It’s a long-held tenet of the business that agents switch firms when times are bad — and few years in recent memory have been worse than 2020.

“When the market is super strong… agents don’t really move,” said Scott Durkin, president and chief operating officer of Douglas Elliman. “That’s a natural evolution of the business.”

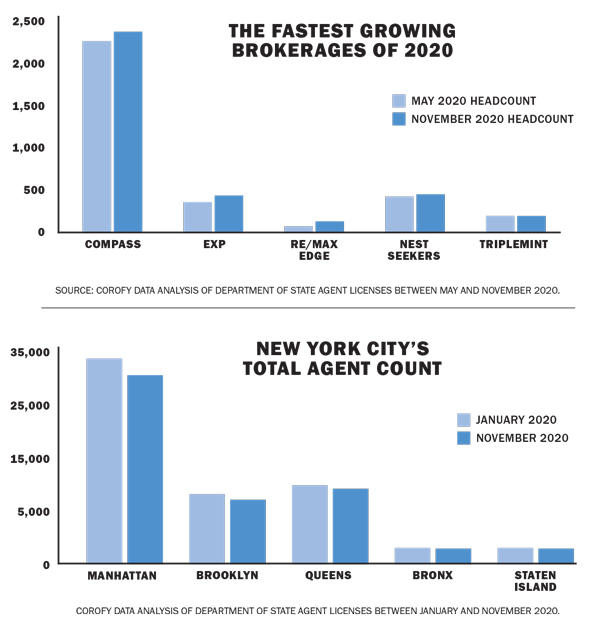

Now, a volatile market has sent brokers running, some from the business altogether. Nearly 4,000 agents terminated their licenses between January and December, a 9 percent drop from 63,835, according to Corofy, a data firm which tracks agent movement. Manhattan lost 2,372 agents, while Brooklyn, the Bronx, Queens and Staten Island lost a combined 1,562.

“The number of agents today is the most important metric,” said Eddy Boccara, Corofy’s founder. “I really consider the agents to be the consumer of the brokerage.”

The drop in headcount is understandable: Many agents saw their income virtually dry up overnight when the pandemic hit. And though the national housing market is roaring, New York City is struggling with an oversupply of high-end condominiums, banks tightening lending standards and buyers’ preferences for more space and private outdoor areas. All told, Manhattan sales fell 46 percent year over year in the third quarter of 2020; in Brooklyn and Queens, deal volume fell 43 and 40.5 percent, respectively.

“It’s a time of enormous dislocation,” said Frederick Peters, CEO of Warburg Realty. “For a great many real estate agents, I think it’s really created a lot of fear.”

The climate hasn’t stopped brokerages, many of which had to make cuts in the early days of the pandemic, from recruiting. Brokerages always want to grow market share by adding more “consumers,” as Boccara put it, but the landscape has become more challenging with more competition, slower sales and fewer agents. Though firms may not have the financial resources to offer big signing bonuses, many have placed an increased focus on rolling out tools to boost productivity, both for existing agents and to lure in new ones.

Read more

The Corcoran Group launched a new customer relationship management system in lockdown and an entirely virtual training center for agents in March. As of early December, the firm had run more than 900 classes on business development, digital marketing and wellness, among others. It is also working on getting a program ready to pay agents their commissions as soon as deals close.

Brown Harris Stevens began rolling out two lending products in December that will front staging costs for sellers and offer bridge loans up to $25 million to buyers at the behest of agents.

“We’re doing it solely because agents have said it’s important,” said Matt Leone, BHS’ head of business development. “I think everything we do is a recruiting and retention tool. … I call it doing your job.”

Meanwhile, Compass is gearing up for its initial public offering, which could mean windfall for the agents who took advantage of its stock options. Earlier this month, Robert Reffkin, the firm’s founder and CEO, encouraged that line of thinking in a recent internal memo to agents.

“We will be able to invest more in building towards the Compass Northstar: Anything an agent needs, Compass provides,” Reffkin wrote.

Coming and going

Even at the best of times, many brokerages view recruiting as a numbers game, where the highest agent headcount reaps the largest gross revenues for the company. But when business is bad, the need for more agents is even more acute.

