New York City’s residential brokerages had their work cut out for them in 2023.

Higher mortgage rates coupled with economic and political uncertainty pushed sellers to the sidelines and stalled transactions. Cash buyers were king, snapping up a record share of the few listings hitting the market.

For residential players, “2023 was certainly a challenging year, to say the least,” said Brown Harris Stevens CEO Bess Freedman.

The chilled market reverberated nationally, with the publicly-traded firms based in the Big Apple joining the cost-cutting wave in anticipation of quarterly losses.

“I think everyone is thrilled that [2023] is over,” said Richard Ferrari, the head of Douglas Elliman’s operations in New York City and the Northeast.

Manhattan

Brokers struggled to get deals over the finish line last year, and it shows: Manhattan’s top firms largely reported sales volumes down from 2022, according to The Real Deal’s analysis of closed sell-side transactions for residential properties, excluding off-market deals.

“Nearly every transaction we did was a slog,” said Molly Townsend, senior vice president and managing partner of The Agency’s tri-state business.

The top 25 brokerages sold $21.1 billion worth of homes in Manhattan, down from $27.4 billion in the previous year.

Corcoran snagged the borough’s top spot again, by a slim margin, with its total sales volume down more than $1 billion from 2022. It wrapped up 2023 with $5.07 billion in sales across more than 2,100 deals in the borough.

“[Last year] was not for the faint of heart,” Corcoran CEO Pam Liebman said. “The good brokers really had a chance to shine, and those who were coasting over the past couple of years had a bit more of a struggle.”

Compass surpassed Douglas Elliman for No. 2 with sales totaling $5.04 billion, down from $6.1 billion in 2022.

Elliman brought in $4.2 billion in sales across more than 1,800 deals, down from nearly $6.5 billion in 2022 and sinking slightly, to third, among the borough’s top firms.

Elliman “introduced a different dialogue,” Ferrari said, encouraging buyers to purchase before an expected decline in rates this year that would boost demand for likely low inventory.

Official debuted on the ranking at No. 8 after its first full year of transactions under the brand backed by Side. The firm, which solidified its name in Manhattan in 2023 after Tal and Oren Alexander left Douglas Elliman, ended the year with $260 million in sales across 33 deals.

The firm’s focus on the higher end of the luxury market meant clients weren’t as impacted by the rise in mortgage rates, according to Tal Alexander.

The Modlin Group, an independent brokerage headed by Adam Modlin, jumped from 12th to 9th in the rankings last year with $240 million in sales across 24 deals. Modlin also claimed the priciest deal in the city last year, an $80 million resale at Vornado’s 220 Central Park South.

Christie’s International Real Estate Group re-entered the Manhattan market in January 2023, when the tri-state affiliate took over its Manhattan operations. The firm also nabbed a slice of new development by teaming up with Reuveni Development Marketing; the partnership placed 16th in the rankings with nearly $104 million in sales.

“We were kind of sailing through how to put us on the map in the best possible way,” said Ilija Pavlovic, CEO of the Christie’s affiliate. “But at the same time, the waters were rough.”

Bond New York, which made its way into the top 25 last year with nearly $40 million in sales across 45 deals, courted buyers to cope with low inventory.

“We made up for what we might have lost in the resale market with some of the highest level of rentals we’ve seen in a generation,” said the firm’s director of brokerage services, Douglas Wagner.

