Measure ULA has collected just $38 million earmarked to spend on Los Angeles’ homelessness and affordability housing crises, according to a recently released report from the Los Angeles City Administrative Officer.

ULA critics note that the $38 million collected by July 1 is far below the $56 million per month needed to reach the $672 million projected total in the tax’s first year. Backers say momentum is building for the transfer tax, and that ULA is on the way to meeting its potential.

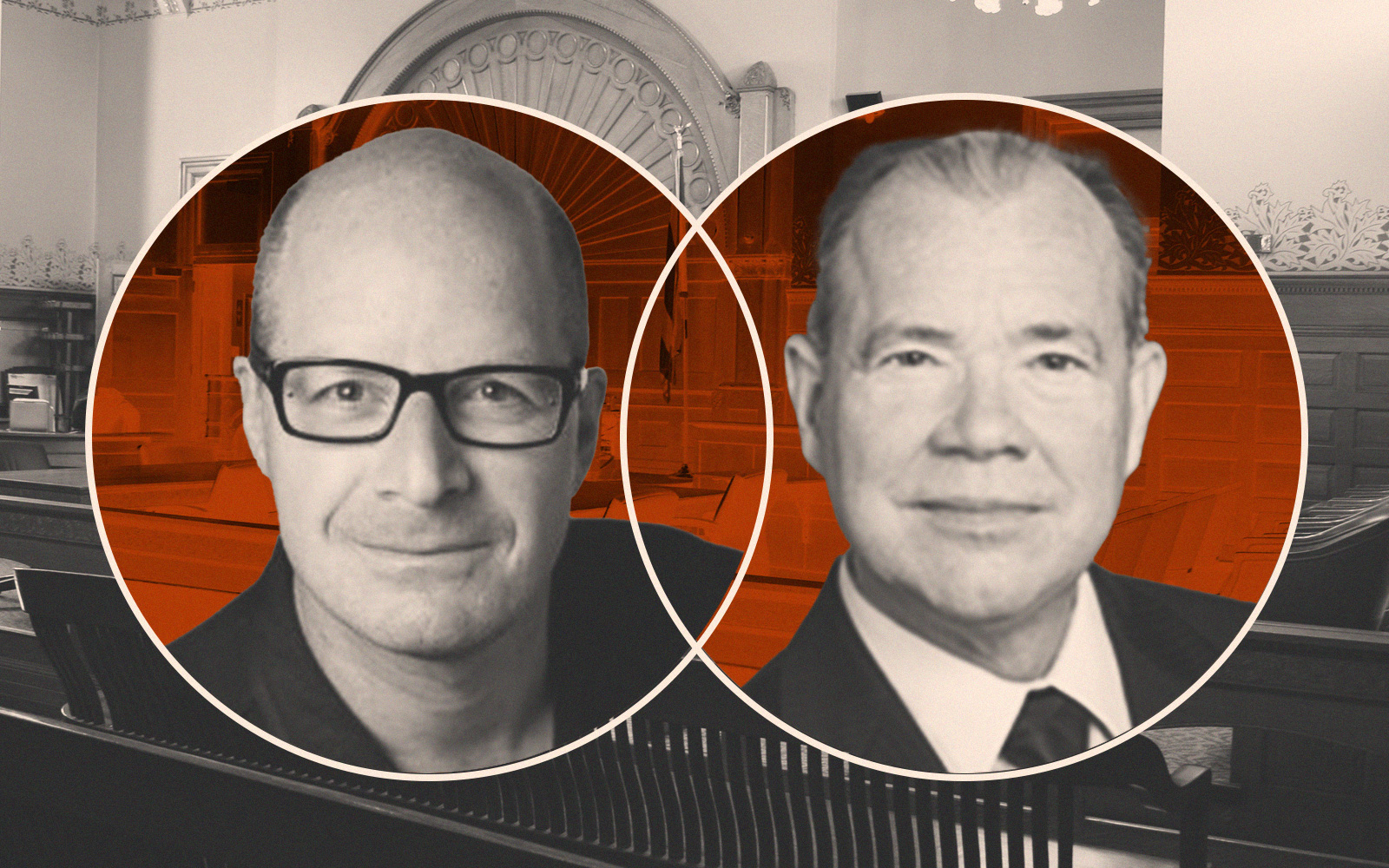

Anthony Marguleas, founder of luxury home brokerage Amalfi Estates, said the only thing ULA has succeeded in is restraining the luxury market.

“The issue is that sellers aren’t selling,” Marguleas said. “They are refusing to put their properties on the market. They don’t want to pay hundreds of thousands of dollars, and sometimes even millions, of dollars for this tax.”

Marguleas said that in the pre-ULA market, an average month would see 50 luxury transactions. But in the months after ULA went into effect, there have been less than 20 transactions a month for homes $5 million and up. His research on MLS found that there were 14 luxury sales in May and 16 in June.

Eli Lipmen, executive director of Move LA, one of the groups responsible for authoring Measure ULA, said the transfer tax’s proponents forecasted progress would be slow.

“We are cautiously optimistic,” Lipmen said. “With its most recent return, ULA receipts in June were $22.5 million — more than double the previous month’s revenue. There is churn in the market. Properties are being sold. We expect it to continue to increase. This wasn’t meant to be a one-year or a 10-year measure. This was meant to be long lasting because there will always be a need for affordable housing.”

Lipmen was confident that property transactions above $5 million would continue to serve as a good revenue source because Los Angeles remains a popular place for investment. Also, property values continue to be steady. He pointed to a recent L.A. County Assessor’s report which announced that the assessment roll was almost $2 trillion in total net value, and increased by almost 6 percent compared to the 2022 roll.

On Aug. 2, the L.A. City Council’s Housing & Homelessness Committee is scheduled to discuss the CAO report, and how ULA funds can fund city programs to people facing eviction from apartments after the Aug. 1 deadline for pandemic rent debt repayment.

The CAO report recommends that the collected ULA revenue be directed toward handling the current rent repayment crisis. The report urges that the money be used for short-term emergency assistance, tenant outreach, eviction defense and prevention as well as protection of tenant harassment.

While a city budget forecasted that $672 million in ULA revenue would be available in the 2023-2024 fiscal year, the CAO report said the budget proposed to spend only up to $150 million because of risks associated with two lawsuits filed against ULA. The hearings for the lawsuits are scheduled in September.

During the run-up to Election Day, ULA backers said the transfer tax would generate about $900 million per year. Language on the November 2022 ballot projected that the measure could generate $600 million to $1.1 billion annually.

Read more