“The industry knows that, really, one out of 10 agents is going to make it and really be profitable for the company,” Corofy’s Boccara said.

The game is harder now than ever before: There are fewer agents across the board, and those left know they’re in demand.

The game is harder now than ever before: There are fewer agents across the board, and those left know they’re in demand.

“The agents themselves are starting to realize that they’re a commodity in hot demand,” Boccara said. “Everybody wants to talk to them.”

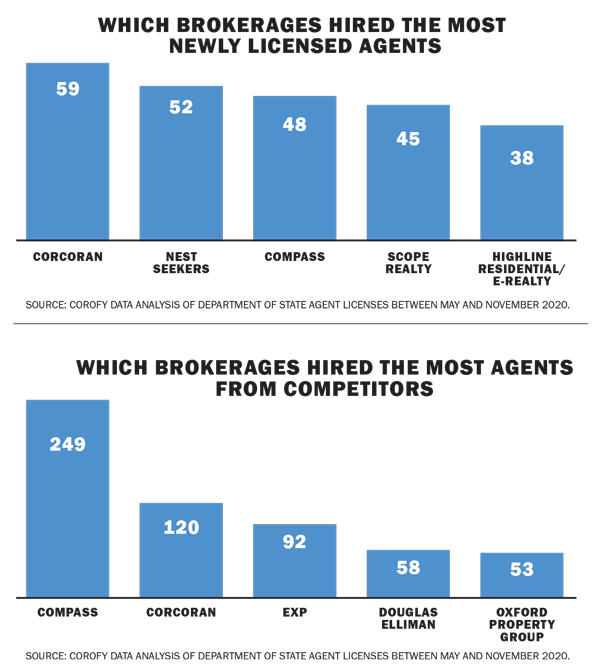

Compass is the recruiting game’s biggest player. The brokerage hired 249 agents away from its rivals between May and November — more than any of its competitors, according to an analysis by Corofy.

“Compass really owns a really, really important market share of hiring,” said Boccara, referring to the strategy of recruiting agents to gain market share.

Rory Golod, Tri-State president of Compass, pushed back, however, saying that firms allowing growth to be driven by headcount was leading the industry “astray.”

“Great organizations are built by being thoughtful and selective,” he said. “We have never thought about our company in terms of the number of agents. … We don’t set targets based on the number of agents.”

The firm was far from alone when it came to bringing on new talent from competitors. Corcoran made 120 new hires, followed by eXp, which drew 92 agents. Douglas Elliman snapped up 58 agents from its rivals, while Oxford Property Group picked up 53.

“We are very aggressive,” said Pam Liebman, CEO and president of Corcoran. “We did not stop.” She did note, however, that the firm had limited recruitment to agents who’d been in touch with the firm before and previously expressed interest out of a desire to be “sensitive” during the pandemic.

Overall, Compass netted 97 agents between May and November — meaning that the firm gained more agents than it lost. eXp Realty, RE/MAX Edge, Nest Seekers International and Triplemint reported similar gains.

Still, Compass churned, or lost, an average of 39 agents per month. Among the city’s other biggest brokerages, Elliman and Corcoran saw an average monthly churn of 54 and 53 agents between May and November, while BHS churn was 9.5.

(Compass disputed Corofy’s results, stating that its churn was just under 2.5 agents per month because the firm only counts “principal agents” not their team members internally.)

At BHS, the firm has upped its marketing budgets and is pouring resources into a new CRM system that recently launched, according to CEO Bess Freedman.

At BHS, the firm has upped its marketing budgets and is pouring resources into a new CRM system that recently launched, according to CEO Bess Freedman.

“We’re just going to be a little bit more flexible than usual taking into account the pandemic,” she said referring to costs agents incur. “We’re sensitive to the agents that have had a really tough time this year.”

Merger mania

For the last few years, consolidation has swept the brokerage industry, and the recent volatility hasn’t changed that pattern. Last year, Compass acquired Stribling & Associates, and in January of this year Bond New York snapped up rental brokerage Caliber Associates, while Citi Habitats merged into Corcoran.

