An Orange County-based investment firm has scored a loan to buy more than 1,000 apartments in Downtown Los Angeles.

MF1 Capital, a partnership between Berkshire Residential Investments and Limekiln Real Estate, provided a $328.8 million, three-year loan to Laguna Point Properties, according to JLL, which arranged the financing for the borrower.

The floating-rate loan includes two one-year extension options.

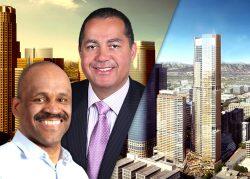

Laguna Point will use the financing to buy five buildings in Downtown L.A. totaling 1,037 units — four pre-war buildings and a property built in 1959. All were renovated between 2007 and 2010. Public records show the properties were previously owned by DTLA Management, run by Eric Shy.

The addresses of the properties are: 548, 600 and 650 South Spring Street, 111 West 7th Street and 215 West 6th Street–all within an area known as the Historic Core district of Downtown.

“The timing could not be better, given the recent gains in occupancy and rent momentum,” Garrett LaBar, Laguna Point’s head of acquisitions, said.

The median monthly rent for a one-bedroom apartment in Downtown Los Angeles has increased 14 percent year-over-year this month to $2,725, according to Zumper. Still, median rents have not returned to pre-pandemic levels.

In October 2019, median monthly rent for a Downtown L.A. apartment was $2,988.

Laguna Point’s new buildings will have to compete with the influx of new apartments over the last five years. Since 2017, more than 10,000 apartments have been built in Downtown L.A. — more than any other locale nationwide, according to RentCafé.

The new financing from MF1 is supported by a $1.47 billion debt fund from Boston-based Berkshire, which closed last year. In 2020, MF1 — the venture with New York-based Limekiln Real Estate — originated more than $2.3 billion of loans for multifamily properties in the U.S.

In January, MF1 provided Brookfield with a $220 million refinancing package for Two Blue Slip — a development in New York City with 421 apartment units.

Read more