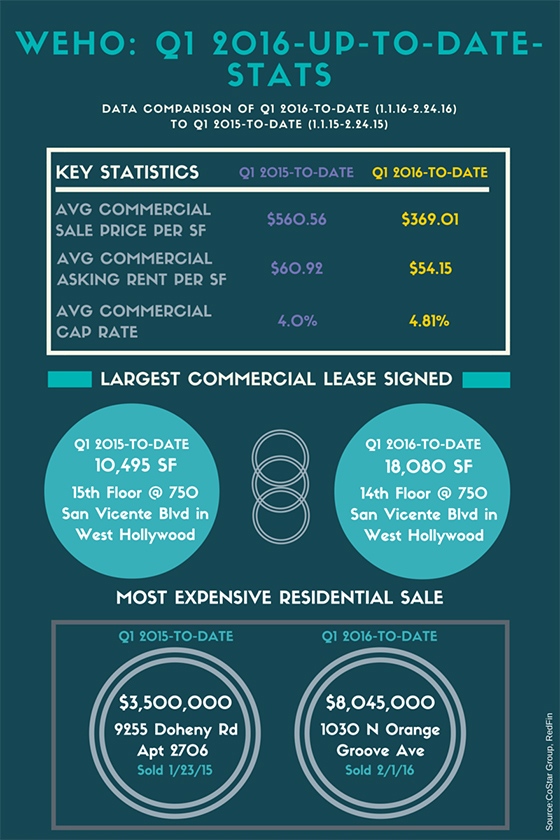

From the start of new year to date, West Hollywood has seen lower asking rents and per-square-foot sale prices than it did in the same period a year ago.

Data from CoStar Group and Redfin, analyzed by TRData, found the average sale price for commercial properties sold this year was $369 a square foot, compared to $561 a square foot in the same period a year ago.

Asking rents averaged $54.15 a square foot a year (or $4.51 a square foot a month) compared with $60.92 a square foot a year ($5.08 a square foot a month) for the same period in 2015.

Commercial cap rates rose to 4.81 percent in the first quarter of the year so far, compared with 4 percent in the same period last year.

The largest commercial lease signed in the submarket so far this year was Grindr’s 18,080-square-foot lease at the Pacific Design Center’s Red Building at 750 San Vicente Boulevard. The biggest lease in the same period last year was in the same building, but for 10,495 square feet.

The most expensive residential sale in the submarket this year happened on Feb. 1, when the property at 1030 N. Orange Grove Avenue traded for more than $8 million. In the same period last year, the most expensive property to trade hands was a condo in the Sierra Towers at 9255 Doheny Road, which traded for $3.5 million.