of JLL’s legacy brokers left, including Mo Beler, managing director of the New York Capital Markets team, as well as brokers Anthony Ledesma, Yoav Oelsner and Glenn Tolchin.

Eastdil Secured also beefed up its ranks in an attempt to regain some of the market share it lost when top dealmakers Harmon and Spies left for Cushman in 2016.

In January, the firm hired Gary Phillips from Allianz of America, where he had been head of acquisitions. And in June, Will Silverman and Matt McCoy left Hodges Ward Elliott to join Eastdil, which in October finalized its management-led buyout financed by Singapore sovereign wealth fund Temasek and U.S.-based Guggenheim Investments.

Eastdil’s hires had a ripple effect. The company’s team of Brett Siegel, Evan Layne and Jean Celestin left the brokerage for Newmark Knight Frank, where they are heading up the investment sales team.

Other firms are seeing tangible returns from big hires in recent years.

Meridian Capital Group, for example, saw its investment sales volume climb nearly 14 percent last year to $1.25 billion. The company’s president, Yoni Goodman, said his firm benefited from recent hires like Amit Doshi and Adam Hess, who both joined the company in 2018.

“It was a combination of the great brokers we started with and some of the new brokers really jiving,” he said.

Some of the top dealmakers said they’re seeing that a lot of new, inexperienced brokers who jumped into the business when the market was hot a few years ago are now getting weeded out.

“In a rising market, any investment sale broker can be successful,” Goodman said. “This market, candidly, requires better brokers.”

Future forecasts

In the midst of a disappointing year, the industrial sector turned out to be the one bright spot.

Industrial was the only major category of properties that saw an increase in activity, as the total dollar volume of sales jumped 44 percent to $3.5 billion, up from $2.4 billion in 2018, according to RCA. The explosion of e-commerce is driving investment into warehouses and logistics centers, and it’s also bringing more brokers into the space.

Joshua Kleinberg, an industrial broker at Cushman, said he’s seeing more people interested in becoming industrial brokers now.

“Five years ago, those guys were all wanting to be retail brokers. Before that, they were all wanting to be office brokers,” Kleinberg said. “The young guys coming out of college right now all want to be industrial brokers.”

Others are hopeful that the market will turn around this year.

JLL’s Bob Knakal said that 2019 ended with a bump in sales, one that makes him “hopeful that 2020 sees a turnaround” in sales figures, but he declined to comment further.

Marcus & Millichap’s Anton said much will depend on how city and state regulations shake out.

He said it’s not clear, for example, if state lawmakers will revise the new rent law or if tougher legislation like the proposal for a so-called “commercial rent control” measure will move forward.

The city’s investment sales brokers, he said, are still trying to find out if things will get better for the industry before they get worse.

“You ask the smartest guys in the room and they don’t know,” Anton said.