It had been a long two years, but the city’s investment sales market finally turned a corner in 2018.

Last year saw the total value of commercial property traded in the five boroughs rise for the first time since the market tanked following the peak days of 2015, according to several industry sources. And a new reality further set in for the commercial brokerage landscape.

Cushman & Wakefield — long used to playing third string behind competitors Eastdil Secured and CBRE — grew its lead by leaps and bounds since poaching Eastdil’s top sales team, led by Doug Harmon and Adam Spies, in late 2016. Eastdil, meanwhile, has struggled to fill that void as it works toward a management-backed buyout from its parent company, Wells Fargo.

“Market share clearly shows this has worked out well for Cushman & Wakefield,” said Anthony Paolone, a stock analyst at JPMorgan who covers the commercial brokerage. But he added that it’s hard to tell if Cushman got the return on investment it was aiming for when the brokerage lured Harmon and Spies with a big signing bonus.

“The level of overall market activity plays a big role, too,” Paolone said.

All in all, buyers and sellers traded $49.1 billion worth of property citywide last year — up 35 percent from 2017’s $36.4 billion, but nearly 40 percent below the peak of $80.4 billion in 2015, per figures from Cushman.

Industry players attributed 2018’s turnaround to a record year for office leasing, a political environment that seemed more settled following the 2016 election and a sense of urgency to lock in deals with the country’s economic expansion nearing a record run.

“There definitely seems to have been a higher number of big-ticket trades last year,” said Mitch Germain, a stock analyst at JMP Securities who covers many of the big real estate service firms. “And I think we’re seeing a bunch that appear to be queued up in 2019.”

Despite the sales boost, though, 2018 also came with its share of challenges. While the combined dollar value of transactions rose, the overall number of trades remained relatively flat. That meant brokers were still competing for roughly the same number of deals they were during the depths of the slump.

And the brokerage landscape was shaken up considerably, with Eastern Consolidated shutting its doors and dozens of established players switching firms — including Bob Knakal, who landed at JLL with dozens of his colleagues after he was fired from Cushman.

And the brokerage landscape was shaken up considerably, with Eastern Consolidated shutting its doors and dozens of established players switching firms — including Bob Knakal, who landed at JLL with dozens of his colleagues after he was fired from Cushman.

Will Silverman of Hodges Ward Elliott, which grew its dollar volume more than 20 percent year over year to $710 million, said there was plenty of uncertainty in the market last year.

“We said at the beginning of the year that sellers had realized it wasn’t 2015, but buyers had also realized it wasn’t 2010,” Silverman said, adding that brokers had their work cut out for them in 2018. “Simply throwing a listing out there, without a tight story, and hoping for a response wasn’t going to cut it.”

Leaders of the pack

In that environment, the biggest players kept busy.

