Rize Irvine, a 363-unit compound in Orange County, has sold for $190 million, according to CBRE, which brokered the transaction.

The sale closed in October, but CBRE announced the transaction on Nov. 15, the Orange County Register reported. The buyer was an LLC called Sierra Village Associates.

CBRE’s Stewart Weston and Dean Zander represented the seller, which was not identified but described as a private real estate company with an extensive portfolio, and is an affiliate of Fairfield Residential. The price works out to about $523,000 per unit.

Rents at Rize Irvine range from $2,706 for a 600-square-foot studio to $3,908 for 1,382-square-foot, three-bedroom apartment. Amenities include a two-story fitness center, a cafe, a community workspace, a pool and a dog park. Rize Irvine, located at 1100 Synergy in Irvine, was built in 2018.

The Rize Irvine sale comes during a time when multifamily transactions are making headlines with a series of nine-figure deals in Orange County. In August, Utah-based Bridge Investment paid $284 million for the 768-unit Madison Park complex in Anaheim. Chapman University paid $160 million for Anavia Apartments in Anaheim, the Orange County Register reported Nov, 17. The apartment complex will house 800 students.

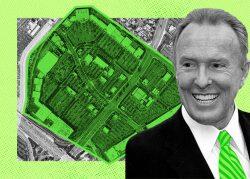

Irvine Company broke ground in September on the Orange Heights project. The development will offer 114 multifamily units and 1,066 single family homes. This summer, the Irvine Company planned to build up to 2,500 lower rent apartments to help the city of Irvine meet its housing element needs. Jeff Davis, an Irvine Company vice president, said that these units would be smaller and placed in denser districts.

— Andrew Asch

Read more