It’s a case of the haves and have-way-mores when it comes to the earnings collected by the leaders of Los Angeles’ most influential public firms in commercial and residential real estate. As both markets plug along with warnings of a downturn looming in the background, the head honchos raked in substantial sums that were essentially on trend with their earnings over the last few years. To understand just how much they made, The Real Deal dug into the latest data available from disclosures of executive compensation packages in securities filings. A thing we learned? The top earner by far, Stephen Schwarzman of the Blackstone Group, had the lowest annual salary of the lot, at $350,000. But of course for chairmen and CEOs, salary is only a portion of the take-home pay, with bonuses and dividends significantly boosting their personal bottom lines.

Read on to learn who earned what.

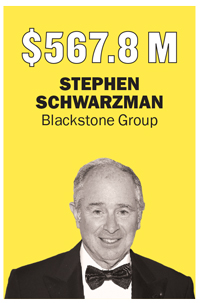

Stephen Schwarzman is co-founder, chair and CEO of the Blackstone Group, a mammoth investment firm with $472 billion in assets under management as of the end of 2018.

Stephen Schwarzman is co-founder, chair and CEO of the Blackstone Group, a mammoth investment firm with $472 billion in assets under management as of the end of 2018.

While Schwarzman took home a hefty $567.8 million in 2018, filings with the U.S. Securities and Exchange Commission show that his salary was a fairly modest $350,000, the same as each named senior executive officer at the company. That number is significant because “it equals the total yearly partnership drawings that were received by each of the senior managing directors prior to our initial public offering in 2007,” according to Blackstone’s disclosures. “In keeping with historical practice, we continue to pay this amount as a base salary.”

The majority of Schwarzman’s 2018 earnings came from Blackstone’s dividends. While the company no longer discloses dividend payments on the particular class of stock owned by Schwarzman, Reuters did an estimate based on a $2.15 per common unit payout that put Schwarzman’s dividend payment for 2018 at approximately $500 million — and that’s a lowball guess, since his class of stock has historically been higher than the common unit. This amount was supplemented by $69.1 million in compensation, likely for investment gains.

Earnings have been up and down for Schwarzman, who in 2017 took in an estimated $786 million. In 2016, he raked in a mere $425 million, down from the $734.2 million he received in 2015. The 72-year-old is estimated by Forbes to have a net worth of $13.2 billion.

Blackstone has been doing some big transactions lately in the Los Angeles area. In March 2019, the Blackstone Real Estate Investment Trust bought the Miro Apartments in Santa Fe Springs for $56.7 million from New York-based private equity investor Praedium Group.

Another Blackstone entity, EQ Office, bought the Lincoln Heights headquarters of fashion retailer Forever 21 in mid-February for $166 million. EQ Office has also been shedding properties. The real estate firm sold a three-building apartment complex in Echo Park to the tune of $25.5 million, and a property in Westlake and one in Santa Clarita for a combined $113.6 million.

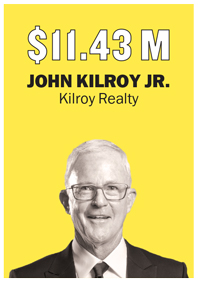

As president, CEO and chair of Kilroy Realty Corporation, John Kilroy Jr. took home $11.43 million in 2017, according to the most recent SEC filings available. Kilroy’s earnings were slightly down from his 2016 income of $11.56 million. And with a salary of $1.2 million in 2017, Kilroy’s take-home pay was made up primarily of his 5.8 million stock options. He also received $3.8 million as part of a nonequity incentive plan and approximately $531,000 in other compensation.

As president, CEO and chair of Kilroy Realty Corporation, John Kilroy Jr. took home $11.43 million in 2017, according to the most recent SEC filings available. Kilroy’s earnings were slightly down from his 2016 income of $11.56 million. And with a salary of $1.2 million in 2017, Kilroy’s take-home pay was made up primarily of his 5.8 million stock options. He also received $3.8 million as part of a nonequity incentive plan and approximately $531,000 in other compensation.

Kilroy Realty was founded by the senior John Kilroy in 1947, and the younger Kilroy has been involved in all aspects of commercial real estate acquisition, entitlement, development, construction, leasing, financing and dispositions since 1967. He was named the company’s president in 1981 and became its CEO in 1991. Kilroy Realty went public in 1996. Today it’s one of the major landlords on the West Coast, with assets in markets from Seattle to San Diego.

