Los Angeles County’s office market is in the mid to late stages of the real estate cycle, according to a new report by CBRE’s Petra Durnin and Maximilian Saia, which uses L.A.’s unemployment rate as a major gauge.

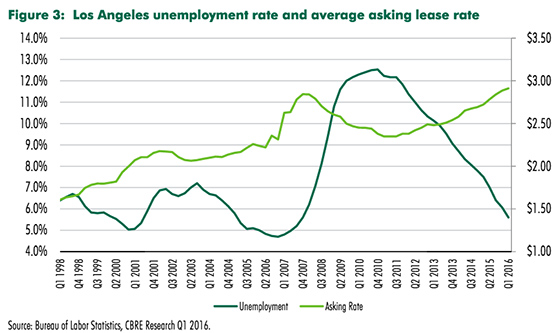

Changes in the unemployment rate are strongly correlated with changes in asking rents and occupancy, Durnin told The Real Deal. At the peak of the last three cycles, the rate converged to a similar reference point: 5 percent. Judging by that metric, L.A. is getting close.

In the first quarter of this year, the unemployment rate fell lower than 6 percent. It will fall to that telling 5 percent in late 2017 or early 2018, Durnin predicted.

Because of where L.A. is in the cycle, the report advises that developers not “hold out for the highest rents,” and instead “start to pre-lease now.”

“Think beyond this cycle,” the report suggests. “Now is not the time to worry about an impending recession but rather to start planning and preparing for when the next downturn will inevitably occur.”

The authors also concluded that L.A’s office market is safer now than it was during the last cycle.

“We are seeing an expansion of industries in less cyclical arenas and that will help buffer L.A. fundamentals as we move through cycle,” Durnin told The Real Deal.

Those less-cyclical fields, such as education and healthcare, now represent a much larger share of employment in the Greater L.A. area than those with bigger fluctuations such as manufacturing and construction, the report said. Education and health services jobs only represented about 13.5 percent of the Greater L.A. employment pie during the peak of the last cycle. They now represent more than 16 percent, according to the report.

The non-cyclical hospitality and leisure sectors have also grown. There were roughly 25,000 leisure and hospitality jobs lost from the previous peak to the low of the last recession. Since then, that sector has gained back those jobs, and many more, hiring more than 160,000 workers. Before the last recession, leisure and hospitality represented 10 percent of employment in Greater L.A.; It now represents 12 percent.

Meanwhile, cyclical jobs are representing a smaller portion than they did at the last peak.

Manufacturing accounted for 11 percent of jobs in the prior peak, and now accounts for less than 9 percent.

Less reliance on cyclical industries means there will be less jobs lost in a downturn, Saia said. That means less vacancy disruption and less price depreciation in the office market, he said.