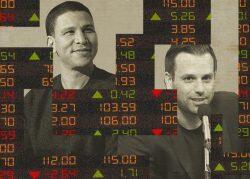

With the push of a button, Robert Reffkin and Ori Allon rang the opening bell of the New York Stock Exchange on Thursday morning, kicking off trading on Compass’ first day as a public company.

The co-founders, grinning and clapping, slung their arms around each other and bumped fists to mark the occasion.

Late Wednesday, Compass priced its stock at $18 per share, 30 percent lower than it initially targeted.

Compass’ IPO has been one of the most-closely watched in the brokerage industry — not to mention the subject of intense speculation, brokerage gossip and palace intrigue. The stock price will reveal whether public-market investors believe it’s a tech company, brokerage or both.

Compass, founded by Reffkin and Allon, burst onto the scene in 2012 with $8 million in seed funding. The New York City-based firm has since raised $1.5 billion from investors, including SoftBank, and now operates in 46 markets with 19,000 agents nationwide.

But it burned bridges with incumbents in many of those markets, where it aggressively hired top agents from competitors. For years, Compass’ critics within the brokerage world have questioned the firm’s assertion that it’s a tech company. After Compass filed its IPO prospectus in March, some analysts and investors began wondering the same.

View this post on Instagram

Valuation game

Compass initially sought to go public at a $10 billion valuation, billing itself as more of a tech company than brokerage. By offering 36 million shares priced between $23 and $26 each, Compass aimed to raise nearly $1 billion in the IPO.

On Wednesday, it slashed the price target to $19 — and later, $18 — and said it would offer 25 million shares. The new price valued Compass at just over $7 billion; its last funding round in July 2019 valued the company at $6.4 billion.

Read more

Sources speculated that Compass received pushback from investors over the price, necessitating the last-minute cut. An updated S-1 also indicated that Reffkin, SoftBank and another key backer intended to purchase blocks of shares amounting to nearly 40 percent of the total offering.

“It’s not the premium you would expect, especially if you think about the growth of the business between 2019 and 2021,” said Nima Wedlake, a principal at investment firm Thomvest Ventures, which is not a Compass investor.

At $7 billion, Compass’ valuation is roughly twice its annual revenue. By comparison, brokerage conglomerate Realogy’s market cap is $1.7 billion, a fraction of its $6.2 billion in revenue in 2020. Listings and iBuying giant Zillow’s market cap is 10 times its annual revenue; brokerage Redfin’s market cap is 7.6 times its revenue; and virtual firm eXp World Holdings has a market cap that’s 3.7 times its revenue.

The long and winding road to IPO

Until recently, Compass deflected questions about an eventual IPO, saying it had the benefit of patient capital from investors. “We don’t need to go public in order to raise capital,” Reffkin said on CNBC in September 2020.

In reality, Compass spent much of last year — in addition to weathering the pandemic — laying the groundwork for a public offering. It beefed up its board and added key executives to its C-suite, including general counsel Brad Serwin. In a December email to agents, Reffkin touted the benefits of going public, saying doing so would allow Compass “to raise capital that we can invest in more tools and more support to help you.”

Compass CEO Robert Reffkin and his mother, Ruth Reffkin (Compass)

The following month, Compass filed confidentiality to go public. A subsequent prospectus, filed with the U.S. Securities and Exchange Commission on March 1, offered investors a detailed look at the company’s financials, including $1 billion in cumulative losses.

The filing showed that Compass’ revenue more than doubled between 2018 and 2019, and revenue last year jumped 56 percent to $3.7 billion. In 2020, losses narrowed to $270.2 million, down from $388 million loss in 2019.

The prospectus also outlined the cost of Compass’ growth, including $300 million in acquisitions between 2018 and 2020.

This is a breaking news story; return to this page for updates throughout the day.