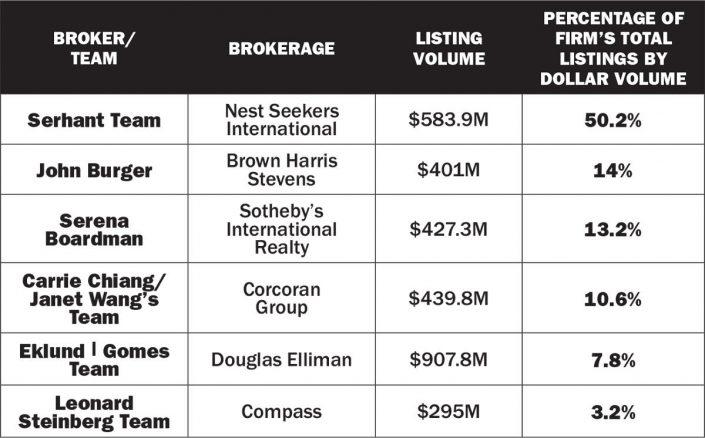

Only one of New York City’s top agents has half of a firm’s listings: Nest Seekers International’s Ryan Serhant.

No one else is even close.

The celebrity broker’s team has $583.9 million of Nest Seekers’ $1.16 billion in exclusive listings in the city, according to an analysis of OLR data by The Real Deal. John Burger, with 14 percent of Brown Harris Stevens’ book, is a distant second.

The state of affairs has been a huge success for Nest Seekers, which has perfected the art of cultivating and channeling star power. But now that Serhant is striking out on his own, Nest Seekers in a bind: His new firm will be a direct competitor, and clients from whom the two have profited over the past 12 years will pick sides.

“I made it very clear when I engaged with Nest Seekers that I was engaging with Ryan,” said developer Jordan Brill of Magnum Real Estate. “I don’t know where that leaves their firm. When Michael Jordan left the Chicago Bulls, you saw what happened.”

Read related story: Inside Ryan Serhant’s new firm

The Serhant story shows how brokerages can reap the financial and branding benefits of star agents. But his departure raises questions about Nest Seekers’ future and highlights the risk that residential brokerages face when they become dependent on star brokers. Still, Nest Seekers appears to be doubling down on the strategy.

Ravi Gulivindala, a broker and member of Nest Seekers’ executive team, said the firm has always served as an incubator for talent, knowing that some of that talent will one day walk.

“Eddie’s thing is always about helping the agent,” said Gulivindala, who likened founder and CEO Eddie Shapiro’s philosophy to building a sports team. “We can’t live under this concept of ‘What if we build somebody and they leave?’”

Tending the nest

In early 2008, Serhant could not have been further from the real estate world.

He had a hand-modeling contract with AT&T and was three years into his acting career, with roles in short films and “As the World Turns.”

But a chance introduction to Shapiro changed all that.

“I thought he was going to be the next Ryan Gosling,” said Jason Paulino, Serhant’s classmate in college theater, who connected him with the CEO in July 2008. When Paulino left Nest Seekers a few weeks after Serhant joined the firm, he still thought his friend was destined for the silver screen.

Serhant would eventually become a star, just not in Hollywood.

Since joining Bravo’s “Million Dollar Listing New York” in 2012, the broker has become a brand unto himself. By 2015, Serhant’s 22-agent team held 57 percent of Nest Seekers’ listings, a dominance that still persists. He’s written a best-seller, “Sell It Like Serhant,” has another book on the way and last year launched an online real estate course. He’s also consistently been one of the top-ranking agents in the city by sales volume.

Shapiro declined to be interviewed for this article. “The Whole is greater than the sum of the parts,” he said in an email. “We live and operate by that philosophy.” (He also contested TRD’s analysis of listing data, but declined to provide further information.)

He did put forward 12 Nest Seekers executives and agents, many of whom said Serhant’s exit would have no impact on the firm’s more than 500-agent operation in New York City.

Still, a comparison of listings at the city’s five largest brokerages shows that no other New York agent even approaches Serhant’s percentage of his firm’s business.

