If there was any doubt that investor enthusiasm for proptech is stronger than ever, let this statistic put it to rest: In the first half of 2019 alone, investment in proptech hit $12.9 billion — eclipsing the previous record of $12.7 billion invested for the entirety of 2017, according to CRETech. With the cash infusion comes an influx of fresh tech talent into the growing space, according to Peter Belisle, Southwest director at JLL.

If there was any doubt that investor enthusiasm for proptech is stronger than ever, let this statistic put it to rest: In the first half of 2019 alone, investment in proptech hit $12.9 billion — eclipsing the previous record of $12.7 billion invested for the entirety of 2017, according to CRETech. With the cash infusion comes an influx of fresh tech talent into the growing space, according to Peter Belisle, Southwest director at JLL.

“People from the tech industry have realized it’s such a huge space that’s been untapped,” said Belisle. “It’s not just capital, it’s tech. That’s a huge change that a lot of people are not really aware of.”

As a result, Belisle expects big changes in the way the local commercial real estate industry functions in the next year and a half. As the software improves, more members of the industry will be relying on tech tools in the course of their everyday business, whether it’s the app a landlord uses to engage tenants or virtual tours that a broker uses to show a space, he said.

Being familiar with proptech software is no longer a bonus, but a necessity, said Sandy Sigal, president and chief executive of Woodland Hills-based shopping center developer NewMark Merrill Companies.

“Brokers have to have tapped into this stuff and be prepared to use it, or be left behind,” said Sigal.

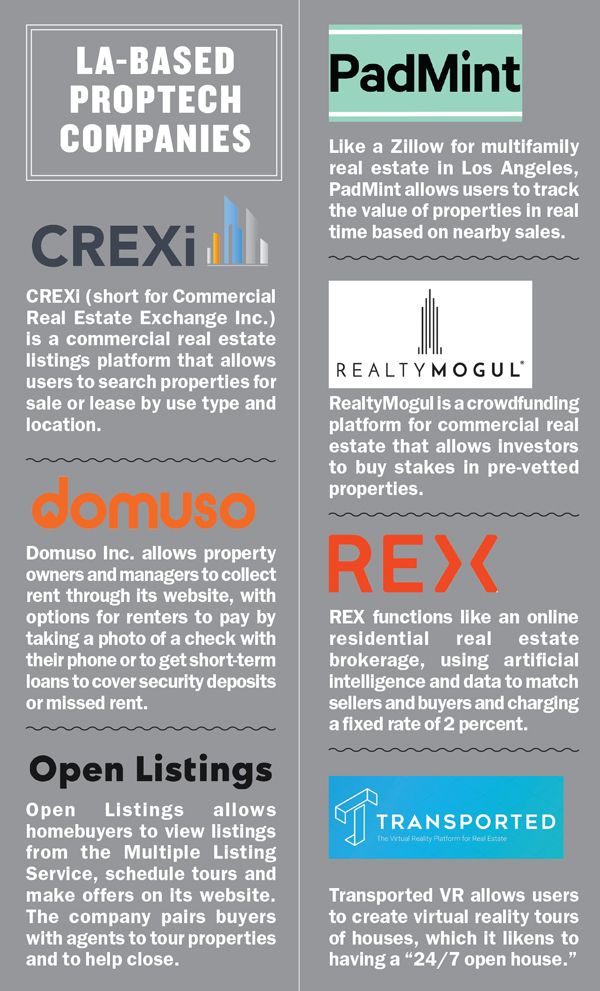

Although iBuying platforms, such as L.A.-based Open Listings and REX, have effectively sought to replace residential brokers, commercial agents for their part aren’t worried about going extinct. Evaluating a restaurant as a potential tenant could include taking into account things like what kind of food it serves and Yelp reviews, said Gabe Kadosh, vice president of retail services at Colliers International.

“You could have all the software in the world, but you still need people on the ground,” said Kadosh.

Belisle believes that the software will increase productivity for commercial leasing brokers.

“Successful brokers who use technology efficiently may be handling more transactions per person than less,” he said.

Here, local professionals nominate the proptech products they’re finding most useful in the line of duty.

Technology: VTS

Who’s it for: Landlords and brokers

What it does: VTS is a leasing and asset management system that allows landlords and brokers to track leasing activity at all their properties in one place. It also develops custom reports that can show, for example, the deal pipeline for a client or availability for a particular property.

User’s experience: Kadosh of Colliers International keeps VTS open on his computer almost all day, using it to keep track of the approximately 25 retail properties — or 2 million square feet — around Los Angeles that he represents, he said.

When using it on behalf of a property owner whose space he’s leasing, Kadosh can enter feedback from a potential tenant after they tour the space that the owner can immediately see. “When paid for by an owner, everything I do they can see word for word, which makes it kind of intense,” said Kadosh.

When using VTS for an asset that he controls, he can generate a PDF report, which he shares with a client ahead of an update call. “Even a few years ago, it used to be Excel. VTS generates fields; it’s very easy to see, for example, when a lease expiration is coming up. It’s very clean.”

He finds it easier to use than Salesforce, which he’s also tried. “Brokers are very good at talking and showing spaces,” Kadosh said. “But when it comes to writing up reports, that’s not our best skill.”

The software isn’t perfect, he notes. Kadosh also represents tenants looking for space, and since VTS is organized by properties, there isn’t a place to keep notes for those transactions. The platform would also benefit from allowing street views of a property and integrating more aspects of a property brochure into its profile in the program, he said.