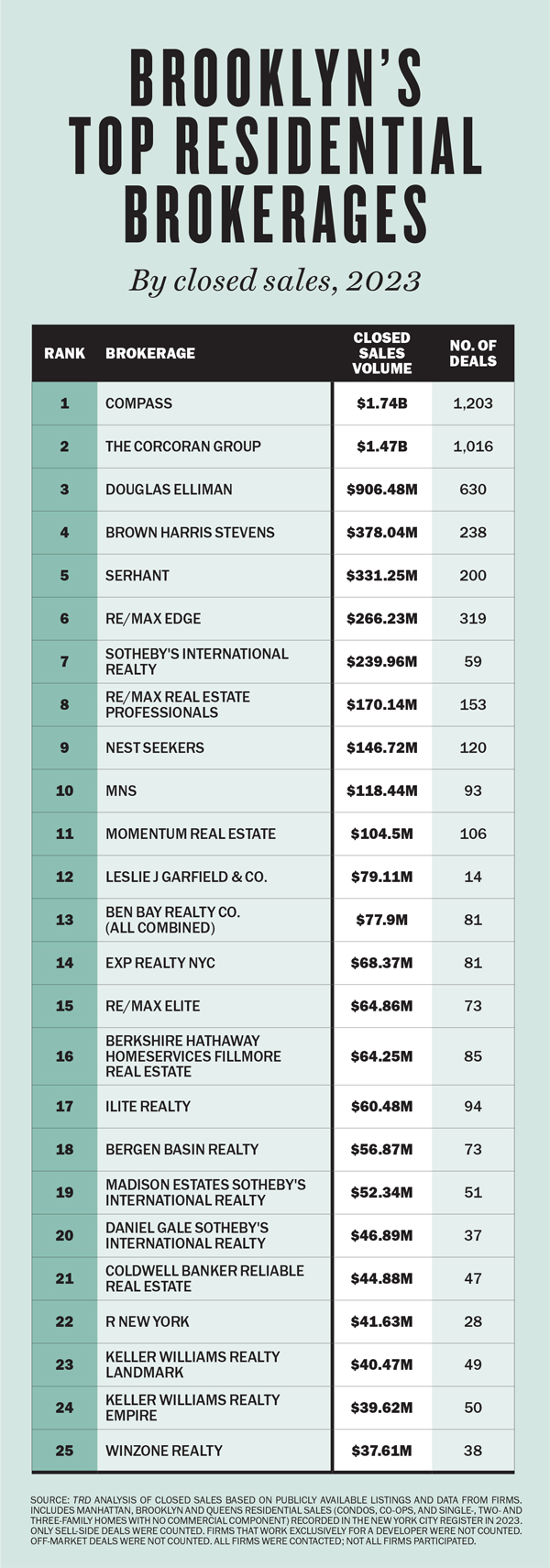

Brooklyn

In Brooklyn, scarce listings hindered sales. After the borough cemented its status with new price peaks during the pandemic, demand for enclaves like Brownstone Brooklyn and Williamsburg rivaled some of Manhattan’s most coveted neighborhoods.

“[2023] was more challenging in Brooklyn than in Manhattan,” Liebman said. “Whether it’s young people or families with kids or couples, there’s so many great neighborhoods. We’re just having trouble satisfying the demand.”

While transactions were stifled, the borough’s top 25 brokerages closed the year with $6.6 billion in sales — a letdown from just under $9 billion reported by the top 20 firms in 2022.

Compass secured the No. 1 slot with $1.7 billion in sales, followed by Corcoran with nearly $1.5 billion and Elliman with $906 million.

Leslie J. Garfield placed 12th again last year, with $79 million across 14 deals. The townhouse-focused brokerage kicked off 2024 with the departure of one of its top brokers, Ravi Kantha.

Kantha’s move to Serhant adds to the roughly three-year-old firm’s presence in Brooklyn, where it snagged the No. 5 spot with $331 million in sales.

Queens

The pandemic supercharged home sales in Queens. But the market steadied last year amid the challenges, according to Eric Benaim, the CEO of Queens-based brokerage Modern Spaces, which ranked fifth in the borough with nearly $230 million in sales.

“Prices per square foot have obviously gone up a lot since Covid,” Benaim said. “But in general, I think the market is stable.”

The top firms in Queens largely held on to their rankings from 2022, but the borough logged a few notable shakeups.

Keller Williams Realty Landmark scored the top spot once again with $341 million across 498 deals, though its volume was less than the $478 million it closed in 2022. Elliman placed second with $274 million across 406 deals.

E Realty International jumped from fifth place to third with $260 million in closed sales. The company replaced Winzone, which fell to sixth with nearly $198 million across 264 deals.

Nest Seekers and Corcoran made major moves in the borough. Nest Seekers rose from 14th to seventh, finishing 2023 with $193 million across 184 deals. Corcoran jumped from 17th to ninth with nearly $136 million across 179 deals.

Want to see the data behind the ranking? Check out the source data on TRD Data now.