Going into the final stretch of the 2020 Kentucky Derby, millions of dollars rested on the performance of a 3-year-old horse named Authentic. The stallion, owned by billionaire self-storage and rental-home magnate B. Wayne Hughes, led Vegas favorite Tiz the Law by half a head.

In eerie silence, the drunken revelers at home due to the pandemic, Authentic pushed toward the finish. With just a quarter-mile left, his jockey’s lash urged him forward. Tiz had taken the Belmont Stakes a few months prior, and nearly half of the $80 million wagered that day had been on him. As the two horses barreled toward the finish, Authentic kept his lead, ruining a lot of bettors’ days. But for Hughes, the moment was nirvanic: after a half-century of thoroughbred ownership, the real estate titan finally had his first Kentucky Derby.

B. Wayne Hughes and a horse race (Getty Images)

Hughes got in early on some major industry trends. He founded Public Storage in 1972 just as Americans began renting empty cubes to hold all their junk (self-storage is now a $39.5 billion industry, according to listings service SpareFoot).

Then, as more Americans started renting homes in the wake of the Great Recession, he founded American Homes 4 Rent, today one of the country’s largest owners of single-family rentals. With an estimated net worth of $4.2 billion, Hughes has plenty of money to spend on his passions. And he’s far from the only real estate baron with cash to spare.

More than 200 real estate moguls appeared on Forbes’ 2021 billionaires list; all told, the industry accounts for about 10 percent of billionaires worldwide. Far more have fortunes in the hundreds of millions, a testament to one of the most lucrative (and risky) businesses on the planet. But with great risk comes great reward, and great rewards lead to great excess. This month, The Real Deal took a look at some of the shiniest toys industry titans ride, fly, sail and display when they aren’t shaping skylines.

By sea, land and air

When Jeff Greene went to Davos in 2015, he caught heat for reportedly saying, “America’s lifestyle expectations are far too high,” even as he flew to the forum on his private jet with his family and two nannies. The comments by Greene, who made his fortune in the housing market crash through credit default swaps on subprime mortgage-backed bonds, looked particularly bad given the context. But Greene’s distaste for the TSA line is shared by other real estate bigwigs.

Don Peebles, a Miami-based developer and founder of Peebles Corporation, used to own a Gulfstream IIB powered by Rolls-Royce engines, according to Global Air. It reportedly fit 12 passengers and featured two separate cabins so he and his wife could enjoy some privacy from their kids, who occupied themselves with an onboard PlayStation.

Peebles sold the jet to get a share in a Bombardier Challenger 300, but as the pandemic curtailed his travel schedule, he scaled back. He now just charters jets and helicopters as needed.

Don Peebles and a Gulfstream IIB (Getty Images)

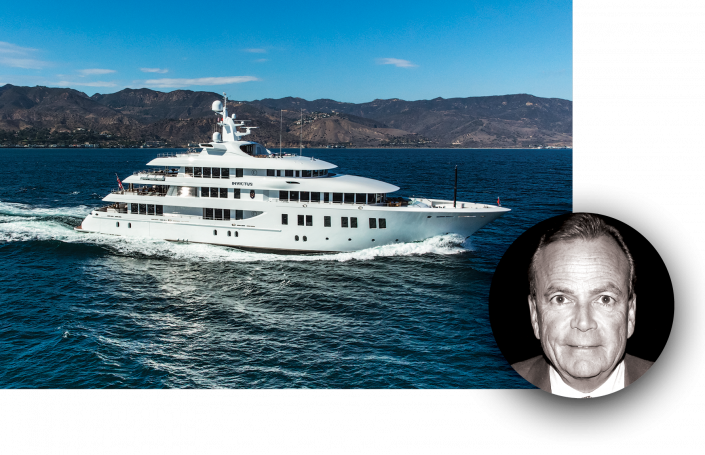

Other real estaters prefer the high seas. Rick Caruso, whose eponymous Los Angeles development company built such icons as the Grove and the Commons at Calabasas, owns a 216-foot superyacht, Invictus. Worth an estimated $100 million, the boat is outfitted with Italian marble, exotic wood on every deck and a custom, ice-strengthened steel hull, according to its builder, Delta Marine. With 14 cabins, a hot tub and a movie theater with stadium seating, Invictus brings the comforts of land to the ocean.