Tech Support: In May, the valuation of VTS reportedly hit $1 billion thanks to a $90 million investment in the company, one of the largest venture investments to date in the commercial property software market. The Series D investment round — which was led by landlords that are also VTS customers, Brookfield Asset Management and GLP — will help fund the rollout of an online commercial leasing marketplace called Truva, which will be available in New York this year before expanding to other markets.

Technology: Placer.ai

Who’s it for: Developers, brokers, retail and hospitality tenants

What it does: Placer.ai uses anonymized data from mobile phones to show customer activity within a geographical trade area.

User’s experience: Sigal at NewMark Merrill Companies uses data from

Placer.ai to gather customer foot traffic data in order to entice prospective tenants to lease space at his 80 shopping centers in California, Colorado and Illinois. He also uses it to evaluate potential acquisitions and to pick the ideal locations for shopper-targeted advertising.

Sigal decided to buy the Madison Marketplace shopping center in Sacramento after data from Placer.ai showed that it had the No. 1 grocer in the area. “Some sellers have some sales data, [but] they rarely have foot traffic data,” he said. “It convinced us we should buy the center.”

He’s currently using data to show potential tenants that his shopping center in Orange County has 50 percent more traffic than the competitor across the street. In the past, he would have had to rely on less scientific ways to benchmark a property’s performance, like counting the number of customers or asking a tenant for their impressions of how many people came through the doors.

“In today’s world, the one with the most data wins,” he said. “That’s our goal.”

Placer.ai shows where Sigal’s customers work and live so that he can tailor his advertising accordingly. “If there’s a segment of the trade area that’s not coming to the center, I do marketing to that area, and then I use Placer to see if it made a difference,” he said.

Sigal said he began using Placer about three years ago, when it was geared more toward individual retail tenants. He’s worked with the company to optimize the user experience for shopping centers.

Tech support: Placer.ai, which announced a $4 million funding round last October, plans to keep working with customers to improve its usefulness. “We want to continue leveraging our AI capabilities to bring forecasting into the mix from sales for a new store to trade area projections, cannibalization estimates, ideal tenant combinations and beyond,” a company spokesperson said in an email.

Technology: PadMint

Who’s it for: Brokers, owners and potential investors

What it does: PadMint uses open source data from L.A. County to give real-time estimates of the value of multifamily properties, similar to Zillow, while also showing recent sales of such properties in the area. Users can generate reports for a building showing things like estimated operating expenses and proposed financing amounts, and through the site they can create social-media-like profiles for networking.

User’s experience: Grant Goldman, a broker associate at Lyon Stahl, a real estate brokerage focused on multifamily properties, has used the free software to generate leads. “It’s become a daily tool for me for prospecting and overall knowledge,” said Goldman. “I can hop on the phone and say, ‘Did you know this sold for x?’” Goldman has used the info on the site to create valuations in half the time it ordinarily would take, and mails them out as a form of advertising. He said that PadMint is the only place he can see multifamily property comps for free: “In the office, we use it as a benchmark, a barometer of the market.”

Although Goldman likes being able to generate reports that he can customize with his company’s logo through the site, he wishes he could modify the reports further, for instance by adding more comps (the site selects the ones it includes). He also thinks a mobile app could come in handy.

Tech support: PadMint is currently being beta-tested in Los Angeles County, but the company plans to expand to other major multifamily markets in the next six months. “Zillow and Redfin changed the way people access residential real estate information and the relationships between agents and their clients,” said Elliot Van Nest, PadMint co-chief executive and co-founder, in an email. “PadMint intends to bring the same transparency to the multifamily market.”

Tech support: PadMint is currently being beta-tested in Los Angeles County, but the company plans to expand to other major multifamily markets in the next six months. “Zillow and Redfin changed the way people access residential real estate information and the relationships between agents and their clients,” said Elliot Van Nest, PadMint co-chief executive and co-founder, in an email. “PadMint intends to bring the same transparency to the multifamily market.”

Technology: CREXi

Who’s it for: Brokers, buyers and sellers

What it does: CREXi allows users to search commercial properties for sale or lease by use type and location.

User’s experience: Mike James, managing partner at James Capital Advisors, uses CREXi as an alternative to LoopNet. He prefers CREXi’s more specialized search criteria, since his firm specializes in net leases. He also says that the information on CREXi tends to be more accurate and that the brokers using the site are of a higher caliber.

“The quick ability to look at a property and mentally download the pertinent information quickly — lease terms, guarantee on lease, franchise or corporation, brokerage commission — it’s all in one spot,” he said.

His firm has closed on deals after submitting letters of intent through the website using its pre-made forms.

James said that doing marketing campaigns on the site allows him to see who has clicked on his listing, so he can then follow up with the buyer if he has a new listing in the same area.

James didn’t have any criticisms of the software, although his associate Nina McGaughy said that occasionally some listings show up on LoopNet that are not on CREXi.

Tech support: The platform has helped facilitate transactions on over 90,000 listings worth more than $450 billion in property value since launching in late 2015, according to the company. CREXi uses machine learning and artificial intelligence to match supply and demand, a spokesperson said in an email. “Essentially, we want to simplify the entire CRE process and arm the brokerage community with a one-stop solution for their business workflow,” the spokesperson said.