Walk into Oren Alexander’s home in Miami Beach and it feels like you’re at one of his listings. A manager greets guests, buzzing them through to the porte-cochère, and ushers them into the lavish Mediterranean-style waterfront property on Flamingo Drive. Oren, sporting a beige jacket and pants, a white T-shirt and sneakers, walks in, grabbing an espresso prepared for him. He heads to a living area overlooking the pool, sitting down next to a wooden coffee table he had custom-made (it’s filled with butterflies under a glass top). He pops up for a bottle of Fiji water and sits back down, recalling how he cut his teeth as a teenager on his father’s custom-home projects in Bal Harbour.

“That was my first introduction to luxury real estate,” he said. “I was going with my dad on the weekend to the construction sites.”

Oren, 31, and his brother Tal, 32, have come a long way since then.

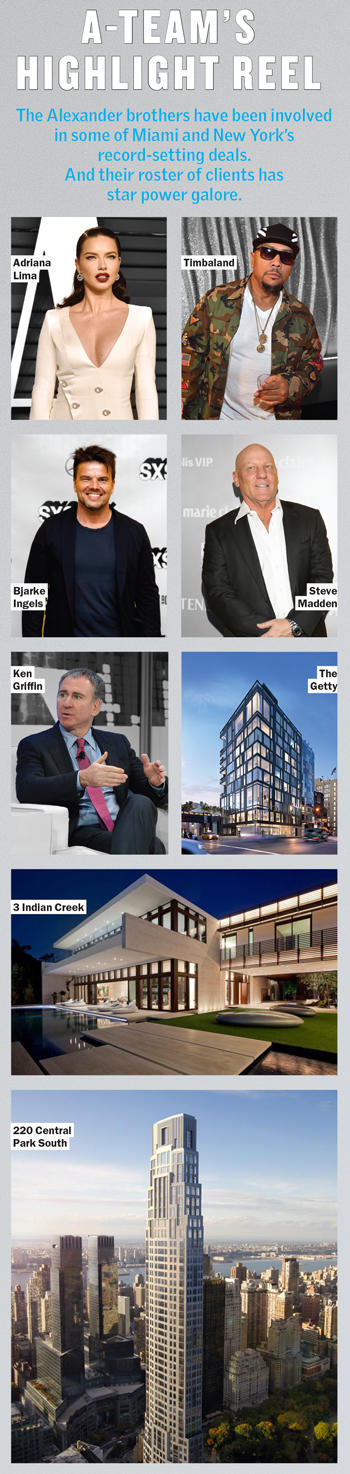

In January, the Douglas Elliman duo closed on the biggest residential sale in U.S. history: Hedge fund titan Ken Griffin’s $238 million purchase of a quadplex penthouse at 220 Central Park South on Manhattan’s Billionaires’ Row. That deal came alongside another mega-purchase by Griffin, a $122 million mansion near Buckingham Palace in London. The Alexanders were involved in that deal, too. And just a few days later, they set a new single-family home record in Miami, selling an Indian Creek Island mansion for $50 million.

“Everyone likes to say this business is about relationships,” Oren said. “It’s about real relationships. Not just ‘this is my broker’ but actually ‘this is my friend.’ It’s not just about being their broker. There’s a lot of people who could just be their broker.”

Oren later drives off in his black Mercedes AMG S63 with a personalized Florida plate that reads “A Team – O.” Tal, meanwhile, is in New York, busy compiling dozens of press mentions of the 220 CPS deal on his popular Instagram account.

No one would ever accuse the Alexanders of being publicity-shy. They represent a new type of broker, one who not only caters to the A-list but practices the A-list lifestyle, mixing business with jet-setting pleasure. In interviews and social media, no detail is spared, from their pre-dawn workouts at Barry’s Bootcamp to showing off their athletic physiques while cruising the Florida coastline, custom suits that fit just so, lavish, model-filled parties and excursions around the world. Their website links to 431 news articles dating back to 2009, and that’s just some of the press they’ve generated. They’re the self-styled “A-Team,” The Jills for the digital age. And they’ve ruffled more than a few feathers along the way.

“They’re polarizing to people, but I’ve always respected them a lot because they are doing things their way, in the sense that they’ve been, from the beginning, going after the very large deals,” said Fredrik Eklund, a top luxury broker at Elliman. The Alexanders, he said, are known for being in the right places, for traveling with clients or courting them at big events. “That takes talent and planning to connect the dots and make the calendar work,” Eklund said. “The rumor is they’re lucky, but I don’t believe in luck in this industry.”

