Home builders in the southeastern corridor of the Sunshine State are facing myriad challenges in 2017. Limited land availability in the tri-county area, historically stringent home-loan underwriting rules for potential buyers, and rising land and labor costs, which are pushing more builders into high-end home construction for the wealthy, are leaving a less affluent but nonetheless large portion of the home market with few options.

Miami-based Lennar, the nation’s second-largest home builder and the market leader in South Florida, faced business conditions that were “suboptimal” last year and may persist this year, CEO Stuart Miller said on a December conference call with stock analysts. Miller said he expects similar slow-growth conditions in 2017, with “some potential upside from the new administration in Washington.”

Home builders as a whole last year started construction of 6,160 single-family homes in tri-county South Florida, 3.7 percent more than in 2015, housing market research firm MetroStudy reported.

But the actual rate of single-family home building varied substantially among the three counties that make up South Florida. While single-family housing starts in Miami-Dade County surged to 2,810 last year, up 18 percent from 2015 — thanks largely to one Lennar development — Broward County saw only a 4.5 percent increase, and Palm Beach County saw a 12 percent drop.

Looking at the players

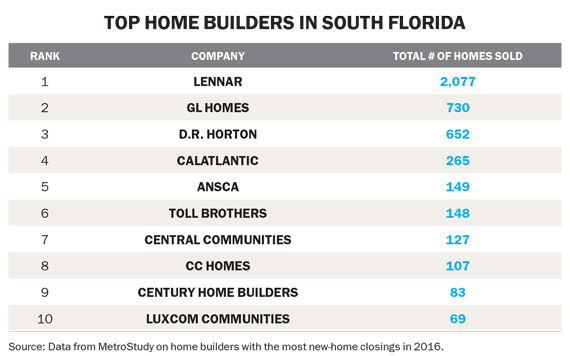

Multiple national home builders including D.R. Horton, CalAtlantic, Pulte Group and Toll Brothers have a sizable presence in South Florida. But they face tough competition from the locals, especially Sunrise-based GL Homes, a leading builder in Palm Beach County, and of course Lennar.

Other South Florida-based companies also have major projects underway: For example, Palm Beach Gardens-based Kolter Homes plans to build 1,300 single-family homes and townhouses in its hometown on 600 acres the company bought for $112 million in 2013. Prices at the development, called Alton, start in the low $400,000s for townhouses and range from the $500,000s to $1 million or more for one-story and two-story single-family homes.

Comparable new construction is scarce in Palm Beach Gardens, said John Manrique, vice president of marketing for Kolter’s new-home division. “There’s just not a lot of it,” he said. “Palm Beach Gardens hadn’t seen a new single-family-homes community in a decade before we proposed Alton.”

But no other home builder in South Florida comes close to Lennar’s leading position in the market.

“Lennar has been the biggest builder in South Florida for a long time. Most of their closings take place in Miami-Dade County, and they have some additional projects in Broward and Palm Beach,” said David Cobb, a regional director at MetroStudy. “Lennar has a 60 percent market share in Miami-Dade. That’s unheard of. If you’re a [competing] builder, you’re happy with a 10 percent share there.”

Indeed, a major reason housing starts surged that impressive 18 percent in Miami-Dade last year was the startup of construction at a Lennar development in Hialeah called Bonterra, where another South Florida-based company, CC Homes, also is busy building homes. “Lennar had over 600 starts there last year,” Cobb said. “CC Homes is also in there, but Lennar is doing the bulk of the housing starts.”

Indeed, a major reason housing starts surged that impressive 18 percent in Miami-Dade last year was the startup of construction at a Lennar development in Hialeah called Bonterra, where another South Florida-based company, CC Homes, also is busy building homes. “Lennar had over 600 starts there last year,” Cobb said. “CC Homes is also in there, but Lennar is doing the bulk of the housing starts.”

