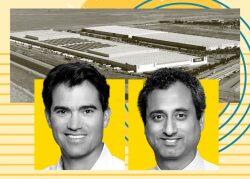

A company owned by Dedeaux Properties has acquired 99 Cents Only Stores’ 882,000-square-foot distribution facility in Commerce for $190 million, or about $238 per square foot, Dedeaux announced Monday.

Dedeaux-owned Dart Warehouse purchased the 24-acre facility in a sale-leaseback deal with the discount retailer, which also is headquartered in Commerce. The distribution center is located at 400 Union Pacific Avenue and 4040 Noakes Avenue. Dedeaux already owns more than 2 million square feet of logistical properties adjacent to the 99 Cent Only Store’s distribution center.

The sale-leaseback deal is short-term and gives Dedeaux time to figure out what it will ultimately do with the space, said Brett Dedeaux, Dedeaux Properties president and managing member.

“We are looking at numerous alternatives, including a possible redevelopment of the site, which would include two of our adjacent buildings totaling more than 400,000 square feet, to create a state-of-the-art distribution campus with excess trailer parking, secured access and privatized streets,” he said in a prepared statement.

Dedeaux Properties’ deal represents one of the largest industrial transactions in Southern California this year. It comes in second place behind the $210 million sale of Santa Fe Springs Logistics Center. The more than 595,000-square-foot compound was sold by DWS Group to Rexford Industrial Realty for about $352 per square foot, according to a third-quarter Kidder Mathews industrial market report.

Another pricey deal was for the Asuza Industrial Center portfolio in the San Gabriel Valley. LBA Realty purchased the 435,000-square-foot property for $126 million or $291 per square foot.

The Dedeaux deal is larger than the top Los Angeles industrial deal for 2022. It was a $181 million trade for a 662,000 square-foot compound located at 2901 Fruitland Avenue in Vernon.

The deal comes when Los Angeles’ industrial market may stabilize after a slowdown. Possible labor turmoil on the East Coast could drive port traffic to the Los Angeles and Long Beach areas. “Interest rate stability and lack of recession or a soft landing should begin stabilizing both lease and sale activity,” the Kidder Mathew third-quarter report said.

Read more