BHS and Halstead’s merger in June was the largest of 2020. The two firms, sister companies under Terra Holdings, now have a combined roughly 2,500 agents. However, the process did result in the departure of 38 “underperforming agents,” according to Freedman and Richard Grossman, president of Halstead.

Freedman said the pandemic was the “catalyst” for the deal. She said Terra had discussed merging the firms for years, but the idea became an “ideal” option as the city locked down last spring.

“If we didn’t have the pandemic, I don’t know that we would have done it at such a quick speed,” she said. “Maybe we would have at some point.”

Oxford Property Group absorbed Kian Realty and Spire Group, which meant adding about 280 agents to the firm over the course of the year.

The firm’s founder and CEO Adam Mahfouda said that Oxford’s growth insulated the firm from the pain of a market where transaction volume has sunk.

“As a company we’re not feeling the toll,” he said. “But a lot of our agents are feeling that.”

In a similar vein, Elegran acquired Anchor Associates earlier this fall, bringing on 20 new people.

Celebrity broker Ryan Serhant took an even more extreme approach, launching a new firm altogether in September. He began hiring immediately, despite the fact that a lot of his existing business will continue to be handled by his team at Nest Seekers.

“I’m not building this for today. I’m building this for 2030, and 2040, and beyond,” Serhant said in an October interview. “The age old way of getting a desk and you have to drive all your own business and it’s the brokerage’s brand first and your brand second … it will not last, it cannot last.”

Serhant’s firm and Triplemint both scooped up agents and staff who had been let go when many firms were forced to make deep cuts earlier in the year.

Triplemint CEO David Walker called cutting support staff and agent services “the wrong strategy” back in June, just as agents were allowed to show homes for the first time in three months.

“This is the time to invest in your agents because the market is going to rebound,” he said at the time. Fast-forward six months, Triplemint said its headcount has increased by about 20 percent since last December. Walker said he stands by the firm’s “targeted and specific” strategy.

“Value to buyers and sellers stands out even more in a challenging market,” he said in December. “It’s the extreme opposite of when the market is roaring, and you can hire your friend who’s done two deals and has their license on the side.”

“Value to buyers and sellers stands out even more in a challenging market,” he said in December. “It’s the extreme opposite of when the market is roaring, and you can hire your friend who’s done two deals and has their license on the side.”

Breaking out

For agents themselves, a different calculus comes into play when deciding whether to stay or go.

The pandemic has led some agents, concerned about health and safety, to retire, according to Barbara Fox at Fox Residential.

“I think a few of them just don’t want to deal with everything,” she said, noting that there is a real fear among agents showing homes and meeting with clients despite there being no vaccine.

“I don’t know anyone who isn’t afraid,” Fox said. “I’ve never been so looking forward to getting a shot.”

Meanwhile, others decided this was the time to leave the sheltered wing of major teams. Two agents who had been on the Serhant Team for seven years, Ivy Kramp and Jenna Amicucci-DeChristopher, decided to move to Compass in late June where they founded a four-person team, which includes another Serhant Team alum Vanessa Beretta.

The brokers, who say they closed $222 million in total sales between 2018 and 2019, said they parted with Serhant on good terms and the decision didn’t have anything to do with his new firm.

“We wish him the best of luck,” said Amicucci-DeChristopher. “Just for us we wanted to go in a little bit of a different direction.” Kramp said the in-house resources at Compass for new development was a big factor in their move.

On the other end of the spectrum, Kayla Lee, who handled sales at new development buildings for Modern Spaces for the past five years before jumping to Serhant’s new firm, said the decision was born out of a lull between projects and wanting a new challenge.

“I thought this would take me to a new level,” she said.

The Peters Breese team at Elliman splintered off from the Eklund-Gomes Team in May, noting that making a move as the market was frozen afforded them additional time to reorganize and communicate with clients. “We have the time to do it now,” as Breese put it.

Aaron Seawood, a Brooklyn-based broker and a founding member of Compass’ sports and entertainment division, agreed. He moved to Triplemint in June for the opportunity to “have a seat at the table” as the firm expanded into Brooklyn.

“When you’re able to be still, you’re really able to be self aware,” Seawood said in June about deciding to make the jump amid so much volatility. “You have a little more time to think about what’s important to you.