Every day, The Real Deal rounds up Los Angeles’ biggest real estate news. We update this page at 9 a.m., 12:30 p.m., and 4 p.m. PT. Send any tips or deals to tips@therealdeal.com

This page was last updated at 4:00 p.m. PT

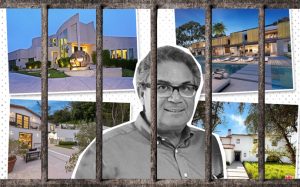

Robert Shapiro and a few of the properties (Credit: iStock)

Ex-luxury property developer Robert Shapiro pleads guilty. The former CEO of Woodbridge Group of Companies pleaded guilty Wednesday to charges relating to his $1.3 billion Ponzi scheme and faces up to 25 years in prison. The Real Deal rounded up some of his more notable real estate deals. [TRD]

Harvey Weinstein sold millions worth of real estate between October 2017 and April 2018. Two properties he sold were in Manhattan, according to an analysis by the Wall Street Journal. The now disgraced Hollywood producer sold a West Village townhouse for $25.6 million, $10.65 million more than he bought it for in 2006; and a commercial condo in Tribeca for $6.1 million, $5 million more than he paid in 1989. The purge of properties began about six months before sexual-misconduct allegations came out against him. [WSJ]

Are TICs the next big thing? Tenancy in common, an ownership model where individuals can buy units in shared properties, is gaining traction in L.A. The units are typically 10 to 20 percent cheaper than buying a condo, allowing longtime renters to become first-time homeowners. Still, securing financing for TICs can be tricky, limiting the pool to those who have a high credit score and at least a 10 percent down payment in the bank. [Curbed]

Art collector Alex Hank takes a loss on Beverly Hills home. Hank sold his pad for $12.6 million, roughly $300,000 less than what he paid for it in 2014. An unidentified Chinese buyer bought the Trousdale Estates home. [Variety]

Motel is shifting to housing. Jamboree Housing Corp. is seeking approvals to convert the 70-unit Econo Lodge in Anaheim into a 70-unit apartment community for extremely low-income residents. A staff report is recommending the Planning Commission approve the move. [Urbanize]

Realogy CEO Ryan Schneider (Credit: iStock)

Realogy’s rocky road is continuing with a stock surge and revenue slide. Following months of decline, Realogy’s stock soared more than 19 percent Thursday as the brokerage giant said it grew its agent base “for the first time in a long time,” despite a reported drop in revenue. [TRD]

Nicholas Cage regrets “real estate buying spree” and $276K dinosaur skull. The actor, who once owned multiple properties in the U.S., the Caribbean and two castles in Europe, has opened up to the New York Times about his real-estate buying spree, ill-fated dinosaur skull purchase, and his quest for the grail in Rhode Island. [NYT]

Falling bond yields are “reviving” the mortgage market. Yields on 10-year U.S. Treasury notes fell to 1.675 percent on Wednesday, and experts predict that already-falling mortgage rates will catch up if the yields remain low. The climate has triggered a boost to the mortgage market. In New York City’s sluggish luxury market, mortgage lenders had become increasingly aggressive in their bids for market share. [WSJ]

What the downsizing spells for the luxury retailer’s various landlords remains unclear (Credit: Getty Images)

What’s next for Barneys’ landlords? The luxury retailer has filed for bankruptcy and will shutter 15 of its 22 department stores. While the retailer’s future is unclear, experts told TRD that negotiations are likely and that Barneys could be prevented from vacating some locations based on concessions from the landlords. [TRD]

Anaheim’s 30-acre “Sinkin’ Lincoln” is getting a makeover. The property has had many lives: It was an orange grove, a landfill, a go-kart track and a mobile home park. Now, the City Council has approved a deal with a joint venture of Zelman Development Company and Greenlaw Partners to redevelop the site into a 73,000-square-foot retail center, up to 65 townhomes, green space and possibly a hotel later. [Bisnow]

Virtual brokerage eXp Realty is continuing its rapid growth. The company reported a “record” $266.7 million in revenue in the second quarter of 2019 — a 104 percent year-over-year increase — while its losses were up 16 percent from the previous year. [TRD]

Robert Shapiro pleaded guilty in a Miami federal court on Wednesday.

LA luxury developer Robert Shapiro pleads guilty. The former CEO of Woodbridge Group of Properties admitted he “misappropriated” up to $95 million of funds from mostly elderly investors to pay for a luxury L.A. estate, artwork, travel, jewelry and more. Shapiro faces up to 20 years in prison for wire and mail fraud conspiracy, plus another five years for tax evasion for steering the $1.3 billion Ponzi scheme. [Miami Herald]

Starwood Capital Group CEO Barry Sternlicht and Lantana campus (Credit: Getty Images and Ehrlich Yanai Rhee Chaney Architects)

Starwood is nearing a deal to buy part of Santa Monica’s Lantana office campus. Barry Sternlicht’s company is set to pay around $220 million for the so-called south campus portion of the four-building complex. David Ellison’s Skydance Media bought the two north campus buildings in March for $321 million. [TRD]

Deal to give historic Buff and Hensman home to USC falls apart. The owner of the Pasadena home, Carol Soucek King, agreed to give the 1979 home to her alma mater, in 2007. King said an “unmendable chasm in the vision of heritage conservation” with the university prompted her to renege on the deal. [Curbed]

Gov. Gavin Newsom backs statewide rent cap. The governor called such a measure “long overdue” on Wednesday. There is one rent cap proposal pending in Sacramento that would bar annual hikes above 7 percent for the next three years on buildings older than a decade. Newsom said he wanted to incorporate in the bill more protections for renters. [LAT]

Celebrity chef Giada de Laurentiis picks up Pacific Palisades bungalow. De Laurentiis paid $4.9 million for the late 1950s home, which comes in at just over 3,600 square feet with five bedrooms. The interiors were recently renovated, including the kitchen. [Variety]

Parkview Financial provides loan for 65-unit apartment project in Koreatown. The $16 million is on the six-story project slated for 719 St. Andrews Place. The developer is a Brentwood-based entity, St. Andrews Place LLC. [Multihousing Pro]

Deal nears to redevelop West Covina’s BKK landfill. Singpoli BD Capital Group would partner with the City of West Covina to turn the former landfill into a 218-acre park. The proposal includes horse and hiking trails, zip lines, and a solar and greenhouse farm. [The Hub LA]

Zillow CEO Rich Barton (Credit: Twitter and iStock)

Zillow’s bet on iBuying boosted revenues, but firm still saw losses. Revenue for Zillow Offers boosted Zillow’s second-quarter revenues 84 percent to $599.6 million, according to its latest earnings report. The company’s second-quarter losses widened to roughly $72 million, compared to just $3 million last year. [TRD]

Climate change is worsening the affordable housing crisis. A new report from the Center for American Progress has found that the national housing crisis disproportionately affects minority communities and the disabled, who also have limited access to resources to recover from natural disasters linked to climate change. [Scientific American]

Housing sentiment reached a record high in July. A monthly index from Fannie Mae has found that consumer confidence in housing his a record high in July, partly due to falling mortgage rates and strong employment. Meanwhile, according to a Redfin report, bidding wars fell to their lowest rate since 2011. Miami was the least competitive market last month, with New York also seeing lower than average activity. [CNBC]

Inflated bond ratings are back. Artificial bond ratings, one of the causes of the financial crisis, still persist a decade on, according to an analysis by The Wall Street Journal, which also found that the main ratings firms have altered some criteria for determining the riskiness of bonds, leading to temporary jumps in market share. [WSJ]

Compiled by Dennis Lynch