After BHS’ Burger comes Serena Boardman, whose $427.3 million in listings account for 13 percent of Sotheby’s International Realty’s inventory. Carrie Chiang and Janet Wang’s team has $439.8 million in listings, nearly 11 percent of Corcoran Group’s haul. Fredrik Eklund and John Gomes’ team had $907.8 million worth of listings, or 8 percent of Douglas Elliman’s total. Leonard Steinberg’s team has $295 million in listings, only 3 percent of Compass’. (The analysis, based on a one-day snapshot of active listings and contracts on OLR on Oct. 1, was only conducted for the most active listing broker at each firm, and did not count founder-dominated firms.)

Compass’ regional president, Rory Golod, was pleased that Steinberg’s business represented the smallest slice of the pie. It’s a big change for the firm: Five years ago, a TRD analysis found that Steinberg’s listings accounted for 51 percent of Compass’ inventory.

“As we’ve become bigger and hired more brokers, obviously the total listings volume of the company is not going to be tied so closely to [one broker],” Golod said. “I think it’s a good thing if a company has a diverse set of agents that represent its inventory, because I think that’s indicative of the health of the company.”

Still, the loss of a star agent is always painful, according to Steve Murray, president of Real Trends, which analyzes the U.S. residential brokerage industry.

Even if a firm is financially insulated from the loss, he said, a top producer’s exit can hurt market share and the marketplace’s perception of the firm. Serhant’s departure was also notable, Murray said, because as of late, star agents usually jump to other firms rather than start their own. He said Serhant’s new firm could inspire others to consider a similar move, or agents to follow him.

Nest Seekers will need to make up for Serhant’s numbers as quickly as possible, Murray said, either by recruiting a new crop of top agents or allocating resources to develop in-house talent.

Shapiro claims he’s already several steps ahead. For starters, Serhant isn’t leaving right away, which will avoid a plummet in the firm’s business. Serhant will continue to service the clients he signed while at Nest Seekers through his old team there and will also promote his listings at Nest Seekers through his new firm’s platforms. Throughout September, Serhant continued signing new contracts with clients at Nest Seekers and said he and the firm will split the commissions.

Serhant declined to comment on why he left the majority of his 40-agent team at Nest Seekers, but said, “[Nest Seekers] and I made an agreement that puts our clients, listings and projects first and foremost.”

In an email, Shapiro called his agreement with Serhant “an example to others in the industry.” Serhant said it was a matter of loyalty and allowed him to avoid any “downtime” as he set up the new firm, which got its brokerage license on Oct. 1.

Life after Ryan

Shapiro hasn’t been betting all his money on a single jockey. He’s been actively grooming the next batch of star agents.

In 2018, as Serhant was getting his YouTube channel off the ground, he reached out to a local YouTube influencer, Erik Conover, to collaborate on a listing video.

That experience prompted Conover, a travel vlogger, to pivot to real estate.

Over the next two years, he and his business partner (and fiancée) Hanna Coleman began shooting videos of luxury homes. Last year, after passing 1 million subscribers, they began interviewing with brokerages.

“We saw that he wanted to uplift us,” said Conover of Shapiro. “He is so forward-thinking and willing to put resources behind something.”

Conover got his real estate license in the first week of October and joined Nest Seekers a few days later. On day one, Shapiro gave him $100 million in listings — including co-listings with other Nest Seekers agents — and hired Coleman as the firm’s head of digital marketing.

Shapiro’s also been working on developing talent through other media. Take Netflix’s “Million Dollar Beach House,” which features only Nest Seekers agents and according to Shapiro has brought in a storm of leads. (Shapiro, an executive producer of the show, said the firm neither paid for nor received any funds from it.)

Rookie agent J.B. Andreassi said he learned that Shapiro was considering him for the show after he reached out to the CEO for a coffee meeting. Andreassi said he “absolutely” felt this was a chance for Nest Seekers to create a new Serhant.

“I think that was in the back of Eddie Shapiro’s mind,” he said.

“Obscurity is an agent’s biggest problem,” said Noel Roberts, another of the cast members. “Hands down, Netflix is where everybody wants to be.”

Nest Seekers and the cast haven’t found out if Netflix will renew the show for another season, but it’s far from the only source of leads courtesy of the streaming giant.

Shawn Elliott, a Long Island native who’s since established a base in Los Angeles, heads Nest Seekers’ “Ultra Luxury Division.” Elliott made several appearances on Netflix’s “Selling Sunset,” which is centered on the L.A.-based Oppenheim Group. He also hosted a miniseries in the U.K. for Channel 5 last year on the world’s most luxurious homes.