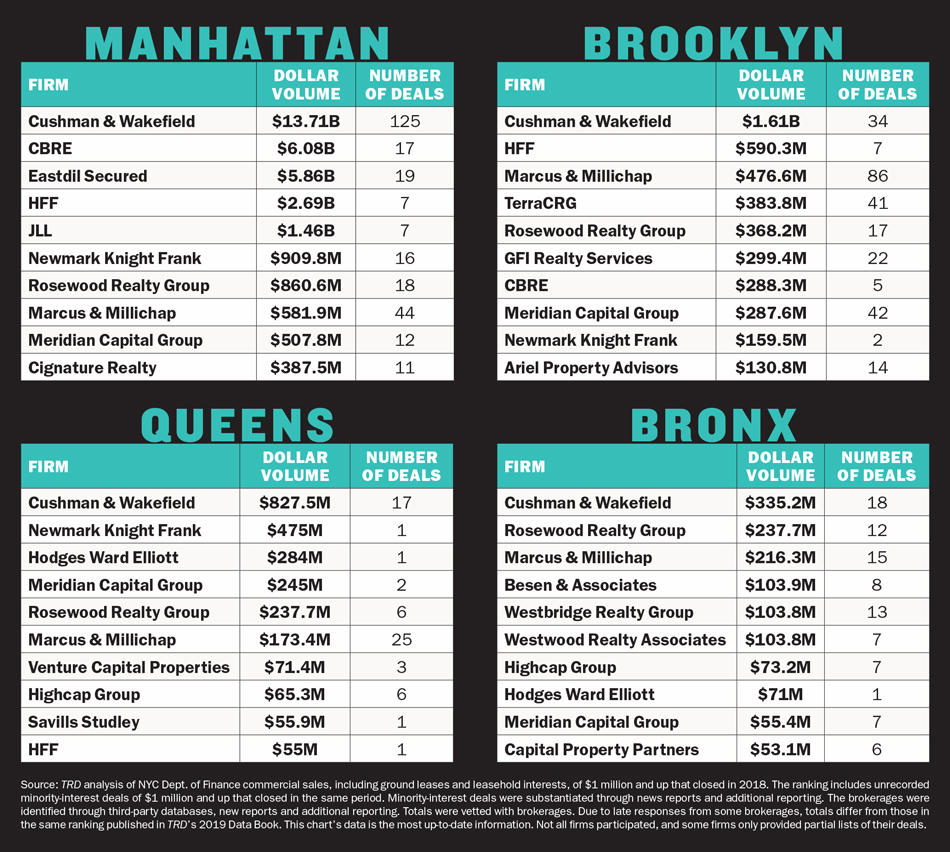

The Real Deal’s annual ranking of the top investment sales firms in NYC — which counted closed sales (including partial stakes), ground leases and leasehold interests of $1 million and up — found that the 20 leading brokerages negotiated $43.8 billion in deals last year. That was up nearly 70 percent from the $26.2 billion the top 20 firms negotiated in 2017.

Cushman, which went public in August, held onto the No. 1 spot for the second year in a row, increasing its dollar volume by more than 150 percent to $16.49 billion in 2018. CBRE remained in second place with $6.37 billion in deals, up slightly year over year, while Eastdil stayed in third despite more than doubling its 2017 total with $5.86 billion last year.

HFF (with $3.34 billion) and Rosewood Realty Group (with $1.7 billion) rounded out the top five.

John Santora, Cushman vice chairman and president of the tri-state region, said having strengths in several areas — from investment sales to office leasing — is seen as “a lot better than if you were a one-trick pony.”

“Having the No. 1 capital markets team in New York is clearly a big sell, especially when a lot of your investors sit here,” he said. “The big sales, the big leasing we do … clearly helps.”

Cushman was on one side of the largest deal last year: Harmon and Spies represented the German real estate firm Jamestown in its $2.4 billion sale of the Chelsea Market building to Google (TRD broke the news of the sale last February).

Harmon said that, while he was at Eastdil, he had represented Jamestown in 2003 when it purchased a 75 percent stake in the building at 75 Ninth Avenue — valuing the property at $285 million at the time. He worked with Jamestown again in 2011 when it recapitalized the Chelsea Market building and bought the remaining 25 percent, this time at a valuation of $795 million.

“If you sell a building three times, each time at more value, that tends to give you a leg up [over] someone who hasn’t,” Harmon said at Cushman’s offices in January during the brokerage’s year-end market presentation. “You know the building, you know the area, you know what’s going on.”

On the other end of the deal, CBRE’s Darcy Stacom and Bill Shanahan represented Google. A representative for the brokerage declined to comment on the deal, citing a confidentiality agreement.

On the other end of the deal, CBRE’s Darcy Stacom and Bill Shanahan represented Google. A representative for the brokerage declined to comment on the deal, citing a confidentiality agreement.

CBRE, which represents Google in its real estate deals across the globe, is notoriously tight-lipped about its valuable client. But Shanahan — speaking generally about the market in 2018 — said big buyers were more willing to pull the trigger than they had been in recent years.