But the brothers shut down when asked about Griffin, who seems hell-bent on breaking every real estate record there is. Days after Oren speaks to The Real Deal in Miami and after the brokers are interviewed for fawning spreads in Forbes and the Miami Herald, Tal cancels a follow-up interview with us in New York. Griffin, it turns out, isn’t so happy with all the attention.

“He [Griffin] had an expectation of privacy, as any client in this position would,” said one source familiar with the hedge-funder’s thinking. “And he will not be working with them again.”

I’d like to thank the Academy

Call it luck, perseverance or just plain chutzpah, but the legend surrounding the 220 CPS sale is that Tal cold-called Griffin and pitched him on the opportunity to buy the most significant (read: expensive) penthouse in the country. A full 3 percent commission on the purchase price would be over $7 million.

Tal offered just the smallest glimpse behind the scenes. “Thankfully, we had a relationship with both the developer and in-house brokerage team, allowing us to get our buyers in just a little earlier,” he wrote on Instagram on Jan. 24, the day after news of the closing broke. “After bringing in a few prospects who weren’t the right fit, I knew we had to go back to the drawing board. After strategically reaching out to a handful of people, this once-in-a-lifetime deal fell into place.”

But sources close to the deal said the transaction didn’t quite play out like that.

Although the Alexanders did make the initial contact with Griffin, the Citadel founder enlisted Howard Lorber, CEO of Elliman’s parent company, Vector Group, to close the deal, sources said. Lorber, who declined to comment for this article, negotiated on behalf of Griffin while Pam Liebman, the CEO of the Corcoran Group, represented the developer, Vornado Realty Trust. The two brokerage chiefs hashed out a deal in a sit-down contract signing.

“Howard deserves a lot of credit, frankly,” said one source familiar with the matter.

Sources close to the deal added that Griffin is “appalled” at the brothers’ exaggerations and misrepresentations of their role in his spending spree. The brothers claimed, for example, that they sold Griffin a $122 million mansion at 3 Carlton Gardens in London. In fact, they made a referral to a broker at Knight Frank, which has a marketing partnership with Elliman.

Record-breaking buyers typically try to stay invisible. Tech billionaire Michael Dell, for example, masked his ownership of the $100 million penthouse at One57 by insisting on nondisclosure agreements, the use of LLCs and a web of lawyers who handled the paperwork. His identity remained secret for four years after the closing.

Record-breaking buyers typically try to stay invisible. Tech billionaire Michael Dell, for example, masked his ownership of the $100 million penthouse at One57 by insisting on nondisclosure agreements, the use of LLCs and a web of lawyers who handled the paperwork. His identity remained secret for four years after the closing.

Days after Griffin’s deal closed — and on the day the Alexanders closed the Indian Creek sale — Tal and Oren appeared on CNBC to discuss the ultraluxury market; a banner on the bottom of the screen identified them as Griffin’s agents. On Instagram, they posted a highlight reel featuring all of the press the deal generated.

“After three years of waiting, the day has finally come, @OrenAlexander and I have officially closed 220 Central Park South’s Penthouse, the most expensive home sale in US history!” Tal wrote. “Through this process, I’ve learned that in the end, the best network wins (and tireless effort of course).”

The post, which generated over 2,000 likes, was reminiscent of an Oscars speech. “I want to dedicate this particular deal to my parents because without them this wouldn’t be possible,” he wrote.

A common misconception is that Oren also represented Griffin in his record $60 million purchase of two units at the Faena House project in Miami Beach. But sources said that Oren’s involvement in the deal was limited to bringing the project to Elliman, which he confirmed. As the project’s representative, Oren worked out of the sales office and used it to network with Miami’s top brokers, he said.

Notably, when Griffin later listed the two units for a combined $73 million, he hired Elliman’s Eloy Carmenate and Mick Duchon.

The room where it happens

“Tal was supposed to be a tennis player,” his father, Shlomy, said in an interview, half-joking that he wanted to see him play in the U.S. Open. (Tal played Division I tennis at Hofstra University, while Oren attended the University of Colorado Boulder.)

The brothers moved to New York in 2008, just as the market was taking a wallop.

“I didn’t know those good years when people were waiting in line to buy a condo,” Oren said. “As humans, you learn to play the hand you’re dealt, and it’s very hard for people to transition, to adapt. I made the best out of it.”

