What do an ice cream maker and gun shop owner from Los Angeles have in common with an investor from Miami?

All three recently cashed out of properties in Opportunity Zones in L.A. The deals closed in February and April but were just filed in public records.

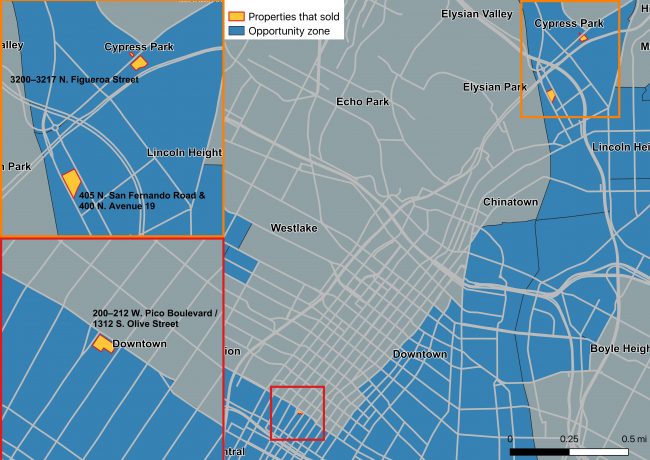

The three deals — which totaled $58 million — all fall within designated federal Opportunity Zones in parts of Cypress Park and Downtown. Long-term investors in those zones can receive significant tax incentives for developing new properties or significantly improving on existing ones.

In L.A., more than a quarter of upcoming residential units and nearly half of commercial space are already in Opportunity Zones, according to an analysis by The Real Deal of ground-up new construction filed with the Department of City Planning from October 2017 through September 2018. Since then, demand for Opportunity Zones has accelerated.

(Click to enlarge) Source: Neighborhood boundaries courtesy of the L.A. Times. Roads courtesy of OpenStreetMaps. Opportunity zone boundaries courtesy of the California Department of Finance.

Of the three most recent deals, at least one of the buyers — Action Investment Group — seems to have had the Opportunity Zone program in mind.

A local firm led by Mayer Separzadeh, it paid $20 million for a block-length assemblage of commercial buildings at 200–222 W. Pico Boulevard and 1312 S. Olive Street in Downtown. The seller was a pair of corporations controlled by Yoav Botach, a prominent local landlord who founded Botach Tactical, a large gun shop in South L.A. Botach bought the assemblage in 2016 for $10.75 million.

Action Investment was acting through Downtown QOF LLC. The “QOF” stands for Qualified Opportunity Fund. Large and small firms and investors nationwide have been launching Opportunity Zone funds with the intention of deploying capital into some of the 8,700 designated zones across the country.

For the second deal, a pair of adjoining warehouses at 405 N. San Fernando Road and 400 N. Avenue 19 sold for $23.8 million. Both the buyer and seller were LLCs tied to the Fifteen Group, a Miami-based firm with a local office in L.A. The properties last sold in 2016 for $17.2 million and had been on the market as development opportunities, according to a profile found on LoopNet.

And for the third deal, GCX — a developer affiliated with Gaw Capital Partners— acquired two buildings at 3200–3217 N. Figueroa Street in Cypress Park for $14.3 million.

Food distributor Arya Ice Cream was the seller. It had purchased the property in 2001 for $1.7 million.

Yoav Botach, Action Investment Group, and Arya Ice Cream did not respond to requests for comment. Gaw Capital Partners and Fifteen Group declined to comment.