“People got more comfortable with what was happening in the market,” he told TRD, adding that Manhattan’s record leasing year helped prop up office sales. “Transactions tended to be a little larger.”

And those high-priced building sales likely play a big part when it comes to each firm’s bottom line. JMP’s Germain said capital markets is a much higher-margin business for the big commercial brokerages than other lines of business.

“I would claim that the investment sales market impacts sentiment across the property service stocks more than anything,” he said.

Down but not out

Eastdil — which took the top spot on this ranking seven years in a row from 2010 to 2016 — has been unable to regain the market share it lost when its top brokers split.

While the firm more than doubled its dollar volume year over year (up from $2.73 billion in 2017), that’s still a fraction of the $22.7 billion it closed in 2015. A representative for Eastdil declined to comment.

To be sure, the firm’s investment sales brokers worked on some notable deals last year, including the $1.15 billion sale of ABC’s Upper West Side campus to Silverstein Properties. And Eastdil represented the media giant on the buy side when it paid $650 million to purchase a development site at 4 Hudson Square.

Sources said Roy March, the brokerage’s CEO, who moved from Los Angeles to New York to take a more hands-on approach with deals, worked on both transactions. March has also reportedly been busy negotiating with the Singapore sovereign wealth fund Temasek Holdings to finance the buyout of Eastdil.

Late last year, the brokerage hired Gary Phillips, the former head of acquisitions at Allianz Real Estate of America, to run its New York office. “We expect him to not only have an immediate impact on the firm’s activities in New York, but also to assist in strategically strengthening our equity sales and joint venture practice across the U.S.,” March said in a press release announcing the hire.

Phillips is looking to poach big names in New York to help fill Eastdil’s ranks, according to several insiders. The firm also saw its hotel team led by broker Larry Wolfe leave in May for Newmark Knight Frank, which ranked No. 7 with $1.55 billion worth of trades last year.

Overall, though, deals above the $1 billion mark were harder to come by last year, with six such trades in 2018, per Cushman, the same number as the year prior. What really drove the market’s recovery last year was the number of deals over $250 million. There were 35 such deals last year — more than double the count in 2017.

Andrew Scandalios, who co-heads HFF’s New York office, said a large chunk of the commercial property listings that came out two years ago didn’t clear because pricing had changed.

“I think clients were more judicious on what they allowed brokers to [widely market] last year,” he said. “And to that extent, there was an expectation of pricing that was met more often than not.”

Yet while the number of deals over $250 million grew, the rest of the market remained relatively flat. Ariel Property Advisors, for example, reported that the total number of transactions across the five boroughs dipped to 2,734, with 30 fewer deals than in 2017.

“There’s still a gap between what sellers want to achieve and buyers want to achieve,” said Ariel’s founder and president, Shimon Shkury.

Revolving doors

Last year was also notable for the number of brokers who switched companies.

One of the biggest catalysts was the closure of Eastern, which called it quits in July after nearly 40 years in the business. That left about 100 brokers covering investment sales, retail leasing and debt deals looking for jobs.

But most wound up at other firms by year’s end, and some brokerages even took the opportunity to launch new platforms. Adelaide Polsinelli was hired by the residential brokerage Compass to lead its new commercial sales division, while Brian Ezratty and Ron Solarz landed at Newmark and Andrew Sasson and Chad Sinsheimer headed to Ackman-Ziff.

Sasson and his partner closed their first deal at Ackman in November, selling the site of a gas station in Long Island City for $31 million. Sasson said there are always challenges when it comes to switching firms, but he noted that since Eastern went out of business, he and Sinsheimer didn’t have to deal with noncompete agreements.

“I think that had a big impact on a lot of our competitors who may have left their companies, as opposed to their company evaporating overnight,” he said. “It was easy for us to continue our business and take it where we were going.”

Another big shakeup in the market came from Cushman, when the contracts binding the three former Massey Knakal Realty Services principals — who joined in December 2014 — expired.

