With traditional residential brokerages already struggling with narrowing margins, a Silicon Valley startup is expanding to Southern California touting it can squeeze commissions even more.

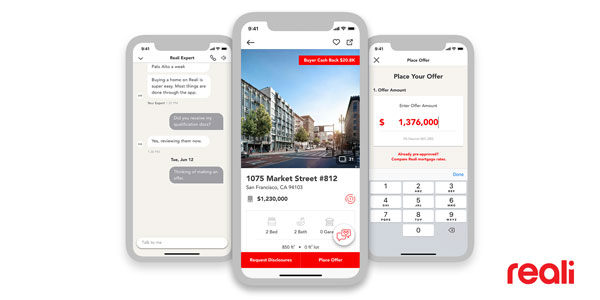

Reali, based in San Mateo, uses artificial intelligence and big data to help facilitate the process of buying and selling a home, a process its founders say can be handled entirely from an app on a mobile phone.

The company is the latest of a flurry of real estate technology firms shaking up the traditional residential real estate ecosystem. With AI-backed platforms and new commission structures, this new wave of brokerages provides a stark contrast from the traditional agent experience in the hopes that they’ll attract more business by discounting costs to buyers and sellers.

But the new push for discount commissions only makes it tougher on traditional brokerages, which are already coping with shrinking margins, agents and executives say.

Reali charges buyers and sellers a flat fee commission that is tiered based on a home’s listing price. Homes priced between $250,000 to $500,000 will command a $5,000 flat fee, while homes priced upwards of $750,000 will require a $10,000 flat fee.

Anything less than $250,000 will be charged a flat fee of $995.

“The current industry is all about commissions,” said Amit Haller, CEO and co-founder. “It shouldn’t matter if we sell a $500,000 home or $5,000 home — we need to provide our services at the same quality.”

Home buyers will also receive a cash-back refund once they close a deal on the Reali platform.

Sellers listing on the platform will pay a flat fee, plus a typical buyer’s agent commission between 2 and 3 percent once their home sells. The buyer’s agent commission, minus the flat fee Reali keeps, will then be handed to the buyer as a refund once the deal closes.

The logic is that the seller will save money by paying a 2 to 3 percent commission to the buyer on the deal, rather than coughing up the traditional 5 or 6 percent that is usually split between a buyer’s and listing agent.

“The fact that buyers get a cash back means that they have more money in their pocket to offer more than if they did not have the cash back, which is good for them and the seller,” Haller added.

Screenshot of Reali app

Prior to launching Reali in 2015, Haller founded Butterfly Investments and Butterfly Communications, a multifamily real estate firm and Bluetooth technology firm, respectively. His co-founder, Avi Avrahami, was a senior partner at Butterfly Investments, and worked on consumer-based web platforms for more than 15 years.

“We’re both techies and we realized that with technology, we can help improve those inefficiencies and provide a better experience to consumers while being able to save them a lot of the cost,” Haller said.

The firm, which has raised $30 million in four rounds of funding — most of it venture capital — is already operating in the San Francisco Bay Area, Sacramento County, San Diego, and other parts of California.

Unsurprisingly, the technology-driven firm is foregoing traditional office space in L.A. Instead, its team of licensed real estate agents are provided with Reali-branded, eco-friendly cars that allow them to meet with clients or verify listings.

Real estate tech startups have become more common as technology becomes more refined and big data more reliable. Other discount brokerages, such as Purplebricks, have taken a similar stance against the traditional commission fee, offering flat fees in lieu of percentage-based commissions.

Traditional brokers have criticized such firms, arguing that the level of service is inferior to what an in-person agent on the ground can provide.

But Haller says Reali “understands the market as good if not much better because we are seeking big data info and analyzing in real time.”

“Technology,” he added, “is always disrupting markets.”