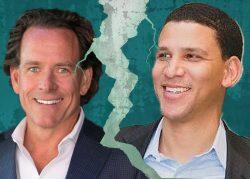

Brokerage veteran Mark McLaughlin has transitioned to a part-time mergers and acquisitions adviser role at Compass, after his two-year contract as chief real estate strategist at the brokerage ended.

McLaughlin, who served as Compass California president between September 2018 and December 2020, returned to the firm in July 2023 in a new role focused mostly on coaching and, as McLaughlin described, to “streamline operations.” During that two-year term, which he said ended in late June, McLaughlin also served as interim president of brokerage operations between July and October of last year.

“I said, ‘Hey, I really want to go and enjoy my life and retire,’” McLaughlin told The Real Deal, saying a deal was worked out to stay on in an advisory role. “I know a lot of CEOs around the country. I can generally pick up the phone with any one of them and have a conversation and so that’s what I’m going to do. How long will I do it? I’d say at least a year.”

A Compass spokesperson confirmed in a statement McLaughlin will “continue to focus on strategic growth initiatives, working in areas where he has already been contributing his expertise.”

The executive’s experience came in handy over the past two years amid an environment of high interest rates and a cooling off of the pandemic-induced run-up in dealmaking.

“We had to transform the business and I think instinctively everybody knew what had to be done, but my experience running the fifth-largest firm in the country up until 2018 just brought a level of confidence,” McLaughlin said. “I really came back as a coach, and I think it served the organization very well.”

McLaughlin was CEO of San Francisco-based Pacific Union International starting in 2009 when the brokerage was generating $2 billion in volume and had a loss of $3.7 million in earnings before interest, taxes, depreciation and amortization. When Compass bought Pacific Union in 2018, the business had scaled through a dozen acquisitions with annual volume jumping to $14 billion and $14 million in EBITDA, an accomplishment the executive touts on the website for his venture fund McLaughlin Ventures.

The executive said the highlight of his recently ended run at Compass was the move to reduce expenditures, while still serving agents. More specifically, there was increased local decision making, with office managers across the U.S. creating their own profit-and-loss statements from which adjustments could be made.

“It was leading with the facts, empowering the field and making sure that we didn’t compromise our agent services to be able to make money in one of the worst markets that we’ve seen,” McLaughlin said.

Even with the industry in a rugged stretch, McLaughlin still expects a comparable, if not more robust, M&A pipeline as what’s been had in the past two years. Consolidation, he said, will continue across brokerages and associated services, such as mortgage and title firms.

On that point, Compass announced Thursday it acquired Colorado Home Realty, a brokerage in Littleton, Colorado, with $617.2 million in 2024 sales volume. The business was launched in 2005 and is helmed by co-founder and CEO Matt Hudson.

Read more