Oren’s big break came at 21, when he sold an $8.2 million penthouse at the Park Imperial to Miami-based attorney Jim Ferraro. Tal originally launched a rental brokerage and joined Elliman in 2012. He still does luxury rentals, although new development sales are an increasingly important part of the team’s business.

“No one is just giving us deals — you have to work for it,” Oren said. “I can tell you yacht brokers in this town who have built a business from just our referrals.”

That might be “a little bit exaggerated,” said Henry Schonthal, vice president at Fort Lauderdale-based Reel Deal Yachts, a luxury yacht brokerage and chartering service. Schonthal, who met Oren while they were in high school, said the two do refer each other a lot of business, which he is grateful for. He declined to detail their arrangement.

What is clear, however, is that the brothers hustle in high places. A few years back, they hosted a private lunch aboard a yacht during Art Basel Miami Beach; afterward, they offered helicopter tours of their listings. They regularly attend the Milken Institute Global Conference, an annual gathering of top business leaders.

In New York, Tal lives at 432 Park Avenue, where he’s drummed up business selling apartments for Alex von Furstenberg and others.

At the infamous Fyre Festival in the Bahamas (Instagram)

“I see him in the gym and in the restaurant,” said one building resident who requested anonymity. But he said Tal isn’t overtly angling for business over dinner. “It’s brilliant for him to know his client and move to the building,” the resident said. “People can trust him more.”

“It’s the philosophy of, if the clients are not coming to you, you go to them,” said the Modlin Group’s Adam Modlin, who worked with the Alexanders on selling the Getty, a boutique condo development on the High Line. In May, private equity executive Robert Smith bought the building’s $59 million penthouse, setting a record for Downtown Manhattan.

“It’s getting on a plane and traveling around the world and networking with the right clientele,” Modlin added.

He argued that most of their rivals don’t appreciate the brothers’ dedication.

“I think people are envious of the success that they’re having, but I find most people today just want glory,” he said. “They’re not willing to put in work.”

Hot type

The Alexanders’ rise coincided with a new era in which top agents are a brand unto themselves, with superstars like “Million Dollar Listing New York”’s Fredrik and Ryan enjoying first-name recognition. Oren and Tal make up for the lack of a TV platform by being ubiquitous. (The brothers were approached years ago about appearing in a reality show but declined. “We felt it wasn’t in line with our brand and our clientele,” Oren said.)

In 2014, Oren and his twin brother, Alon, celebrated their 27th birthday with a bash at Beautique, the now-shuttered Manhattan lounge known as a “playpen for millionaires.” Afterward, a two-minute video depicted the festivities (and featured testimonials from Lorber and developer Zach Vella). For Tal’s 30th in 2016, a production group compiled scenes from a celebratory weekend in the Hamptons. The two-minute video, set to Travis Scott’s “A-Team,” opens with a champagne-filled boat ride at sunset and closes with Tal — in a feathered turban and tunic — blowing out the candles.

Eklund acknowledged that media attention is a “double-edged sword” but called it immensely significant to his own business.

Tal and Oren enjoying a camel ride in Doha, Qatar (Instagram)

“You have to be tactful,” he said, “but it’s important to stick out and build a name for yourself and be recognizable. If you’re likable and people have fun with you and become friends with you, that’s how you win clients over. Both Oren and Tal have exactly that. You want to go to dinner with them, but you always want them to be your broker.”

“I think the differences between us are what complements the partnership,” said Modlin. “One way is not right or wrong. They have a formula for success; I have a formula for success.”

The Alexanders’ hunger for publicity sometimes backfires, however.

In 2014, news of a reportedly nine-figure deal for the Wildenstein family’s Upper East Side townhouse was leaked to the New York Post. The wealthy Middle Eastern nation of Qatar was said to be in contract for the property, and the deal, being brokered by the Alexanders, generated scores of press hits. The brothers took a celebratory jaunt to Qatar’s capital, Doha, where they were photographed riding camels.

However, that August, the deal fell apart, with sources speculating that Qatar was stung by backlash from the publicity. It was also revealed that the price in the defunct deal, contrary to the way the Alexanders had represented it in the media, wasn’t nine figures, or $100 million and up, but $90 million.

After the Qatari deal fell through, Chinese conglomerate HNA Group bought the townhouse in $79.5 million in 2017. The following year, Len Blavatnik, the billionaire investor behind Faena House, bought it from HNA for $90 million. On Instagram, Tal claimed that perseverance helped them complete the Wildenstein deal “with another one of our clients.” But sources close to the sale insist the Alexanders were not part of it.

