In an uncertain U.S. economy, real estate investment trusts have had a standout year. Overall, the sector has notched better than 25 percent total returns year-to-date, among its best performances of the decade.

Those strong 2019 results came as the Federal Reserve slashed interest rates three times this year, U.S. gross domestic product grew at a slow but even pace and there remained lingering concerns about the global economy, said Haendel St. Juste, a REIT analyst at Mizuho Securities USA.

Instead of hampering growth, that uncertainty provided the ideal environment for REITs, which have also benefited from continued strong industrial and manufactured housing markets nationwide.

“It’s a low-risk, low growth, but steady-Eddie type of sector,” St. Juste said.

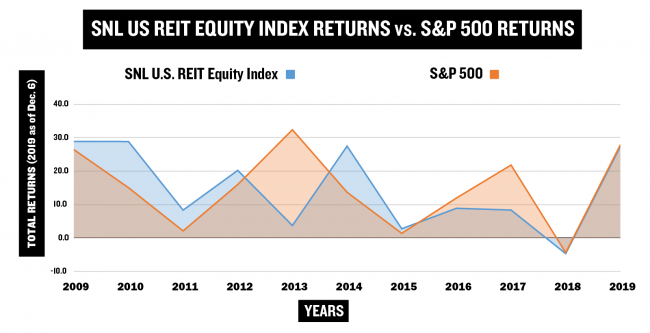

If the SNL U.S. REIT Equity Index stays around the same point through the end of December — with total returns of 27.4 percent — that would make 2019 the third-best performing year this decade, according to data from S&P Global Market Intelligence as of Dec. 6. The top years of the decade for REITs were 2009 and 2010, which tied with 28.9 percent returns.

But there are pockets of problems amid the strong topline figure reported as of Dec. 6, in the SNL U.S. REIT Equity index. Some REIT subsectors aren’t faring as well, namely retail, to no one’s surprise. Going into 2020, that has created an environment of the haves and have nots, analysts and experts said.

“We would characterize this as a market where a rising tide has not lifted all boats by any means,” said Richard Hill, a managing director at Morgan Stanley, who heads its U.S. REIT equity and commercial real estate debt research.

So far REITs are neck-and-neck with the S&P, with the REIT index trailing the broader market by less than a percentage point. That’s a reversal from earlier in the year, when REITs outperformed the S&P.

The shift was likely more so because the S&P has caught up to REITs, Hill said. And some good news — an improved outlook on the U.S. trade tussle with China — led many investors back to cyclical stocks over defensive ones, like REITs, he added.

“I do think investors are a little bit conflictive of where the market is going,” Hill said.

The third quarter also saw some stocks underperform, giving back much of the returns gained over the year, said James Shanahan, a senior analyst with Edward Jones.

“With valuations stretched the way they were and results coming in below analysts’ expectations, it was enough to send some of these REITs’ stocks down 5 percent, which is a pretty significant move for a REIT following an earnings announcement,” he said.

Shanahan pointed to medical office and senior housing REIT Ventas. The firm reported net income of almost $85 million in the third quarter, down from $210 million the prior quarter. It attributed the decline in part on a struggling senior housing portfolio. So far in 2019, its one-year returns are down almost 8 percent, according to S&P. “[Ventas] gave back a lot of the return they had been able to deliver year to date,” Shanahan said.

Haves and have-nots

Though the headline returns figure paints a rosy picture for REITs, there is a sizable gulf between the best- and worst-performing subsectors.

The top-performing sector year-to-date is manufactured housing, raking in 54.5 percent one-year gains, according to S&P. Following close behind was industrials, at 52.3 percent.

Manufactured housing is generally considered a safe sector to invest in, one that sees investor capital pouring in when there are concerns about the economy and fewer compelling investment opportunities, St. Juste said.

A top performer in the space this year is Sun Communities, which is seeing 59 percent returns year-to-date. The Michigan-based REIT has 389 manufactured housing and recreational vehicle communities around the U.S. and Canada.

Private equity firms have poured funds into mobile homes in recent years. For instance, Brookfield Asset Management owns some 130 mobile-home communities. That makes the Canadian-based asset manager one of the largest manufacturing housing investors in the country.

Industrial giants go toe-to-toe

As for industrials, it’s been a favored property group for years — including 2019 — in part a product of the continued growth of e-commerce, and the need for last-mile warehouses and data storage centers. That shows little signs of abating, even if industrial stocks look expensive, analysts and experts said.

San Francisco-based logistics giant Prologis has tallied year-to-date returns of almost 59 percent, according to S&P. This year, it’s gone toe-to-toe with Blackstone to gobble up massive industrial portfolios. In October, it acquired rival Liberty Property Trust in a $13 billion deal.

Meanwhile, Blackstone made its own massive logistics play when it dropped $19 billion on an industrial portfolio from Singapore-based GLP.

Not surprisingly, malls have performed the worst this year amid retail’s continued struggles. Malls marked 9.4 percent losses year to date, the only sector with negative returns in 2019, according to S&P.

But investors are increasingly distinguishing between different retail subsectors. Store closures and retail bankruptcies — like those of Forever 21 and Payless — have pummeled mall REITs.

Even the top name mall REITs are feeling the pain.

Simon Property Group, which operates 233 malls and outlets globally, is posting return losses of 7.2 percent since the start of the year. Macerich, another class-A mall owner that has been working to redevelop its portfolio, is seeing losses of nearly 31.5 percent over the same period.

But Simon is doing relatively well in a challenging retail environment, Shanahan said. Like other operators, Simon has been working to repurpose its properties, and recently invested $280 million in online discount retailer Rue Gilt Group to expand their purchasing platforms.

Looking toward 2020, analysts are keeping an eye on trade and how it will affect investment. And with steady — if slow — GDP growth, “the U.S. REITs are in a favorable place,” St. Juste said.