Every day, The Real Deal rounds up Los Angeles’ biggest real estate news. We update this page in real time, starting at 9 a.m. PT. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 3:30 p.m. PT

The five priciest homes to hit the market in Los Angeles County last week included one owned by Candy Spelling. The list totaled $118 million, with two properties in Malibu’s Carbon Beach, two in Brentwood and one in Beverly Hills. [TRD]

Equity Residential CEO Mark Parrell and a rendering of the 4th and Hill tower

Equity Residential’s new renderings for its proposed 428-unit tower in DTLA show the project is slightly scaled back. The development, 4th and Hill, has been five years in the making, and now appears to be back on track. [TRD]

Brookfield Asset Management is bullish on mobile homes. The company, which has poured billions of dollars into trailer park sites in the past few years, is not alone. The properties have increasingly become a must-have for some of the world’s richest private equity players. [TRD]

The backyard of the Beverly Hills Post Office mansion. (Credit: Realtor.com)

Capitol Records CEO unloads Beverly Hills Post Office manse at big profit. Steve Barnett sold the 7,000-square-foot home for $17 million, nearly twice what he paid for it seven years ago. New York financier Rob Rosner bought the property in an off-market sale. The neoclassical Spanish-style home was built in 2001 and has four bedrooms and seven bathrooms. [Variety]

Pan Am Equities’ Glassell Park project earns ire of L.A. River activists. The 419-unit Casita Lofts project is planned at the entrance of the future 18-acre Bowtie State Park along the L.A. River. While supporters of the project say the project would provide much-needed housing and could revitalize a largely industrial area, opponents say it could block access and commercialize the entrance to a public space. [LAT]

City of L.A. approves $20 million in affordable housing bonds for two projects. One development is in East Hollywood and the other in Sawtelle, and combined they have 113 units of permanent supportive housing. Thomas Safran & Associates is behind the Sawtelle project and Affirmed Housing Group is developing the East Hollywood complex. [Urbanize]

“Fair Pay to Play Act” could mean create a house-buying pipeline of college athletes. SB-206, which Gov. Gavin Newsom signed into law on Monday, allows college athletes to make money off endorsements, meaning some top stars at universities like USC and UCLA could find themselves shopping for a new home. Real estate agents stand to benefit, but say the measure also presents challenges. [TRD]

SoftBank is bringing on Sprint’s former CEO to help turn around WeWork. SoftBank head Masayoshi Son has asked Marcelo Claure to take a more hands-on role at the company after the recent ouster of co-founder and CEO Adam Neumann. His exact role has not been specified, but he would focus on opportunities to cut costs and increase revenues. Senior WeWork executives Sebastian Gunningham and Artie Minson have been appointed co-CEOs of the company. [Bloomberg]

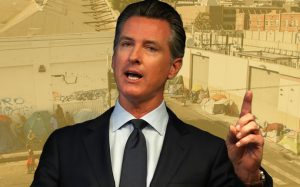

Gov. Gavin Newsom and a homeless tent encampment in Skid Row in September 2019 (Credit: Getty Images)

Newsom signs bill to let people house friends at risk of homelessness. AB-1188 lets people move at-risk friends and family into their units. Their landlord can then raise their rents. Both the landlord and the original tenant can evict the person on short-notice. The bill is meant to provide some flexibility for people at risk of homelessness. [TRD]

Forever 21 has filed for bankruptcy. It has landed $75 million in new capital from TPG Sixth Street Partners and $275 million in financing from lenders with JPMorgan Chase as the agent. The store had been one of the largest mall tenants still standing, so the filing could spell trouble for major mall owners like Simon Property Group and Brookfield Property Partners. It plans to close up to 350 stores overall but will keep operating its website and hundreds of stores in the United States. [Bloomberg, NYT]

Blackstone’s Jonathan Gray (Credit: Getty Images and Wikipedia)

Blackstone is buying Colony Capital’s national warehouse portfolio for $5.9 billion. The portfolio spans 60 million square feet across 465 warehouses in 26 markets. Areas of strong concentration include northern New Jersey, California, Florida, Dallas and Atlanta. [TRD]