By the numbers, the L.A. leasing market managed to keep up with demand last year, but there are signs that a slowdown is in store.

A remarkable amount of L.A.’s office space — 2.1 million square feet in the fourth quarter of 2016 — was absorbed, making it the second strongest quarter since early 1998, according to data provided by CBRE (the strongest quarter occurred in 2005). In addition, office asking rents grew 6.6 percent over the previous year, JLL reports.

But L.A. industry experts suspect the office market has summited a peak that will soon give way to a plateau — and perhaps even a downward slope as construction costs continue to rise.

The recent uptick in available sublease space is one of the first signs of a slowdown, said Michael Soto, research manager at Transwestern. Brokerages have now started closely tracking the disparity between direct vacant space and overall vacant space as a way to monitor the increase in sublease activity.

The fourth quarter of 2016 saw 4.1 million square feet of subleased office space, a number that included both vacant and occupied space. It amounted to the highest percentage of office sublease space since 2011, according to Soto. The number represented a 42 percent increase from 2014 and a 9 percent increase from 2015, he said.

Why so much extra space? A number of fast-growing startups expanded into new, larger spaces and left their previous, smaller offices open to sublease. Conversely, some once-healthy startups downsized because of financial woes.

This year, a new trend is afoot, said Mark Sokolowski, a Southern California-based director with Newmark Grubb Knight Frank Global Corporate Services. Office tenants have become austere in their selections, only taking the space they need. Only when companies have solid growth projections do they strategically build expansion options into their contracts.

This year, a new trend is afoot, said Mark Sokolowski, a Southern California-based director with Newmark Grubb Knight Frank Global Corporate Services. Office tenants have become austere in their selections, only taking the space they need. Only when companies have solid growth projections do they strategically build expansion options into their contracts.

“Tenants are becoming more cautious,” Sokolowski said. “Now their projections are quantified and conservative. Cautiously optimistic, that is the tenants’ position at the moment.”

Even with the game of musical chairs that startups played with office space in 2016, there was so much space occupied in the office sector that landlords began pushing rents into an aspirational realm. Santa Monica accounted for a quarter of all the absorption in greater Los Angeles in the fourth quarter of 2016, according to CBRE. Not coincidentally, the area also commanded some of L.A.’s highest rents, with landlords asking $5.61 a square foot, a 20-cent jump from the previous year.

Companies that once stumbled upon “good deals” can expect to see a rent spike at renewal.

“Given the absorption, there are landlords that don’t want to come out with outrageous premiums, but one of the ways for them to continue to puff up their numbers without discouraging tenants with an astronomical asking rate is to figure in annual rate bumps,” said Sokolowski. “They’ll give tenants a market rate of $2.75 (per square foot) as opposed to pushing to $2.90 and pricing themselves out of the game. Then they’ll ask for 4 percent annual bumps.”

The roundabout nature of these ambitious rents is likely to falter by 2018 as direct leases plateau, say industry experts. The idea that landlords have the upper hand is a holdover from quarters that witnessed dramatic vacancy drops. This is expected to give way as prices for existing space in the office market contend with new construction that is delivered in the next two years.

At the close of the first quarter of 2017, more than 2.4 million square feet of office space was under construction in L.A., according to a report by JLL. Most of it will be delivered by the end of 2017, with only a small amount coming online in early 2018.

Hollywood is currently the most active spot for development in Los Angeles, with 595,255 square feet currently under construction, according to CBRE. In the fourth quarter of 2016 a whopping 358,256 square feet of office space was absorbed, bringing the 2016 total for net absorption to 687,504 square feet, with an average asking rate of $2.68 a square foot, reports CBRE.

Like Hollywood, DTLA is experiencing a construction boom. There are 356,141 square feet under construction, with an average asking rate of $3.33. Gains were also made in new construction in Playa Vista, where the Playa Jefferson project (55,454 square feet) joined the Brickyard project for a total of 548,836 square feet of new office space in the area, reported CBRE.

Any early- to mid-2017 office space that becomes available will struggle to command rates that cushion construction- cost increases, but the blow should soften in about 18 to 24 months, said Sokolowski. “By the time the product comes online in the next year or so, the surrounding office market rates will have already risen. Anything that comes online now will have a hard time recapturing construction costs,” he said.

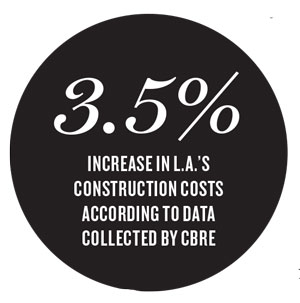

According to data provided by CBRE, construction costs in Los Angeles rose 3.5 percent in 2016, outpacing the national average, which hovers around 2.3 percent annually.

“Tighter labor-market conditions pushed wages upward,” said Andrea Cross, CBRE’s head of office research, in a market report. “The effect was compounded by increased fees from contractors, who charged more … because they were stretched across a larger number of projects and would need to use less-experienced crews for some projects — allocating to those projects more hours than would be necessary with the best crews.”

