Blackstone Group launched its first non-traded real estate investment trust and is looking to raise $5 billion from investors.

The new REIT, dubbed Blackstone Real Estate Income Trust, will focus on core properties including hotels and multifamily buildings, according to an SEC filing cited by Bloomberg. Blackstone is primarily known as a manager of private investment funds, although it also runs a publicly traded mortgage REIT. The company had $103.2 billion in real estate assets under management as of June 30.

The new REIT appears to be part of Blackstone’s [TRDataCustom] push into stable, income-producing assets that come with less risk but also offer lower returns. In December, the fund manager bought Stuyvesant Town-Peter Cooper Village for $5.3 billion in partnership with Ivanhoe Cambridge through a core-plus fund.

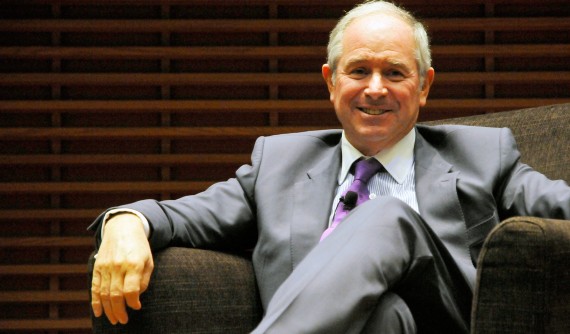

“The prospects for growth in that business are huge,” Blackstone CEO Stephen Schwarzman said on an earnings call in April, speaking of low-risk real estate. “As we move into the retail chain of distribution with this, we should be able to create a really very large-scale business.”

The new REIT has yet to buy any properties. [Bloomberg] – Konrad Putzier