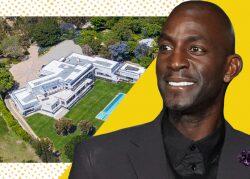

Kevin’s Garnett’s $16 million Malibu home sale has turned out to be anything but a slam dunk.

Three years since the NBA Hall of Famer reached an agreement to sell the property to Hacopian Design & Development, the deal is mired in legal scuffles over payments and blame for the soured trade.

The property at the center of the dispute sits on about 7 acres at 27715 Pacific Coast Highway. Garnett sold it partially completed.

Now, as a two-year-old lawsuit against the buyer winds its way through Los Angeles Superior Court, a new complaint was filed in June against the title and escrow companies involved in the transaction.

Under terms of the 2021 sale, buyer Ando Hacopian of Hacopian Design & Development Group agreed to handle Garnett’s closing costs and any prior liens. Meanwhile, Garnett was expected to walk away with $6 million, including $2 million in cash at closing. An LLC managed by Garnett would carry two, $2 million notes. One was secured at 7 percent interest and would sit junior to an $11 million loan provided by Marquee Funding Group. The second note was unsecured and payable after the property was completed and resold, according to the purchase agreement submitted with court documents.

Garnett’s lawsuit against the title and escrow companies alleges Hacopian is a “fraudster of the highest order” and that Closing Agents Escrow and its CEO, along with First American Title Company, turned a blind eye to the alleged fraud.

Closing Agents Escrow CEO Judith Sender, a spokesperson for First American Title and Hacopian –– who is the defendant in a separate lawsuit brought by Garnett — did not respond to a request for comment.

Garnett claims Hacopian said half of the $2 million due at closing was required to be held in escrow, according to the most recent lawsuit.

“The fact is, Hacopian did not have the necessary funds to close and lied to induce me to close rather than to call a default,” Garnett said in a declaration last year for the separate dispute against the buyer.

Garnett goes on to say a statement provided as proof of a $5.5 million balance for Hacopian was later confirmed through a subpoena with a balance of $50.

Attorneys for Garnett in the latest lawsuit allege Hacopian duped a second party in VIG Private Lending, which agreed to finance a secondary $2 million loan toward the purchase price in exchange for nearly $4 million in cash at closing. The agreement pushed Garnett’s note to a third deed of trust position, which the basketball star contends occurred without his knowledge.

When Hacopian allegedly defaulted on the VIG loan, the lender foreclosed, triggering the loss of Garnett’s unsecured note.

Hacopian said in his own declaration last year he was under the impression that if he found financing to pay VIG, the property would be sold back to him.

“I put all potential deals that I had been working on aside and focused on this project once again with the understanding that if I held my end of the bargain so would the foreclosing lender,” Hacopian’s declaration said.

He went on to claim he found financing in late 2022, but VIG “went silent.”

Ultimately, attorneys for Garnett argue in the latest lawsuit the alleged fraud would not have worked without the escrow and title companies being “involved in this entire charade.”

The latest lawsuit seeks to-be-determined damages, including interest and attorney fees.

Read more