“It’s an easy entry business and therefore an easy exit business,” Mike Pappas, CEO and president of The Keyes Company/Illustrated Properties told TRD, articulating an intrinsic truth about the residential brokerage business that veterans of the industry know all too well.

Brokers largely credit the industry’s characteristically high rate of turnover to the constant influx of new professionals into the field. But experienced agents, too, contribute to the high rates of comings and goings, hopscotching from one brokerage to another as they search for higher commissions or a change in culture. And a recent spate of brokerage acquisitions by larger firms may also have contributed to a higher churn, with some agents opting out when their company comes under new ownership.

“Miami, in particular, has always been very active with agent movement,” said Beth Butler, Compass’ general manager of Florida. “Agents are smart, they’re savvy, always looking for a good deal.”

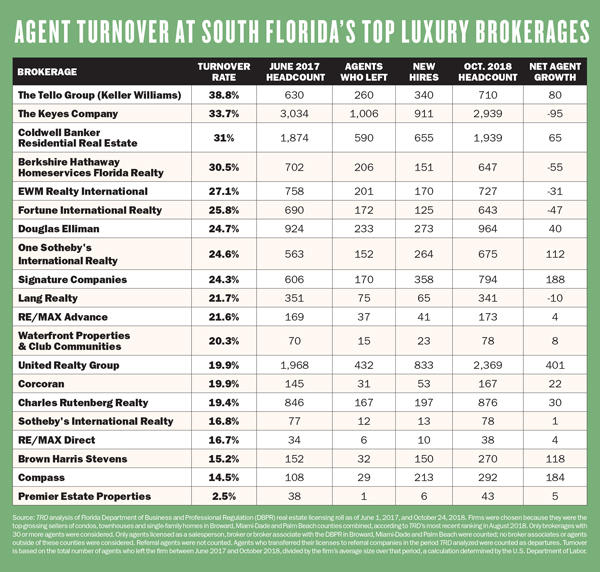

To determine which firms were seeing the most gains and losses of agents, The Real Deal analyzed the rate of agent turnover at South Florida’s top 20 brokerages using a formula determined by the U.S. Department of Labor. The rate is based on the total number of agents who were with the firm in June 2017 but not in October 2018, divided by the firm’s average size over that period. The 20 firms included were determined by dollar volume of sales of homes priced at over $3 million between August 2017 and July 2018, as reported in TRD’s fall 2018 top brokerage ranking. Only brokerages with 30 agents or more were considered.

The results of the analysis show a wide range of turnover figures, from as high as 39 percent to less than 3 percent. But a high rate isn’t necessarily bad and a low rate isn’t necessarily good. A firm’s turnover rate largely depends on its overall philosophy. Some, such as The Keyes Company/Illustrated Properties, prioritize efforts to increase agent rosters, believing that the business’ success largely depends on recruiting new agents as a key to boosting sales volume and revenue.

“There is a direct correlation between the number of associates and market share,” said Pappas. His company ranks as the largest brokerage in South Florida, with nearly 3,000 agents, according to TRD’s analysis.

Others disagree with that approach, believing that the sheer number of agents does not guarantee sales. With a turnover rate of 24.7 percent, Douglas Elliman is less growth-focused, according to Jay Parker, CEO of the Florida brokerage.

“Our focus at Douglas Elliman is not based on growth for growth’s sake,” Parker said, adding that he has no target figure for the number of agents the firm wants to have in South Florida.

As Miami’s resi market enjoys a bump — with the number of third-quarter sales up 11.1 percent from the same time in 2017, according to a recent Douglas Elliman market report — amid a buyer’s market, brokerage leaders discuss what makes their agents stay put and how acquisitions have impacted the rates of resignations, hirings and firings.

The interlopers

The bulk of turnover at resi agencies revolves around those who get into the field and then get out of it just as quickly, most brokerage leaders concurred.

From January 2017 through November of this year, more than 52,000 new professionals got licenses to sell real estate in Florida, according to the Florida Department of Business and Professional Regulation. A total of 272,578 agents held active licenses statewide at the end of fiscal 2017, the department’s most recent figures show.

“There are always people transitioning in and out of our industry,” Ron Shuffield, president and CEO of EWM Realty International said. “They are independent contractors and 100 percent commission, and some people like that and excel at that, and others find it is not exactly what they thought.”

It’s easy to see why the field lures so many newbies every year. Brokerages in South Florida generally offer an 80/20 commission split between the agent and the firm, sources say. That can sometimes rise to 85 or 90 percent or more, depending on an agent’s sales.

Some brokerages, including United Realty Group, offer 100 percent commission and require only a $299 transaction fee per sale. That may explain why the firm added 833 new agents, the most of any brokerage, during the period TRD analyzed. United Realty Group did not respond to requests for comment.

But while commissions may be high in some places, many agents fail to close enough deals to make the career worthwhile, which leads to high turnover in the industry, experts said. According to the National Association of Realtors, among 1.3 million associates nationwide, 8 percent of Realtors did not make any sales last year, and another 19 percent only made between one and five sales.

A franchise of Keller Williams, The Tello Group, had the highest turnover of the firms analyzed, with a rate of 38.8 percent. Natascha Tello said the number largely reflects the industry norm of at least 30 percent attrition each year, which she said may be even higher in Florida. However, the TRD analysis found that only three other brokerages in the top 20 had a rate of 30 percent or more.