“These guys need to learn to keep their mouths shut,” one source said.

Despite their success — or because of it, perhaps — the brothers have been dogged by claims of nepotism and those who say Lorber has fed them deal after deal over the years. “Everyone knows how they got to where they are, what kind of business they run and what kind of people they are,” said one agent.

The Indian Creek mansion the Alexanders sold for a record $50 million in February was bought by Angouleme Holdings II Limited Land Trust. A company sharing the same name, according to Bermuda government records, is controlled by Abdulhadi Mana Al-Hajri, a Qatari businessman and special assistant to the ruler of Qatar.

Tal and Oren declined to comment on the identity of the buyer. Notably, the 11-bedroom waterfront mansion was developed in 2011 by their father, Shlomy.

Friends with benefits

There’s no question the Alexanders’ relentless networking has paid off.

Their list of buyers reads like a celebrity honor roll: Timbaland, Steve Madden, Adriana Lima, Bjarke Ingels.

Last year, the Alexanders’ 10-person team sold $264.1 million worth of real estate, according to research firm Real Trends. They are perennial winners at the Ellies, Elliman’s annual award ceremony; last year, Tal was cited as the agent who did the most broker-to-broker referrals.

In New York, the Alexanders are currently on the sales team at the Renzo Piano-designed condo at 565 Broome Street, as well as 111 West 57th Street, the skinny supertall by JDS Development Group and Property Markets Group that has a projected sellout of $1.37 billion.

“Their Rolodex is beyond impressive,” said Ronen Guetta, a Hamptons developer who met the brothers poolside at the W Hotel in Miami several years ago. This past summer, the brothers sold one of his spec homes — a 9,800-square-foot manse in Water Mill — to “Hamilton” producer Sander Jacobs for $7.3 million. Guetta said even though Tal and Oren are “charmers,” they’re not pushy.

“They can be at dinner with you and they won’t just talk business,” he said. “They’re smart; they know if they make the right moves, you’ll use them.”

“To me it doesn’t feel like a job, it just feels like my life,” Oren said. “It’s really a nonstop process of growing the network, building the network.” That quest has taken them everywhere from the mountains of Japan to the infamous Fyre Festival in the Bahamas, where the brothers chartered five boats and shelled out several thousand dollars apiece for VIP tickets; the idyllic Bahamian setting, with “a lot of young people on the beach in their bathing suits,” was a leg up from your typical festival, Tal told the Wall Street Journal in April 2017. When Fyre turned out to be a farce, the brothers didn’t miss a beat. “Fyre Fest is over before it started, A-Team fest starts now,” Tal posted on Instagram from the Exumas.

That 24-7 schmoozing makes some of their competitors anxious and hesitant to work with them. An agent in Miami said other brokers are nervous about bringing their buyers to Oren “because he’ll be on a private jet with the guy the next day.”

Shortly after meeting Ferraro, the attorney, in 2009, Oren called his father to tell him he was flying with him on a private plane to New York. Then 21, Oren ended up representing Ferraro in his first major deal; even then, he was quick to make the most of it, reaching out to the press to do some self-promotion. “It felt really good to be there to be in that game, to be talked about,” Oren said. “It’s something i knew I wanted. I did everything to stay relevant. I didn’t want to be a shooting star.”

“I like to call this whole business one big game of connect the dots, and Instagram helps us play that game,” he added.

During the interview in Miami Beach, Oren mentions that he’ll be flying back to New York that day, after joining agents that JDS chief Michael Stern flew down to tour Monad Terrace, the developer’s luxury condo project being designed by Jean Nouvel.

Tal Alexander, Howard Lorber, Michael Stern and Oren Alexander

Stern considers Tal and Oren “very good friends” of his, but he also does business with them.

“Those things are not mutually exclusive, and I think that’s part of what’s made them successful, their incredible social network,” Stern said. In 2017, they went to Vegas together to watch the Mayweather-McGregor “money fight.” “They’re incredibly smart. They work very hard. People don’t get the full picture of how much work they do,” he said.

The difference between the Alexanders and other brokers is that they don’t tell clients what they necessarily want to hear, according to Nathan Berman, who developed Tribeca celebrity condo haven 443 Greenwich Street .

“In that sense, I can trust what they say,” said Berman, who tapped the brothers to rent several investor units at the property. “They deliver what they promise.”