Divvying up the pie

D.R. Horton, the nation’s largest home builder, has acquired land in South Florida for some infill projects in overlooked areas, especially in Palm Beach County. They also have been active in Miami-Dade, according to Cobb. “And they’ve hit some price points that other builders are mostly neglecting… The risk to that strategy is rising interest rates. Those buyers are typically less qualified and have less money to put down than people who are more affluent,” he said.

In terms of market share leadership in South Florida, “it’s Lennar, GL Homes, D.R. Horton and everybody else,” Cobb said.

Data from MetroStudy shows that Lennar closed sales of 2,077 new homes in South Florida in 2016, far more than any other builder in the tri-county market. GL Homes was a distant second with 730 closings. Two national home builders ranked third and fourth in South Florida, D.R. Horton (652 closings) and CalAtlantic (265). Fifth-ranked with 149 new-home sales in South Florida last year was Boynton Beach-based Ansca Homes, which has nearly sold out its 516-home development west of Delray Beach called Villaggio Reserve, where a variety of price ranges lured both luxury homebuyers and first-timers.

In early February, Lennar further built its share of the South Florida market via acquisition. It bought another publicly held, Florida-based home builder, WCI Communities of Bonita Springs, for $643 million. WCI shareholders voted Feb. 10 in favor of the deal, which added to Lennar’s inventory of South Florida development sites.

On the company’s website, WCI lists four developments in South Florida: Heron Bay and Parkland Bay in Coral Springs, Estates at Tuscany in Delray Beach and The Club Ibis in West Palm Beach. “Some of the WCI communities are going to potentially replace communities that we might have purchased otherwise,” Miller said during last December’s analyst call. “We’re purchasing excellent communities that are already mature and underway, and that’s very attractive to us.”

GL Homes is another local heavyweight among single-family home builders in South Florida, especially in Palm Beach County, where the company has sold out multiple developments for residents 55 and older.

In January, the firm announced it had sold 150 homes at Valencia Bay, more than a quarter of the planned 582-home development west of Boynton Beach geared toward the 55-and-over crowd. Prices start at $497,000 and range as high as $809,000. When completed, Valencia Bay’s shared amenities will include three swimming pools, a tennis center and a 30,000-square-foot clubhouse. It’s the ninth such 55-and-older development the privately held firm has launched in Palm Beach County.

And the company is now building on South Florida land it acquired more than a decade ago and held during the housing market crash. GL Homes has “a great position in terms of a land base. The bad news is, they had to carry it during that difficult time. But they have a very strong investor base. They are well-financed,” said Lewis Goodkin, a South Florida real estate development adviser with Miami-based Goodkin Consulting. “And they have been doing a very good job selling what is really retirement- and pre-retirement-oriented product. They were well-thought-out and attractively priced.”

And the company is now building on South Florida land it acquired more than a decade ago and held during the housing market crash. GL Homes has “a great position in terms of a land base. The bad news is, they had to carry it during that difficult time. But they have a very strong investor base. They are well-financed,” said Lewis Goodkin, a South Florida real estate development adviser with Miami-based Goodkin Consulting. “And they have been doing a very good job selling what is really retirement- and pre-retirement-oriented product. They were well-thought-out and attractively priced.”

Show us the money

But even the best home builders have felt the pinch from strict home-loan qualifications.

Mortgage pricing has gotten a lot of attention since December, when the Federal Reserve raised the range of its benchmark overnight interest rate from 0.5 percent to 0.75 percent, with another raise seeming all but certain in March. But a bump-up in interest rates is a smaller problem for potential new-home buyers than current credit qualifications for a mortgage loan, Goodkin said. “One of the big problems is getting people financed. It’s much more restrictive,” he said. “More deals fall out because of that.”

Though a sudden surge in interest rates would be a serious problem for home builders, a gradual increase in rates appears more likely, Goodkin said. “But who knows? Especially in the era of Mr. Trump, there are a lot of things we don’t know,” he said.

