It’s a good time to be an apartment landlord in Los Angeles.

That was the overarching sentiment at the bullish quarterly multifamily debriefing Thursday in the Downtown Los Angeles office of CoStar Group, the global property research company.

“Multifamily [properties] are the only property class where investments are increasing,” said CoStar’s senior market analyst Steve Basham, speaking at the event. “The rising unaffordability of home ownership, the increasing economy, growing jobs and a young population makes Los Angeles one of the most attractive rental investment markets in the country, and probably the world.”

Low-paying jobs and the rental market

Basham said that while economic recovery was strong and employment is on the increase, “a lot of jobs are concentrated in lower-paying or shift jobs,” resulting in anemic income growth.

While the high-paying tech companies have made big splashes with office leases in Silicon Beach, they create a relatively small amount of new jobs, Basham said.

Because employment growth is not equating to income growth, fewer people can afford home ownership. As a result, the demand for affordable rentals has skyrocketed.

Rents have cooled since 2015

Rent growth in 2015 was just shy of 8 percent, a figure impossible to maintain as more supply comes on-stream, Basham said. For 2016, rent growth has is forecasted to stand at about 4 percent at the end of the year, based on two quarters of data.

“That’s coming down from such an incredible high in 2015,” he said. “Demand was high last year, and that allowed landlords to aggressively push rents. Even though demand in L.A. is still strong, those levels of growth weren’t able to be maintained.”

Who’s heading Downtown?

Currently, construction of luxury rentals in DTLA is outpacing demand and, as was noted in an earlier CoStar report, vacancy is on the rise. But Basham said he is not anticipating increases to the vacancy rate to be steep.

“We might see some weakness in that [luxury] sector, but not so much that you’ll see projects not being finished or bankruptcies,” he said. “There will be rising concessions though — a year’s free parking, six weeks free rent – and that will slow effective rent growth.”

Concessions can already be seen at Carmel Partners’ Eighth & Grand apartments, where up to five weeks of free rent and 12 months of free parking are advertised. Prospective tenants can also get a month off rent at the newly opened Hanover Olympic apartments on Olive Street and Sares-Reis Group’s 240-unit Wakaba LA in Little Tokyo.

The future of downtown living, Basham said, rests on new residents being pulled in from other parts of Los Angeles, who can afford the $2,500-and-upwards rents.

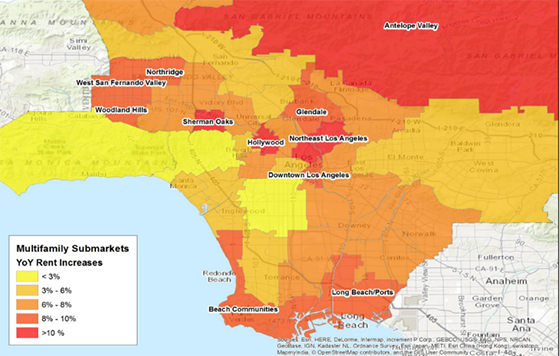

A heatmap of rental growth (credit: Andrew Rybczynski of CoStar)

A widening circle of hot spots

Developers are zeroing in on “secondary submarkets” in the county, Basham said, as more renters who are priced out of city centers turn to places like the Valley.

“Areas like Woodland Hills and Northridge have been experiencing some of the highest rent growth, likely a result of affordability issues,” Basham said. “As values nudge upwards Downtown — extending to peripheral areas like Koreatown and Westlake — tenants are being pushed out of metro areas into Long Beach or Antelope Valley.”

A streamlining of entitlements in Glendale makes that a prime spot for development as well, he said.

Antelope Valley saw more than 7 percent rent growth in the first two quarters of this year. Tarzana, where Gelt has been planning developments, saw more than 6 percent growth.