Knakal and more than 50 former Massey Knakal brokers landed at JLL, which ranked No. 7 in 2018 with $1.54 billion in deals. (Unlike many other brokerages on this ranking, JLL did not submit deals, so its final tally may be incomplete.)

Last year marked a bit of a rebound for the firm, which saw its volume dip after a team of top brokers led by Yoron Cohen and Richard Baxter left for Colliers International in December 2016. JLL hired Mo Beler from Rockwood Capital to oversee its investment sales practice in 2017, and last year the brokerage negotiated the sale of the Plaza Hotel as well as the sale of 5 Bryant Park, which JLL co-brokered with HFF.

Beler said he brought his buy-side perspective to valuing real estate and pitching JLL’s services to potential clients. He added that the firm’s institutional practice combined with Knakal’s expertise in middle-market deals gives it a clear edge. “There is a white-glove approach to the entire market, which creates an advantage for us going forward,” Beler said.

Paul Massey parted with Cushman in April to start his own brokerage, B6 Real Estate Advisors, while James Nelson decamped to Avison Young in January. Nelson said he has a team of nearly three dozen brokers now and that Avison closed nearly $400 million in deals last year. “We have a track record now that we can point to,” he said.

Cushman, meanwhile, has retained roughly 50 legacy Massey Knakal brokers and plans to remain an active player in the middle-market space they specialize in.

But there were other firms where losing a top broker meant a major hit.

Besen & Associates saw its numbers tumble by nearly 50 percent to $321.2 million last year after its co-founder and top broker, Amit Doshi, left amid an ugly legal battle. In May, Michael Besen sued Doshi for $10 million, claiming he mismanaged the brokerage and several investment properties they own together.

Doshi, who declined to comment, joined Meridian Capital Group a few months later, in July. (Meridian’s dollar volume on deals in 2018 rose above the $1 billion mark for the first time since it launched its investment sales arm in 2015.)

Besen declined to comment on the litigation with his former colleague but acknowledged the effect his departure had on the company.

“When a seasoned broker departs, of course it has an impact,” he said, adding that his firm has other revenue streams, including property management, and is “better insulated than competitors.”

“We have a growth strategy in motion for the brokerage and advisory business over the next 12 months,” Besen said.

Choppy waters ahead

Overall, 2018 was a mixed bag.

The $49.1 billion in total sales was on par with the average $45 billion of commercial property that has sold annually since 2010. But last year was neither a boom nor a bust, and brokers are starting 2019 cautiously.

In the city’s multifamily market — a core asset class in the outer boroughs — the outlook is decidedly mixed. While changes to the federal tax code offer a promising cash cow for investors, reforms to New York’s rent laws have the potential to sabotage entire investment strategies.

The much buzzed-about Opportunity Zone program allows investors to pay no tax on investments they hold for 10 years in designated areas. “The discussion around Opportunity Zones positively affects land prices in the boroughs,” said Ariel’s Shkury. “More transactions and higher prices.”

But virtually everyone agrees that what the state Legislature does to rent stabilization will impact the kind of OZ investment decisions buyers make. On the table is the elimination of a host of rent increase loopholes that building owners have been able to take advantage of for years.

Shkury said he expects to see a slowdown in rental building sales through the first half of 2019 — until the legislative picture becomes clearer.

Avison’s Nelson forecasted a 25 percent decline in dollar volumes on multifamily trades this year. “There’s no question that we are facing major headwinds from Albany,” he said. “There’s going to be a lot of investors sitting on the sidelines waiting to see what happens.”

Many of the city’s investment sales brokers, then, will have to navigate choppy waters as the new year rolls forward.

Cushman’s Harmon said that in a market like 2015’s, there was a sense that you could just auction off a property and it would trade. When things turned south, he noted, no one looked good.

“But in this middling market, there are plenty of people that have big listings that are not getting across the finish line,” Harmon said at the brokerage’s market briefing in January. “There is a real skill. So this market shows who’s got talent.”