“Florida in general is a transient state — a lot of people come and go,” plus entry into the real estate profession is easily attainable, she said.

It’s those who have been in the industry for years who largely remain loyal to a firm, Pappas said. Overall, his firm’s top 10 associates average a tenure of 14 years, and the top 100 associates average more than 10 years with Keyes, he said.

The post-acquisition scramble

A number of acquisitions of smaller firms by bigger entities have effectively made many agents change firms at the very least in name only. Keyes, Compass and One Sotheby’s are among the firms that have made significant acquisitions in recent years, but most of the acquiring brokerages assert that the mergers haven’t made their brokers flee. Only a few of the smaller acquisitions occurred during the period studied in the TRD analysis.

Pappas said of 550 agents who joined Keyes as part of its 2016 merger with Illustrated Properties, only five have left.

Compass, which had a 14.5 percent turnover rate during the period TRD analyzed, is known to be aggressive in acquiring boutique brokerages, as well as in its recruiting efforts. In the past two years, the firm has acquired four local brokerages, which added a total of 120 agents to its roster. Butler said that all but five of the 29 agents who left during that time frame were either asked to leave due to low productivity or because they failed to pay dues or left the business.

Compass, which had a 14.5 percent turnover rate during the period TRD analyzed, is known to be aggressive in acquiring boutique brokerages, as well as in its recruiting efforts. In the past two years, the firm has acquired four local brokerages, which added a total of 120 agents to its roster. Butler said that all but five of the 29 agents who left during that time frame were either asked to leave due to low productivity or because they failed to pay dues or left the business.

But sometimes amid an acquisition, agents opt to leave rather than join the new, larger brokerage, brokers said.

“There is no guarantee that [brokers from the firm being acquired] are coming over,” said Phil Gutman, president of Brown Harris Stevens Miami, which had a 15 percent turnover rate over the period analyzed. “You have to have a meeting to sell them on why they should come over with you.”

Wrangling recruits

At TRD’s Miami Showcase & Forum in October, Compass CEO Robert Reffkin characterized his approach to recruitment by saying he’s like a “door knocker agent” who is “happy to pitch myself 10 times.”

Rather than hire agents who are new to the industry, Compass focuses on those with experience. The firm’s local “growth team” reaches out to connect with agents at other firms and also handles inbound inquiries.

“When we started, we did a lot more outreach,” Butler said. Now, agents reach out to Compass because they know an agent or hear about the firm’s growth, so only about 20 percent of new hires are from outreach efforts, she said.

Compass is far from the only firm looking to get the best and brightest to come over from other firms. At the Signature Real Estate Companies, based in Boca Raton, recruiting new agents is serious business.

Ben Schachter, broker and president of the firm, said it brings on 10 to 30 agents per month. About 70 percent join Signature from other brokerages, while 30 percent are new to the industry and newly licensed. The firm only extends an offer to about 48 percent of the candidates it interviews, and of those, about 87 percent join the firm, he said.

“We look for people who have a tremendously raging fire to be successful,” Schachter said.

Signature, which was formed 12-and-a-half years ago and now has nearly 800 agents, has a professional recruiter on staff who pursues agents on a target list based on tenure, volume of sales and geographic location. Yet most agents come as referrals from other agents, who earn 5 percent of the gross production the new agent brings in for the first 12 months, Schachter said.

Separating the wheat from the chaff

Of course, there are also instances where brokers aren’t cutting the mustard and must be shown the door. Douglas Elliman may also terminate agents if they do not meet the firm’s $3 million production standard each year, although there are exceptions, Parker said.

“We don’t want dead weight on our roster. For us, it’s not now many agents do we have, it’s how much business are we producing,” he said.

At Signature, agent performance is assessed every 90 days, including how many listings agents have generated and their professional development in terms of additional training and education.

“I fire as much as 20 percent of our workforce every single year because they are not producing,” Schachter said. During the time period TRD analyzed, Signature had a turnover of about 24 percent, and Schachter figures that of 170 agents who left, probably 100 to 125 were terminated during that time frame.

“If you want to hang your license and be left alone, we are not for you,” said Schachter.

And there are plenty of simpler reasons for departures: Some seasoned agents decide they don’t want the full-time job, or choose to relocate yet want to retain their licenses. Firms such as Douglas Elliman allow them to move into a separate but affiliated business as referral agents.

“We allow them to hold a license but they don’t have to pay insurance or dues,” said Parker. “They’re not actively selling real estate, but they can earn a referral fee, so we transfer them to our referral network.”

Parker estimates that about 60 agents transferred to that network during the 16-month period TRD analyzed, contributing to the firm’s 24.7 percent turnover rate during that time. In the analysis, brokers who transferred to a referral network counted as departures.

Regardless of industry hiring and firing practices, experts in the field expect the high degree of turnover to continue. At Compass, with offices stretching beyond South Florida to the west coast of Florida, Jacksonville and Orlando, Butler figures the firm will have at least 1,000 agents in the state by the end of 2019. Most of that growth will likely be through hiring individual agents and teams rather than acquiring brokerages, she said.

“All these new firms are certainly going to shake things up, and it’s already a market where people move very consistently,” Butler said. “It should continue to be an active recruiting environment.”