Rick Caruso and his superyacht, Invictus (Getty Images)

New York developer Charles Cohen took customization to a whole new level for his yacht, Seasense. Cohen spent years searching for the right ship before falling for a 220-footer with a massive pool on the main deck. “This is really the case of expanding the envelope to take something land-based and put it on the sea,” Cohen told Architectural Digest.

Charles Cohen and his superyacht, Seasense (Getty Images)

Cohen and his wife designed the interior with the help of Area Architecture, which also worked on their L.A. home and Cohen’s offices. The decor paints the boat in luscious shades of blue, meant to emulate the ocean. Cohen intentionally avoided the dark woods and low ceilings of other ships he toured, building out a full gym and a 98-inch movie screen on deck. A movie buff with his own film distribution company and the winner of an Academy Award, Cohen installed an entertainment system that lets guests access an extensive film catalogue from any room.

Of course, the expenses don’t end once the boat hits the water. Yachts like Invictus and Seasense can accumulate annual costs of anywhere from $3.2 million to $6.3 million, according to Superyacht Intelligence, which covers the industry. Between fuel, crews and mechanical upgrades, these floating mansions can sink even the most buoyant wallet.

And then there’s Roy Carroll. The motorhead developer, who founded North Carolina-based Carroll Companies, boats, flies and drives in style. His 190-foot yacht, Skyfall, features a wine cellar, two hot tubs, a masseuse and a helipad that converts to a basketball court.

Carroll flies in his private Gulfstream G450 jet between his projects, which hopscotch the South’s “It” cities such as Nashville, Austin and Dallas. The plane can fly 14 passengers almost 5,000 miles, according to NetJets.

Roy Carroll and a Ferrari (he owns at least six) (Getty Images)

And when he simply must stay on the ground, Carroll still has the horses. No, not the ones that neigh — Carroll’s horses roar. He reportedly owns six Ferraris, and doesn’t just keep them in the garage. Instead, he competes in the Ferrari Challenge, described on the Italian automaker’s website as “a competition for those who, not satisfied with just driving their Ferraris on the road, feel the urge to compete in top-level sprint races.”

Since his debut on the tour in 2020, Carroll has finished second in two races.

Gil Dezer (photo by Sonya Revell)

But the industry’s biggest car nut is undoubtedly Gil Dezer. The Miami builder developed the Porsche Design Tower and is now working on the Bentley Residences, both in Sunny Isles Beach. That’s business, but here’s where it gets personal: Dezer owns the Aston Martin DB5 James Bond drove in “Goldfinger,” a Bugatti Veyron — No. 305, in an ode to his adopted hometown — and a whole host of other supercars. He’s a former winner of the Gumball 3000, a celebrity motor rally that takes place on public roads.

Ball is life

The industry’s most ruthless developers amassed their fortunes by outmaneuvering the competition, so it’s no surprise that many spend their spare time and money on professional sports teams.

Neil Bluhm, the founder of JMB Realty and Walton Street Capital, already owns several iconic pieces of the Chicago skyline. But he also owns a few of its sporting icons. Bluhm holds minority stakes in the Bulls and White Sox, and reportedly coveted the Bears as well. While he never completed that Windy City trifecta, there’s still time: The Bears recently partnered with Bluhm’s gambling outfit as the team’s exclusive sportsbook. Further, they plan to bid on a 320-acre racetrack owned by Churchill Downs Inc., a publicly traded gambling and racing company that holds a majority stake in Bluhm’s nearby Rivers Casino.

Ed Roski Jr. and the Staples Center (Getty Images)

As professional sports arenas grow more luxurious, franchises stand to gain from an owner with real estate know-how. Ed Roski Jr., president of Majestic Realty, made his mark on the L.A. sports scene by leading development of the Staples Center. The Downtown arena now hosts the Lakers and the Los Angeles Kings, both of which Roski has partially owned since the 1990s. During his tenure, the franchises have had six NBA championships and two Stanley Cups.

Roski has taken his love of sports to extreme environments, completing grueling physical challenges across the world. An avid explorer, he has biked across Myanmar, reached base camp at Mount Everest and plunged 2.5 miles underwater to visit the wreck of the Titanic in a Russian submersible.

He’s also funded or participated in more than a dozen trips to Melanesia, the stretch of Southern Pacific islands that includes Papua New Guinea and Fiji. There, Roski collected rare art now on display at the Bowers Museum in Santa Ana, California.

