The rubber is finally hitting the road in Los Angeles’ Opportunity Zones. When looking at the biggest commercial sales in the L.A.’s zones over the past six months, evidence of the federal program’s power is showing up in the bottom line: sale prices that are double or triple what commercial sellers originally paid for those properties just one or two years ago.

Take 550 South Palos Verdes Street in San Pedro. Starwood Capital Group announced a joint venture with Holland Partners to complete a 375-unit multifamily apartment building on the property in May. Starwood paid Holland $109.97 million in the transaction. Holland originally bought the 2.5-acre site in 2017 for $24.5 million, according to TRD research.

And there’s 3318 La Cienega Place in West Adams, an industrial property that Carmel Properties bought for $14 million in 2017 and sold for $29 million this year.

These deals aren’t outliers. A recent report from Reonomy found that price appreciation of Opportunity Zone assets in the Los Angeles-Anaheim metro area has accelerated, while prices have remained steady for non-Opportunity Zone assets, “suggesting that the legislation has begun to function as designed in LA.”

Created as a part of the federal Tax Cuts and Jobs Act of 2017, the Opportunity Zone program offers tax incentives to funds that invest in specific low-income Census tracts, based on 2010 Census data. The U.S. Treasury Department issued a round of clarifications on the law in April 2018, sparking a recent increase in interest among investors, according to experts.

There’s a big tax benefit. Individuals who make investments within Opportunity Zones through “Qualified Opportunity Funds” can defer taxes on capital gains or avoid them entirely if they meet specific criteria.

Many buyers and sellers are jumping into the action in the Los Angeles metro area, which has more than 250 Opportunity Zones.

“Q3 will be pretty telling,” said Sam Viskovich, vice president of marketing for Reonomy. “To get the full write-off, you have to invest this year. That is why we should see a degree of activity this year.”

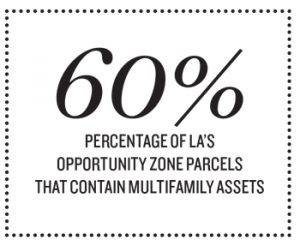

In the Los Angeles-Anaheim metro area, 11.2 percent of commercial assets are within Opportunity Zones, according to Reonomy. The largest portion of the commercial stock in local opportunity zones — about 60 percent — consists of multifamily properties; 17 percent of the properties are industrial and 12 percent are retail, Reonomy found.

In The Real Deal’s list of the priciest Opportunity Zone deals in the last six months, five of the 10 sales were for industrial properties, three were for multifamily properties, one was for an office building and one was for a vacant lot.

All of the sales took place in areas with two overlapping incentives: Opportunity Zones and Transit Oriented Communities, a program that allows multifamily developers to build bigger around transportation hubs if they set aside some units to be affordable. A project could potentially make use of both sets of incentives if it qualifies for both programs.

And of course some of the areas designated as Opportunity Zones in Los Angeles — among them the Arts District and Hollywood— are in areas that probably would have had investors flocking anyway, because their fortunes have risen since the 2010 Census.

And of course some of the areas designated as Opportunity Zones in Los Angeles — among them the Arts District and Hollywood— are in areas that probably would have had investors flocking anyway, because their fortunes have risen since the 2010 Census.

“These Opportunity Zone projects are piggybacking on the success of other developments going on in that area,” said Loryn Arkow, a partner in the real estate law practice group at Stroock.

Here is a look at the 10 top sales.

777 South Santa Fe Avenue

Closing price: $193.5M

In April, Access Industries, Warner Music Group’s parent company, spent $193.5 million to acquire the roughly 259,000-square foot building from Shorenstein Properties. Warner will relocate its West Coast headquarters to the building, exercising an option it had secured, along with the space, two years ago. Bank of America provided a $135 million mortgage.

“The Opportunity Zone designation and potential benefits are a factor, but not the sole determining reason for making an acquisition,” said Jonah Sonnenborn, head of global real estate for Access Industries. “We like buying well-located real estate in an area where we have strong conviction for its growth.”

