Compass is aiming to go public at a $10 billion valuation, positioning itself as a tech company rather than a traditional brokerage.

The New York-based firm said it will offer 36 million shares priced between $23 and $26 apiece, according to an updated S-1 filing with the U.S. Securities and Exchange Commission. At that price, Compass will raise $936 million in its public debut.

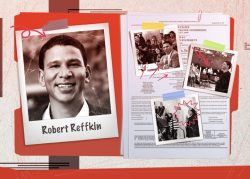

Founded in 2012, Compass has been a fast-growing competitor to traditional firms. It has 19,000 agents across the U.S., and was last valued at $6.4 billion after a funding round in July 2019. The firm has raised $1.5 billion from investors, including SoftBank, Fidelity and Dragoneer.

In its IPO filing, Compass reported $3.7 billion in 2020 revenue, up 56 percent year over year.

But Compass’ heavy spending and lack of profitability has made it a target for critics, who have questioned its valuation. In the IPO filing, Compass listed $1.1 billion in cumulative losses, including $270.2 million last year.

Seeking a tech company multiple

By seeking a $10 billion valuation, Compass is positioning itself more like listings and iBuying giant Zillow than brokerage conglomerate Realogy.

Real estate tech stocks have surged in recent months, thanks to the booming housing market and urge to digitize the antiquated homebuying process.

On Tuesday, Zillow stock opened at $137.95 per share, giving it a $33.5 billion market cap, or 10 times its 2020 revenue. The company generated $3.3 billion in revenue but lost $162 million last year.

By comparison, Realogy opened at $15.47 per share. Its market cap is $1.7 billion, a fraction of its $6.2 billion revenue in 2020. Realogy lost $360 million last year.

Like Zillow, tech brokerages Redfin and eXp World Holdings are trading at multiples of their revenue.

Redfin, the discount brokerage that went public in 2017, opened at $68.18 per share on Tuesday with a $6.8 billion market cap. That’s 7.6 times its 2020 revenue of $886.1 million. Redfin lost $18.5 million last year.

Virtual brokerage eXp World Holdings opened at $50.74 per share on Tuesday, with a $6.7 billion market cap. That is 3.7 times its revenue of $1.8 billion. In a year when much of the country was stuck at home, cloud-based eXp reported record profits of $31 million in 2020.

Based on last year’s earnings, Compass is seeking a valuation that’s 2.7 times its annual revenue.

Compass has long touted its suite of tools that it says make agents more productive. But in recent years it invested heavily in buying technology to build an “end-to-end” platform.

In 2019, it acquired Contactually, a popular customer relationship management software company, for $26.1 million. It later struck a $70 million deal to buy Modus Technologies, a title and escrow startup. This year, it agreed to buy Washington, D.C.-based KVS Title for $52.2 million.

Housing boom helps

Compass is also striking when the housing market is hot.

Last spring, Compass laid off 15 percent of staff and projected a 50 percent drop in annual revenue. Within a few months, it claimed record revenue in May, June and July.

This February, U.S. home sales were up 9.1 percent year over year, according to the National Association of Realtors. (From January to February, sales dropped 6.6 percent, but only because of limited inventory on the market.)

Other real estate startups have also rushed to take advantage of strong activity in both the housing and stock markets.

Lemonade, an insurance startup, went public last summer in one of the year’s strongest IPOs. Shares jumped 144 percent on the first day of trading in August. In December, Airbnb’s stock more than doubled as soon as the opening bell rang on its IPO.

Other real estate startups are merging with blank-check firms — not just to go public, but to do so at eye-popping valuations.

Instant homebuyer Opendoor went public in a $4.7 billion deal in December with a blank-check firm backed by Chamath Palihapitya. Rival Offerpad announced its own IPO plan last week, via a $3 billion deal with a SPAC sponsored by Zillow co-founder Spencer Rascoff. Doma, a title insurance startup, also plans to go public in a $3 billion SPAC deal.

Although Opendoor’s valuation mirrored its 2020 revenue, Offerpad’s valuation is double its projected revenue of $1.4 billion in 2021. Doma’s valuation is 7.3 times its 2020 revenue. The valuation is 15.8 times its “retained fees and premiums,” a more conservative metric that reflects how much money the company makes selling title insurance.

Read more