Kilroy is also a big player in the Los Angeles commercial real estate. In November 2018, Kilroy Realty leased 355,000 square feet of office space to Netflix at the Academy on Vine project under construction in Hollywood. This $450 million mixed-use development broke ground in June and will take up an entire city block.

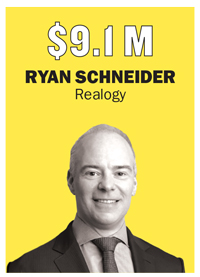

Ryan Schneider is fairly new to the world of real estate titans. He became CEO of Realogy Holdings Corporation in December 2017. Previously, Schneider spent 15 years in senior leadership at Capital One Financial Corporation.

Ryan Schneider is fairly new to the world of real estate titans. He became CEO of Realogy Holdings Corporation in December 2017. Previously, Schneider spent 15 years in senior leadership at Capital One Financial Corporation.

In 2018, he took home a total of $9.1 million, a sizable increase from his $5.2 million compensation package in 2017. According to the most recent available filings, Schneider’s 2018 pay included a base salary of $1 million, up from his $153,846 salary in 2017. Schneider’s 2018 pay was also included $5.9 million in stock awards, $1.5 million in option awards, $660,000 as part of a nonequity incentive plan and $60,747 in other compensation.

In 2018, Realogy logged approximately 1.4 million home sale transaction sides, reaching a transaction volume of approximately $512 billion, up 1 percent from 2017. However, last year was a tough one for Realogy, as it was for many industry players, with fourth-quarter revenue at the company down $90 million from the year prior. Realogy announced that it will cut costs going forward, and it plans to save $70 million in 2019 by reducing corporate expenses.

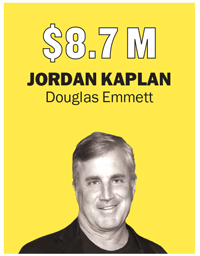

Jordan Kaplan’s $8.7 million compensation package for fiscal 2017 was composed of a base salary of $1 million, stock awards of approximately $7.7 million and other compensation of $32,490, according to the most recent SEC filings. That was up from his compensation of $7.9 million in 2016 and $7.5 million in 2015.

Jordan Kaplan’s $8.7 million compensation package for fiscal 2017 was composed of a base salary of $1 million, stock awards of approximately $7.7 million and other compensation of $32,490, according to the most recent SEC filings. That was up from his compensation of $7.9 million in 2016 and $7.5 million in 2015.

Kaplan joined Douglas Emmett in 1986 and currently serves as its CEO, president and a member of its board of directors.

The company has approximately 18.5 million rentable square feet of Class A office space and 3,595 apartment units in Honolulu and Southern California.

This past April, the company announced plans to build a three-story office complex that would offer 67,000 square feet of space in its Warner Center office campus in Los Angeles.

David Neithercut’s overall take-home pay in 2017 was $8.67 million. These earnings consisted of a base salary of $900,000, $6.37 million in share awards, $1.39 million in option awards and $11,166 in other compensation.

David Neithercut’s overall take-home pay in 2017 was $8.67 million. These earnings consisted of a base salary of $900,000, $6.37 million in share awards, $1.39 million in option awards and $11,166 in other compensation.

This is Neithercut’s last year at the helm of Equity Residential. The multifamily real estate company recently announced that he will be retiring at the end of 2019 after 12 years as president and CEO.

Mark Parrell, executive vice president and chief financial officer at Equity Residential, will step into its top leadership role.

According to the National Multifamily Housing Council, Equity Residential is the third-largest apartment owner in the U.S., with investment in or ownership of 307 properties consisting of 79,482 apartment units across the country. In Southern California, the company has 95 properties, according to its 2018 portfolio summary, with 23,381 units that rent at an average of $2,465.

Late last year, Equity Residential made a long-term investment in going green. The company issued $400 million in green bonds, which are expected to generate $396.7 million by the time they mature in 2028. Equity Residential plans to use those funds for sustainability-focused projects, such as the 383,000-square-foot development at 855 Brannan Street in San Francisco, the largest LEED Platinum-certified multifamily property in the city.

As president and CEO of the CBRE Group, Robert Sulentic took home a compensation package of $8.6 million in 2017. That total included a salary of $990,000, $5.1 million in stock awards, $2.5 million in nonequity incentive plan compensation and $4,500 in other compensation, according to the most recent filings available. In 2016, Sulentic took home $4.96 million, and in 2015 his total compensation was $7.7 million.