Built in 1912, the building was renovated and restored by Rockefeller Kempel Architects and Rockwell Group. Warner Music Group moved its West Coast HQ into the building shortly before the acquisition. “It’s a long-term investment for the company,” said Sonnenborn.

550 South Palos Verdes Street

Closing price: $109.97M

Starwood Capital tapped its $500 million Opportunity Zone fund to get involved with this property, which Holland Partners purchased in 2017. Holland had been working a different capital partner before Starwood became involved, according to a source close to the project. “Starwood ultimately came in and purchased it prior to the completion of construction because of the recent designation of the Opportunity Zone,” the source said.

Completion of a planned seven-story multifamily building, located at the intersection of the waterfront and San Pedro’s commercial district, is slated for the spring of 2020, according to Starwood. Offering views of Long Beach, it will include residences from studios to four-bedrooms as well as a two-story fitness center, a pool deck and a rooftop lounge with outdoor kitchens.

Anthony Balestrieri, senior vice president and head of Starwood’s Opportunity Zone investment business, pointed to San Pedro’s “favorable” supply and demand fundamentals.

“San Pedro’s Opportunity Zone designation has accelerated investment into the neighborhood, which we expect to grow,” Balestrieri said in a statement.

5242 West Adams Boulevard

1241 Vine Street and 1665 North Sycamore Avenue

Closing price: $39.25M

As its first Purchase in Los Angeles, Slate Property Group, based in New York City, scored these two multifamily properties for $39.25 million from a family trust. They’re not far from the planned Netflix complex Academy on Vine, slated to open in 2020.

“There’s been a huge rejuvenation of Hollywood,” said Strook’s Arkow, who added that it’s not the Opportunity Zone status but the streaming service’s presence that’s driving investment in this area: “The Netflix expansion has had a huge impact on that area of Los Angeles.”

Slate Managing Director Steve Figari seconded the notion. “[The purchase] was just focused around Slate’s desire to expand our business outside of New York,” he said.

A 55-unit residential complex, which was built in 1926, occupies about 38,523 square feet of floor space at 1665 North Sycamore Avenue, according to Trulia. The other property, at 1241-1249 Vine Street, is the site of the historic Villa Elaine apartments, with more than 100 units, said Figari. Both of the buildings are rent-controlled.

5837 West Sunset Boulevard

Closing price: $38M

Cypress Real Estate Group purchased this multifamily property for $38 million from Cornerstone Holdings and Harridge Development Group in April. The 12-story apartment tower at the intersection of Highway 101 and Sunset Boulevard includes 79 units that are a mix of studio, one-bedroom and two-bedroom apartments.

Cornerstone, based in Aspen, Colorado, originally acquired this property in February 2011 in a partnership with Harridge, with Cornerstone owning 58 percent of the development through Bay Area firm Urban Green Investments, according to Cornerstone’s website.

Neither the sellers nor the buyer could immediately be reached for comment.

2020 East 7th Place and 2045 Violet Street

Closing price: $32M

Located next door to Warner Music Group’s headquarters at 777 South Santa Fe Avenue, these industrial properties, spanning roughly two acres, were a natural acquisition for Access Industries.

Located next door to Warner Music Group’s headquarters at 777 South Santa Fe Avenue, these industrial properties, spanning roughly two acres, were a natural acquisition for Access Industries.

“We were a logical buyer because of the proximity to the larger transaction,” said Access’ Sonnenborn. “The fact that they are in an Opportunity Zone is attractive, should we one day redevelop the property.”

A cold storage building currently occupies 2020 East 7th Place, and 2045 Violet Street is currently being leased to tenants such as Bow Truss Coffee.

Lion Real Estate Group, an investor in more than 10 office properties in Opportunity Zones in Los Angeles County, was the seller of both properties.

“We have a good relationship with them,” said Jeff Weller, a co-founder and partner at the firm. “We knew they wanted it. We’re not really ground-up developers. We will reposition properties and spend money re-tenanting them.”

