As the National Football League’s Los Angeles Rams flew home from Atlanta in their chartered United Airlines jet, defeated by the New England Patriots at the Super Bowl, teammates glimpsed their future from the airplane window — the first new football stadium built in the City of Angels since the 1920s.

The Los Angeles Stadium at Hollywood Park, which is scheduled to host the 2022 Super Bowl and the opening ceremonies of the 2028 Summer Olympics, is a beacon of hope at a time when new construction starts across the greater Los Angeles area were down 11 percent last year compared to 2017, according to Dodge Data & Analytics.

Building the stadium will be a costly endeavor. Developer and team owner E. Stanley Kroenke is ponying up part of the nearly $5 billion — twice the cost of any other U.S. stadium — needed to transform a horse racing track into a 70,000-seat entertainment complex.

The Rams’ new stadium is on schedule to open before August 2020, partially thanks to a “management logistics flow” devised for the job by Hunt Construction and its German-owned partner, Turner Construction.

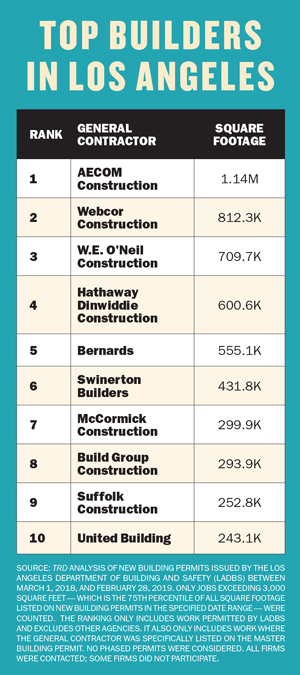

Hunt is part of AECOM, the Fortune 500 multinational behind the most development, in terms of square-footage, filed in Los Angeles County in the last 12 months, according to an analysis by The Real Deal.

As construction companies ride out the last of a development boom that began some years ago, The Real Deal reviewed hundreds of permit applications filed with the city’s Department of Building and Safety to determine which companies lined up the most new work across the county between March 1, 2018, and February 28, 2019.

The construction firms at the top are engaged in projects that were largely launched when Chinese capital was flowing freely into Los Angeles. But as the pipeline of projects gets a bit lighter, material costs rise and skilled labor remains short, those firms are diversifying their in-house offerings and plotting their futures carefully.

Hellacious hurdles

The Golden State has always been a tough playground for contractors.

Ryan McGuire, executive vice president at the Chicago-based construction giant Clayco — among the top 30 contractors in Los Angeles, according to TRD’s ranking — said that he adds up to eight months when planning a Californian project compared to a similar build elsewhere.

“There are cultural differences such as robust environmental considerations unique to California, and typically more stakeholders to meet, but they do make the project stronger at the end,” he told The Real Deal.

McGuire said labor shortages are his biggest headache.

“If we need 400 electricians for a job, we have to look outside the usual area and talk to the unions about dealing with the need. We are now going into schools and hoping to find the next generation interested in such careers.”

And Clayco is not alone in that endeavor. This summer a trade association, the Associated General Contractors of California (AGC), will launch a campaign to attract new talent to the industry.

“Our recent survey showed that 78 percent of firms have problems filling craft jobs, and there is a shortage of salaried staff in 68 percent of companies,” said Peter Tateishi, CEO of the Sacramento-based AGC.

“We need to reshape the narrative to tell young people this is an industry with real money and careers,” Tateishi said. He added that he’s lobbying in Washington, D.C., for temporary worker visas, but the political winds do not appear to be in his favor.

But some say there may be some relief on labor issues as the Los Angeles market cools.

Overall, commercial building starts were down 12 percent from 2017 to 2018. Warehouse construction starts were down 17 percent, retail construction was down 38 percent (thanks, digital shoppers!), and despite record bookings, hotel starts were down 43 percent.

Adding to the strain on construction firms is the rising cost of materials, due in part to a trade war with China. The rising cost of imported steel — up 25 percent since tariffs were imposed by the Trump administration in 2018 — has wiped out the 3 to 5 percent profit margins baked into many Californian projects, according to the ACG.

“Many members face a choice between working at a loss or walking away from jobs for clients who will not build political uncertainty into the bidding process,” said Tateishi. “And there is no end in sight for this turmoil.”

The China factor

The China factor

A big factor in the decrease in projects is the withdrawal of Chinese investment in Los Angeles development, a move that follows Beijing’s 2016 advice to its homegrown investors to dump their property portfolios in the U.S. to prop up the troubled renminbi currency (see page 46 for more on the withdrawal of Chinese investment).

Chinese investment has financed a lot of current construction, especially on large mixed-use projects in Downtown Los Angeles. Those investments came with unique risks, as seen in the headline-generating stutter of Oceanwide Plaza. Containing three towers opposite the Staples Center and offering Park Hyatt-branded condos and a giant LED screen wrapped around its mall, the project was financed by an limited liability company that’s a subsidiary of Beijing-based Oceanwide Holdings.

But in January, construction was suspended for “capital restructuring” in the face of six subcontractors filing mechanic’s liens totaling $62 million for work on the project.

The biggest claim was from Webcor Construction, which said it was owed $52 million. The San Francisco-based firm came in second in The Real Deal’s analysis and is currently working on the $2.5 billion Century Plaza condo redevelopment near the Fox Studios lot in Century City.

Webcor is also working with another powerful contractor, Swinerton Builders, on a $1.6 billion Oceanwide project in the Bay Area; the San Francisco Chronicle reported the project’s Chinese managers may be seeking refinancing.

Swinerton, sixth in The Real Deal rankings, knows how Chinese investors think. It’s currently building Perla, a 35-story condo tower near Downtown’s Grand Central Market funded by the Shanghai Construction Group.

While work resumed at Oceanwide Plaza in March, its near neighbor, the Grand, is also underway. The Gehry-designed mixed-use spread, also funded with Chinese capital, is under construction by AECOM.

Chinese investors tend to stick close to city centers, except in the case of the Warner Center residential towers in Woodland Hills — a rare suburban and low-cost venture. Build Group Construction, number eight in The Real Deal ranking, is on that project.

Survival of the fittest

Outside Downtown hot spots, the construction business is losing steam, so how can contractors protect themselves?

One way is to bring critical services in-house: Clayco’s Treehouse division, an incubator or accelerator for inventive new products, has invested in drone services and windows that darken in bright sunlight.

Bernards, number five on The Real Deal’s list, having just completed the OLiVE DTLA mixed-use project on Downtown’s Olive Street, is beefing up its digital blueprint department, devoting an in-house team to its building information modeling and virtual design and construction programs.

Another stratagem is sticking with what you know.

During his career, Trace Chalmers, president of Chalmers Equity Group (CEG), which is among the top 30 construction firms identified by The Real Deal, has expanded into downtown creative spaces. CEG built the new Arts District headquarters for Lucky Brand Jeans.

But Chalmers’ firm keeps its bottom line rooted in building food and cold storage facilities, and CEG has curbed its expansion in anticipation of a slowdown.

“We have stepped back from seven or eight possible developments, not just because of rising costs but also to be in a stronger position in a softening market,” Chalmers said. “It will not be like 2008. The banking sector is in a stronger place, but it could be tough for the unprepared.”