As president and CEO of the CBRE Group, Robert Sulentic took home a compensation package of $8.6 million in 2017. That total included a salary of $990,000, $5.1 million in stock awards, $2.5 million in nonequity incentive plan compensation and $4,500 in other compensation, according to the most recent filings available. In 2016, Sulentic took home $4.96 million, and in 2015 his total compensation was $7.7 million.

CBRE had global revenue of $21.3 billion in 2018, making it one of the world’s largest commercial real estate services and investment firms. The company has more than 450 offices (eight in Los Angeles County) and over 90,000 employees around the world.

As chair of Douglas Elliman and president and CEO of Vector Group Limited, the parent company of Elliman, Howard Lorber took home $8.4 million in 2018, down from the $10.6 million executive compensation package he received in 2017 as well as the $11.1 million he received in 2016.

As chair of Douglas Elliman and president and CEO of Vector Group Limited, the parent company of Elliman, Howard Lorber took home $8.4 million in 2018, down from the $10.6 million executive compensation package he received in 2017 as well as the $11.1 million he received in 2016.

With a 2018 salary of $3.2 million, $1.15 million in option awards, $3.4 million in nonequity incentive plan compensation and approximately $604,000 in all other compensation, Lorber had a decent year.

Lorber also serves as executive chair of Nathan’s Famous, vice chair of Ladenburg Thalmann Financial Services and a director of Clipper Realty.

In 2019, as a result of his cost-of-living provision, Lorber’s salary was increased to $3.299 million from $3.248 million.

Elliman has had a larger presence in Los Angeles in recent years. In 2017, the company acquired the Los Angeles-based luxury brokerage Teles Properties, making Elliman the second-largest nonfranchise brokerage firm in California. Today Elliman has 20 offices in the state, with 12 of those in Los Angeles County.

In 2018, however, Elliman was deeply affected by the overall slowdown in the residential market and saw a decrease in profits of 75 percent.

As CEO, president and chair of the board at Hudson Pacific Properties (HPP), Victor Coleman took home $6 million in compensation for fiscal 2017. This pay package consisted of a $725,000 salary, a bonus of $290,000, $3.8 million in stock awards, approximately $1.2 million in nonequity incentive plan compensation and $15,060 in other compensation.

As CEO, president and chair of the board at Hudson Pacific Properties (HPP), Victor Coleman took home $6 million in compensation for fiscal 2017. This pay package consisted of a $725,000 salary, a bonus of $290,000, $3.8 million in stock awards, approximately $1.2 million in nonequity incentive plan compensation and $15,060 in other compensation.

That was up from Coleman’s take-home package of $5.6 million in 2016 but lower than the $8.9 million compensation he earned in 2015.

Coleman has been a member of HPP’s board since the company went public in 2010. Coleman founded the private real estate investment firm Hudson Capital, the predecessor to HPP.

In 2018’s fourth quarter, the company signed 75 new and renewal leases, including Technicolor’s renewal in Hollywood. Despite this, earnings were down 50 percent for the quarter. And while net income for all of 2018 was up 45 percent from 2017, revenue grew less than 1 percent, to $728.4 million. According to Coleman, however, this is all part of HPP’s growth plan, as the company expects loads of cash from leases that were put in motion at year’s end.

In 2018, CEO and president Michael Schall took home $5.4 million in total compensation from Essex Property Trust, up from his 2017 take-home pay of $4.6 million. His 2018 compensation package included a salary of $800,000, stock awards of $2.3 million, option awards of $750,023, $1.5 million as part of a nonequity incentive plan and $33,954 in other compensation.

In 2018, CEO and president Michael Schall took home $5.4 million in total compensation from Essex Property Trust, up from his 2017 take-home pay of $4.6 million. His 2018 compensation package included a salary of $800,000, stock awards of $2.3 million, option awards of $750,023, $1.5 million as part of a nonequity incentive plan and $33,954 in other compensation.

Essex’s properties are located in the Seattle metropolitan area and Southern and Northern California. In 2017, the company acquired five communities with a total of 1,897 apartment homes for $566.8 million, the majority of which — 1,098 — were in

San Jose.

In 2018, Essex acquired two communities for $139.4 million and sold four communities. The total proceeds from those sales were $417.3 million. This year has already been an active one for Essex in the Los Angeles area. In January, the company sold a Downtown apartment building in L.A. for $220 million and continued construction of a new 200-unit apartment building in Hollywood that will include 4,700 square feet of ground floor retail space, a gym, swimming pool and roof deck. Essex broke ground on the $54 million project in 2017.