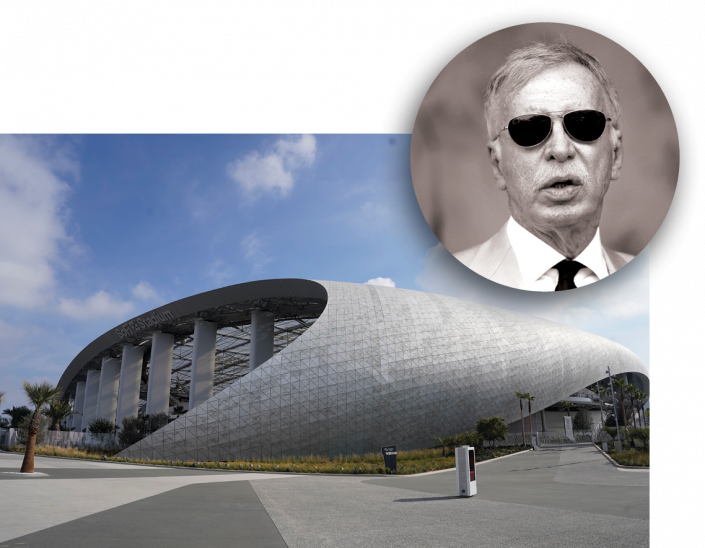

Elsewhere in L.A., Stan Kroenke has blurred the lines between real estate and sports to such a degree that it begs the question which is his primary enterprise. While he is one of the largest landowners in America, with 30 million square feet of commercial real estate and nearly 1.4 million acres of ranchland, he has also compiled a portfolio of sports teams across every major league.

Stan Kroenke and SoFi Stadium (Getty Images)

He relocated his highest-profile team, the Los Angeles Rams, to the most expensive stadium in the world, his $5.5 billion stadium SoFi Stadium in Inglewood. The arena is more than twice as costly as the runner-up. Kroenke also holds stakes in the Denver Nuggets and Colorado Avalanche, as well as the state’s professional soccer and lacrosse teams. He even holds an interest in Arsenal, an English Premier League powerhouse.

Ted Lerner at the Nationals’ World Series parade in 2019 (Getty Images)

For Ted Lerner, founder of Lerner Enterprises in Maryland, buying the Washington Nationals in 2006 represented the fulfillment of a “lifelong dream.” He played an active role in reshaping the baseball franchise after it moved to the nation’s capital from Montreal, helping turn the team from a perennial loser to a champion. In 2018, he passed control of the team to his son, Mark. A year later, the Nationals won their first World Series.

Stephen Ross and the Miami Dolphins (Getty Images)

But they can’t all be winners. Stephen Ross, the founder and chair of Related Companies, purchased 50 percent of the Miami Dolphins for more than $1 billion in 2008. The following year, he bought another 45 percent of the team. While the Dolphins won their division in Ross’ first year, they’ve since achieved only two winning seasons.

All about the arts

There’s a 14-foot tall rabbit in the lobby of 51 Astor Place. It’s bright red, weighs three tons and is worth millions of dollars. And it’s just one piece of developer Edward Minskoff’s formidable art collection.

Edward Minskoff and a “Balloon Rabbit” by Jeff Koons (Getty Images)

Known as “Balloon Rabbit (Red),” the Jeff Koons sculpture has sat in the lobby of Minskoff’s East Village office building since he built the tower in 2013. The developer, who founded Edward J. Minskoff Equities in 1987, has a well-known penchant for visual arts, with a collection of 20th- and 21st-century art comprising more than 700 pieces. He owns works by Willem de Kooning, Jackson Pollock, Jean-Michel Basquiat and Roy Lichtenstein as well as at least 17 pieces by Pablo Picasso, according to ARTnews.

While he shares Minskoff’s love for Koons, Jerry Speyer has a collection that also features works by unknown artists. The chair of Tishman Speyer has been building his collection since 1964, when he bought his first painting at a show in Greenwich Village, he told Crain’s. His Upper East Side mansion is reportedly so full of art that visitors get a catalogue guiding them along the jam-packed walls.

Speyer even served as chair of the Museum of Modern Art for 11 years before stepping down in 2018. He reportedly leveraged his industry know-how to persuade the owners of the Dorset Hotel to sell their building to the museum for $25 million under value when it moved to Midtown.