These conditions are likely to hamper asking rates at newly built office properties that will become available in 2018 and 2019, said Eric Kenas, research market director at Cushman & Wakefield.

These conditions are likely to hamper asking rates at newly built office properties that will become available in 2018 and 2019, said Eric Kenas, research market director at Cushman & Wakefield.

As insurance, some developers are turning their attention to submarkets that have performed well in the recent past, like Hollywood, and are building on spec in the hopes that preleasing rates will hold. Preleasing is currently leading new construction activity, say industry experts.

Netflix, for example, has been preleasing space at a rapid rate, including the under-construction Icon Tower at 5800 Sunset Boulevard. The company also plans to expand into the Sunset Bronson Studios next to the Icon Tower, complete with soundstages and five stories of office space. Both sites are owned by Hudson Pacific Properties.

Netflix is expected to turn the collective 415,000 square feet into its L.A. HQ, and rumor has it that the company may be taking even more space from Hudson Pacific. HPP is under contract to buy the old Hollywood Center Studios’ 15-acre site and is in talks to build a 575,000-square-foot development as well as upgrade existing studios.

As next-generation content providers like Netflix continue to grow and converge in L.A., preleased space is expected to remain heated into early 2018 — and so is the tech sector, say industry insiders.

Of the 200 million square feet of office space in L.A., 38 percent, or 76 million square feet, is now leased by technology and creative tenants, according to CBRE. Snap Inc., the parent company of Snapchat, is a five-year-old company that has set up shop in Venice, where it occupies about 95,000 square feet. Last year, Snap leased an additional 80,000 square feet at the Santa Monica Airport, and in Q4 2016, it inked a deal for 300,000 square feet in Santa Monica Business Park at Ocean Park Boulevard and Centinela Avenue, with an option to take an additional 100,000 square feet, as reported by The Real Deal. Although the terms of the deal weren’t released, landlord Blackstone is asking $4.65 to $4.95 per square foot for similar spaces in the Park, according to its website.

Of the 200 million square feet of office space in L.A., 38 percent, or 76 million square feet, is now leased by technology and creative tenants, according to CBRE. Snap Inc., the parent company of Snapchat, is a five-year-old company that has set up shop in Venice, where it occupies about 95,000 square feet. Last year, Snap leased an additional 80,000 square feet at the Santa Monica Airport, and in Q4 2016, it inked a deal for 300,000 square feet in Santa Monica Business Park at Ocean Park Boulevard and Centinela Avenue, with an option to take an additional 100,000 square feet, as reported by The Real Deal. Although the terms of the deal weren’t released, landlord Blackstone is asking $4.65 to $4.95 per square foot for similar spaces in the Park, according to its website.

Overall, West Los Angeles had 680,870 square feet absorbed in the fourth quarter of 2016. In fact, the fourth quarter reeled in most of the year’s gains, which amounted to 998,808 square feet absorbed. The average lease rate was $4.66 a square foot, according to CBRE. Data provided by Colliers International recorded a more than 7 percent gain in Santa Monica’s office asking rates, year over year.

Meanwhile, the Downtown Los Angeles Arts District, with its galleries, bars, coffee shops and restaurants, is still an active industrial zone, but one that may soon attract media and entertainment firms the way Playa Vista has become a magnet for creative companies. So far, liquid-meal maker Soylent has inked a 29,000-square-foot lease at 555 Mateo Street and plans to move into the $80 million under-construction building by early summer. And the Row, a retail and office development that will eventually offer 1.3 million square feet of creative space, is now home to a handful of retailers and office users like MiTu, a digital firm that occupies 13,000 square feet, as reported by TRD.

The Brickyard in Playa Vista, developed by Tishman Speyer, has helped the neighborhood become a magnet for creative companies.

The Warner Music Group also moved into the Arts District in one of the largest deals of the last 12 months, leasing 257,028 square feet in a newly converted building that once housed a Ford Model T assembly line.

Hollywood and Downtown L.A. hot spots aren’t the only places tenants are finding new digs. In 2016, Hasbro Studios turned to the Media Studios North office park in Burbank. The film production firm relocated and expanded in 2016 when it moved into a new 80,000-square-foot space at 3333 West Empire Avenue, said Jonathan Larsen, principal and managing director at Avison Young, who represented Hasbro in the deal. The company had previously occupied a 45,000-square-foot space on North Hollywood Way in Burbank before moving to the updated offices, owned by Worthe Real Estate Group and Shorenstein Properties. According to industry experts, the deal included a lease rate of $4.85 per foot, per annum.

“Given all the economic instability we’ve lived through in the past few years, with the crash, the stagnation and then a market that’s been on fire, landlords are pushing rates up,” Sokolowski said, “but everyone still wants a good deal. They’re just going to be harder to find now.”