Lion, in tandem with Ensyd apparel manufacturer Dalton Gerlach, made an Opportunity Zone acquisition in late June — a new office building at 5242 West Adams Boulevard. (See our deep dive into the West Adams neighborhood on page 40.) With office tenants able to take advantage of the tax benefits of investing in Opportunity Zone buildings by adding furniture and fixtures, “we have a ton of tenants looking to lease it,” Weller said. “We’ve got incredible activity.”

6629 Independence Avenue and 6636 Variel Avenue

Closing price: $31M

Natalie Levy Sarraf, an executive at Andwin Scientific, sold these properties in Canoga Park to the Hanover Company for $31 million in March. A private real estate company based in Houston, Hanover plans to build a 394-unit residential complex. Andwin, a medical supply company, is the current occupant of most of the land.

Hanover has gotten city approvals to tear down three industrial buildings occupying 72,000 square feet and replace them with residential buildings. TCA Architects will design the 378,000-square-foot development. The project is slated for completion in 2021, according to TCA’s website.

3318 La Cienega Place

Closing price: $29M

An LLC controlled by Jim Jacobsen, CEO and chair of Redcar Properties, acquired this industrial property in April for $29 million, according to TRD’s research. The 1.3-acre property, originally acquired by Carmel Properties in 2017 for $14 million, includes a 30,400-square-foot warehouse. The $17.4 million acquisition loan came from Deutsche Bank. Carmel Properties, through a spokesperson, declined to comment.

The warehouse is next to Cumulus, a mixed-use project under construction that spans more than 1.15 million square feet. It will bring 1,210 residential units to the area.

Redcar specializes in commercial real estate in Los Angeles, with a focus on “underperforming properties in high growth urban neighborhoods,” according to its website.

2020 East 7th Place and 2045 Violet Street

1515 East 15th Street

Closing price: $28.1M

Rexford Industrial Realty, a real estate investment trust focused on industrial properties in Southern California, purchased this property in an “UPREIT” transaction, where the seller contributed the property to the company’s operating partnership and, in exchange, got equity in newly issued cumulative redeemable convertible operating units, according to an announcement from Rexford. The purchase price was

$28.1 million.

“We were able to provide a tax-efficient solution to the seller by structuring the sale as an UPREIT contribution,” said Howard Schwimmer and Michael Frankel, co-chief executive officers of Rexford, in a statement.

The seller was Graff California Wear, a sportswear company founded by a husband-and-wife team in 1933 that was known for making women’s sportswear such as slacks and “slacksuits.”

Rexford bought the property in an off-market transaction. It aims to complete minor renovations and lease to a single tenant or pursue full industrial-use redevelopment.

405 North San Fernando Road and 400 North Avenue 19

Closing price: $23.8M

Fifteen Group, a private investment group focused on real estate, was listed as both the buyer and seller for this property, which sold for $23.8 million in February. It was sold for $11.66 million in 2016 and assessed at $12.1 million last year. Fifteen Group did not respond to requests for comment.

This type of sale, in which the same party is named as buyer and seller, while not common, is not unheard of for affiliates. In Opportunity Zones, to get the tax benefits, a fund must acquire the property via a sale to a party in which the original seller has no more than a 20 percent interest, said attorney Eric Requenez, a partner at Stroock.

Sometimes, the owners will sell some of their original interest to get the tax benefits because they cannot simply transfer their ownership to a new LLC.

“What we have seen is some entities where they had a Qualified Opportunity Zone investment and were willing to divest themselves of at least part,” said Requenez.

1600 & 1614 North Hudson Avenue

Closing price: $20M

KOAR Institutional Advisors sold this Hollywood parking lot for $20 million to an affordable housing developer linked to CRA Investments, based in Dexter, Missouri. It is next to a property where KOAR plans to build the 191-room Schrader Hotel.

Surrounded by the boutique hotel Mama Shelter, the Dream Hollywood Hotel and the 287-unit Camden Property Trust/SBE mixed-use development, the parcel is zoned for hotel, mixed-use or apartment development. Located six blocks from the Hollywood/Highland Red Line station, the property has been leased to the parking lot operator until March 2021, but there is no option to renew. Neither KOAR nor CRA Investments responded to requests for comment.