“I became a star in Europe,” he quipped.

As Elliott and the Hamptons cast reap the rewards of their TV presence, Nest Seekers is leveraging the shows to help its London-based division expand across Europe.

“I think what you’ve got to look at is the British and Europeans’ appetite for Americanisms,” said Daniel McPeake, who leads the European branch of Nest Seekers from London. “There’s an appetite here, in France, in Spain, to see the glitz and glamour of America.”

McPeake said the Netflix shows especially help him recruit because they’re all about the agents.

Specifically, “it shows how much money they make.”

“That’s the biggest thing that’s helped me,” he said.

Reality overload

The visibility-above-all approach isn’t embraced by everyone. Corcoran didn’t allow its agents to star in reality TV shows, though it made an exception when it hired “MDLNY” cast member Steve Gold after Town Residential closed in 2018.

Compass has also been critical of agents appearing on reality shows, though one of its own, Kirsten Jordan, was cast for “MDLNY” last year.

Compass’ Golod said the idea of using TV shows as a growth strategy for the firm is a nonstarter, despite the boost in exposure such opportunities bring for the individual agents.

“Television is not something that can scale. It takes time, and it’s selective,” he said. “Hundreds of agents can’t appear on TV.”

While not everyone loves the idea of having agents on screen, some brokerages are doubling down on the star broker by devising new business models that benefit both rainmaker and firm.

Take Side, the San Francisco-based firm that has raised more than $70 million in venture capital since its founding in 2017. The company — whose motto is “Not all agents, just the best agents” — acts as a white-label firm, or one without its own branding.

All agents at the firm get a 90-10 split. Side handles all back-end operations, while brokers cover most of their own marketing expenses. Agents even cover rent if they choose to have an office.

The practice already exists at more traditional firms, like Elliman, for certain top producers. For example, Eklund and Gomes’ team, which they run with Julia Spillman, taps company resources for all back-end work while maintaining its own marketing, branding and even office spaces.

Golod said Compass puts “a lot of effort” into helping agents develop their own brands.

“The brand of the agent is more important than the brand of the firm,” said Golod. “People don’t choose firms, they choose agents.”

But the business model of white-label brokerage is far from proven. Side has yet to be profitable, and for traditional firms, balancing the resources a star broker demands or expects with what the company can afford is a constant struggle, according to Stuart Siegel, who runs Engel & Völkers NYC.

“Do you want market share, or do you want EBITDA?” asked Siegel, referring to a company’s operating profitability.

Often, a firm’s efforts to gain market share involve undercutting competitors on price and offering top agents higher splits or signing bonuses — all practices that can take away from the firm’s profitability.

Murray, Real Trends’ president, said he’s not aware of any firm that is losing money to retain top producers, but he said the margins for the brokerage are thinner.

“They make a lot less than they used to off top producers because of competition for top agents,” he said, “whether that’s caused by Compass or eXp or other companies that are out aggressively recruiting top producers.”

For its part, Nest Seekers — with more than 1,000 agents worldwide now, thanks to recent expansions in Connecticut, Palm Beach, Miami, Los Angeles and London — is trying to have it all. The firm still operates like a traditional brokerage, driven by its recruiting efforts and recent acquisitions of smaller firms, but it’s augmenting that strategy with bold, agent-driven bids for market share and brand recognition.

Nest Seekers is also building out its new development division. The firm claimed it has $7.5 billion in new development projects on the market or in its pipeline. And in June, Shapiro appointed Michael Bethoney, a former member of the Serhant Team, to lead the newly minted team.

Gulivindala said that Nest Seekers has weathered the pandemic well and not had to make any demoralizing announcements, such as layoffs. But the brokerage has not revealed specifics about its finances, and as a private company, it doesn’t have to.

“Look, every firm has a very senior good agent,” he said, referring to Serhant. But the firm has positioned itself so that everyone at Nest Seekers benefits from being under the same “umbrella.”

In Serhant’s case specifically, Nest Seekers will retain a piece of his business for the foreseeable future.

“Our continued relationship revolves around servicing our vast portfolio of clients,” Shapiro said in an email. “We still have a journey ahead with that.”