On the plus side for builders, the prospect of higher mortgage rates has pushed some undecided South Floridians to borrow to buy a new home now. “When rates are picking up, we tend to see a little more urgency in the market,” said Brent Baker, president of the Southeast Florida Division of Pulte Group. “If you we were considering buying something, you may decide to go ahead and pull the trigger.” The executive added that older homebuyers tend to see an offset to higher mortgage rates in higher yields on their savings accounts.

Everything old is new again

Pulte’s biggest single-family construction project in South Florida will unfold in Palm Beach County on a 230-acre cluster of polo fields. Pulte paid $49 million last year for that 160-acre property in Lake Worth, called the Gulfstream Polo Club, plus several nearby properties, and the builder has deals to acquire 70 adjacent acres in 2018.

Pulte is building 916 single-family homes and townhouses in the development, which they call The Fields, and already plans to hold a model grand opening in April; move-ins are expected to start in the summer. Starting prices will range from around $335,000 for townhouses to the high $300,000s for single-family homes. “Builders that can bring houses to market for less than $500,000, there’s strong demand out there for them,” Baker said.

Pulte’s polo repurposing project represents a broader trend among home builders to redevelop property instead of building on big pieces of undeveloped land, which are hard to find in much of South Florida, especially in metropolitan Miami.

“Miami-Dade is pretty much built out,” said Jack McCabe, a real estate analyst with McCabe Research & Consulting in Deerfield Beach. “You try to find 20 or 30 acres for a single-family-home project, and the only thing you’re really going to find now is infill, tear-down and rebuild, or a golf course potentially going out of business.”

Interior shot

In fact, golf courses past the peak of their popularity increasingly are targets for residential redevelopment in South Florida. For example, the city government of Boca Raton ignited a bidding war last year after deciding to sell the 194-acre Boca Raton Municipal Golf Course. GL Homes offered $73 million, while Lennar’s $51 million offer included a land transfer to the city that would reduce the cash portion of its bid to $41 million. GL would build almost 600 homes, while Lennar would build 390 single-family homes, 95 villa-style residences and a 200-bed living facility that would provide in-patient care. A decision on whom to award the bid has yet to be made.

Lennar’s planned redevelopment of the Boca Raton Municipal Golf Course may be part of a bigger company plan for Palm Beach County.

“It’s my understanding Lennar is opening a new division here in South Florida, and they are planning to expand into Palm Beach County and northern Broward County,” said McCabe, citing land availability as a lure. “Palm Beach County has the majority of the vacant land in the three counties, particularly in the northwest section of the county.” Lennar declined a request for an interview for this article.

McCabe also said Lennar would be able to build homes at prices below those at most new-home developments in Palm Beach County.

“GL is known as a more upper-end type of builder,” he said. “Lennar is more of a first-time and move-up type of builder overall. So I think they see a need and an opening with very little competition, if they can get the land cheap enough.”

We built this city

Several sprawling tracts of land in Palm Beach County are already seeing residential development, but few match the scale of Westlake, a master-planned community in rural Palm Beach County, where Minto Communities plans to build 4,600 homes and 2.2 million square feet of commercial properties.

Minto bought the 3,800-acre site, a former citrus grove, for $41 million in 2013, though construction just started in late November. Clashes with the Palm Beach County government over development approvals delayed construction and led Minto to arrange the incorporation of Westlake as a city last year, giving the company greater control over its master-planned development.

“Unfortunately, we’re about a year and a half behind where we thought we’d be,” said Michael Belmont, president of the Florida operations of Ottawa-based Minto.

But the regulatory experience with Westlake is unlikely to make the company turn away from the Sunshine State, where the privately held firm has built more than 25,000 homes in 44 communities since the late 1970s.

Belmont said Minto plans to open model homes and a sales center at Westlake by fall and to market its first 150 homes at prices starting in the low $300,000s.

And that is a price few home builders in South Florida can afford to charge, said McCabe. “There is a tremendous demand for homes priced at $500,000 and below, especially $300,000 and below,” he said. “The problem is, most developers haven’t figured out how to build in those price ranges profitably. That has caused development to stagnate where we really need it.”